- GBP/JPY Price Analysis: At a crossroads testing points of control following BoJ drop

Market news

GBP/JPY Price Analysis: At a crossroads testing points of control following BoJ drop

- GBP/JPY bears move in on key points of control following BoJ drama.

- Further downside eyed but corrections not impossible.

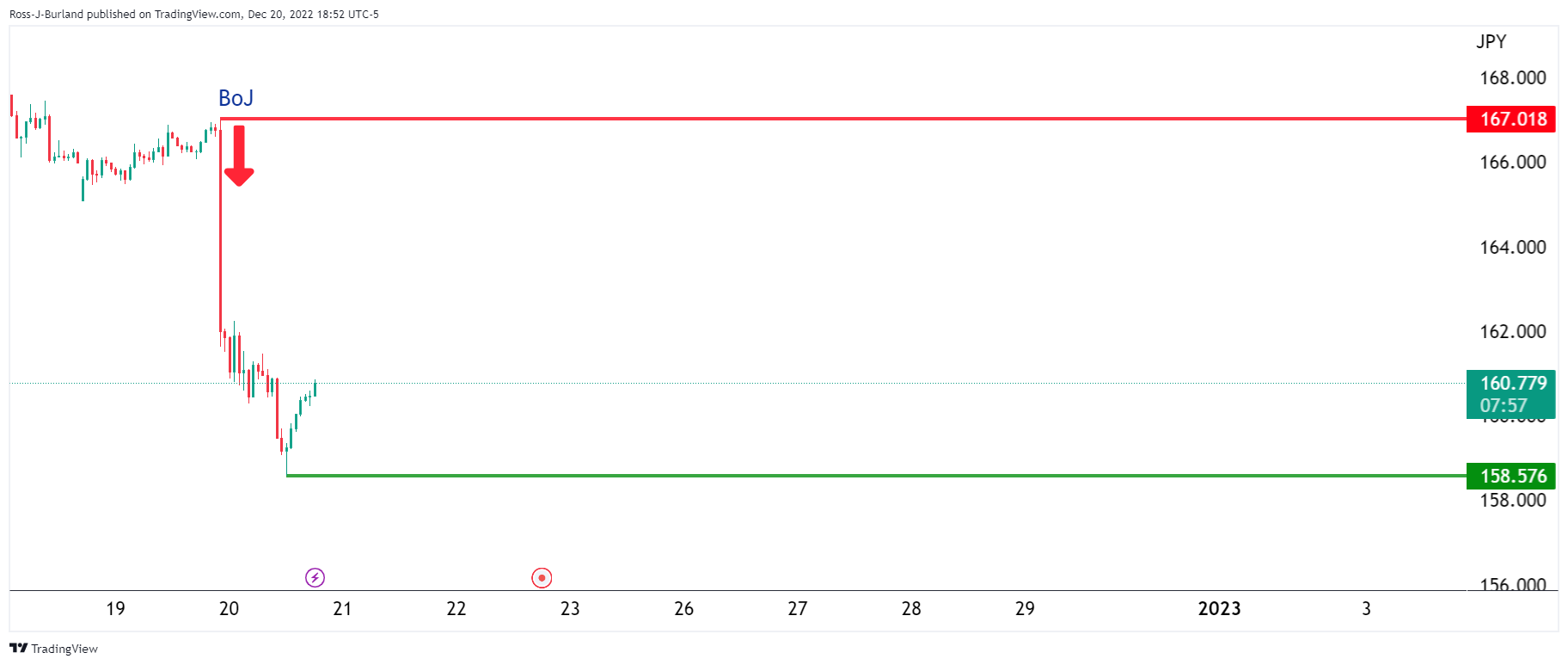

GBP/JPY fell off a cliff in Asia yesterday and continued lower overnight following the Bank of Japan shocked markets on Tuesday with a surprising tweak to its bond yield control. The BoJ has adjusted the terms around long-term interest rates, allowing them to rise more in a move aimed at easing some of the costs of prolonged monetary stimulus.

Consequently, the yen soared across the board sending GBP/JPY down by 5% falling from a high of 167.08 to a low of 158.58:

GBP/USD daily chart

From a daily perspective, the price penetrated below the point of control on the recent move from the prior swing low marked in September and has come right back into it on a correction.

Should the bears commit at this juncture, there could be more downside in store for a continuation of the move over the coming days and weeks:

A 100% expansion of the prior consolidation daily channel's range comes in near the prior structure around 147.70. A move of just a 50% expansion of the range comes in at 153.80ish, back to the September swing lows.

However, should there be a continued correction, then a retest of the prior structure that aligns with a 61.8% ratio could be in order, albeit less likely from a fundamental standpoint at this juncture: