- Gold Price Forecast: XAU/USD bears pile in on hawkish Fed statement, critical daily support under pressure

Market news

Gold Price Forecast: XAU/USD bears pile in on hawkish Fed statement, critical daily support under pressure

- Gold price has dropped on the Federal Reserve statement and interest rate decision.

- Fed hikes rates with a hawkish statement by 50 basis points, as expected, US Dollar and US Treasury yields rally.

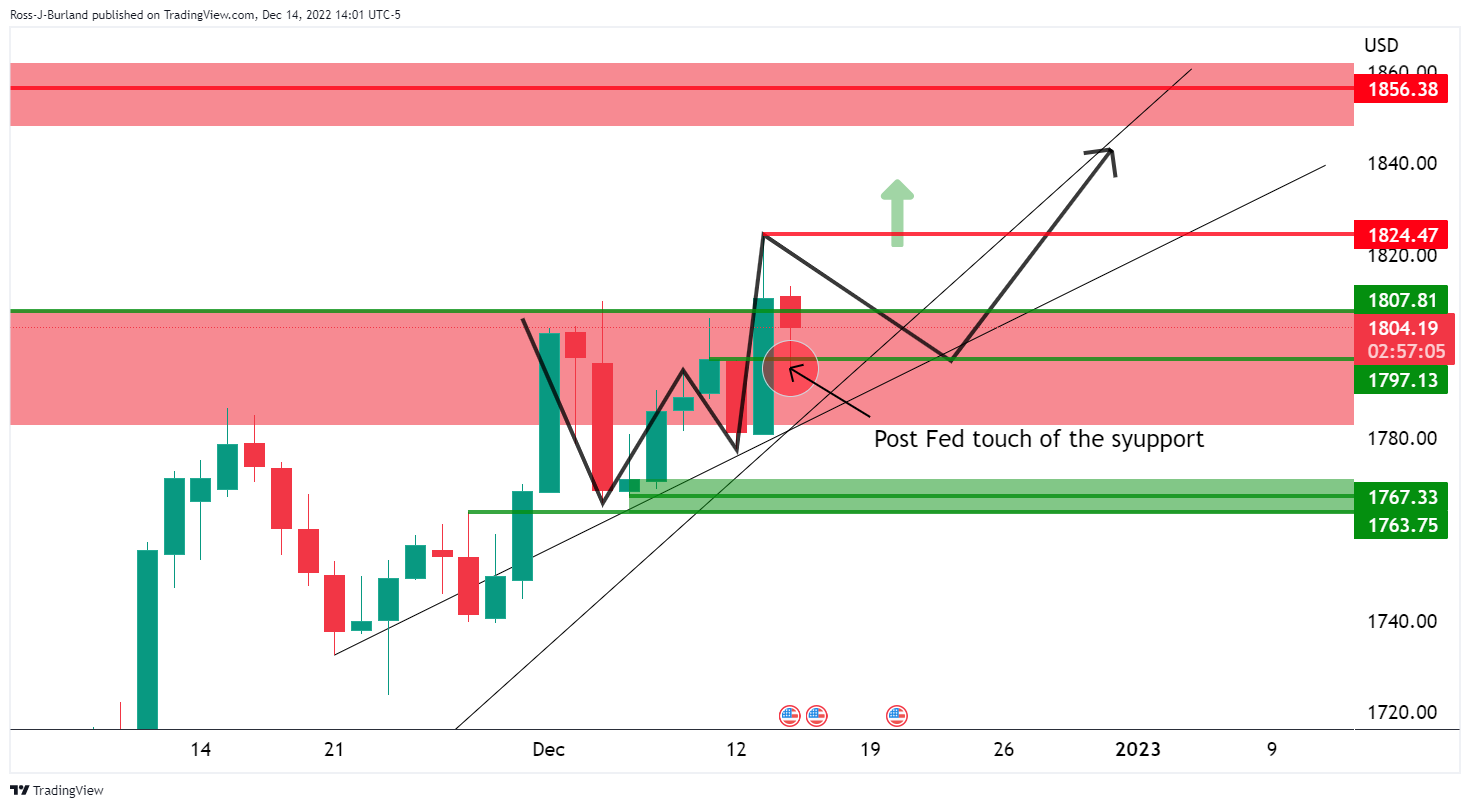

- There are prospects of a move in Gold price towards $1,850s on the upside or a break below $1,800 opens $1,770/50.

The United States Federal Reserve has hiked rates by 50 basis points at the conclusion of the Federal Open Market Committee's two-day meeting on Wednesday and signalled plans to keep lifting them next year to combat high inflation.

The US Dollar and US Treasury yields have rallied on a hawkish statement and the Gold price has dropped to $1,795 the low so far to test a critical area of daily support as illustrated in the technical analysis below.

Fed key takeaways

- The Federal Reserve hikes 50 basis points, as expected

- Target Range stands At 4.25% - 4.50%.

- The vote was unanimous.

- The guidance in the statement repeats that: "The Committee anticipates that ongoing increases in the target range will be appropriate."

Watch Fed Chair Powell live

Today's Federal Open Market Committee meeting is bringing an assortment of moves to chew on, including the Fed chairman, Jerome Powell's press conference up next. this can be watched in the live link above.

Jerome Powell will be looked at to bring clarity to the interest rate decision and the statement for where the committee views the future of its inflation fight. He is expected to reiterate Fed will raise rates and keep them high until inflation shows concrete signs of coming back to the central bank’s 2% target. This might imply a higher terminal rate for which would be expected to support US Treasury yields and the US Dollar, a headwind for the Gold price.

Gold technical analysis

Prior to the announcement of a 50bp hike, Gold price was at $1,810 and had carved out a W-formation. This is a reversion pattern and was expected to see the price retest at least the neckline support as follows:

After the Fed

From here, there are prospects of a move towards $1,850s on the upside while a break of the support of the W-formation opens the risk of a run to test below $1,800 and towards $1,770/50 below the bullish trendline supports.