- USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

Market news

USD/JPY Price Analysis: Corrective bounce needs validation from 132.80

- USD/JPY picks up bids after falling the most since October 1998.

- Oversold RSI backs recovery moves bearish MACD signals 50% Fibonacci retracement challenges bulls.

- Previous support lines, key SMAs are additional upside hurdles to cross for the bulls before taking control.

- August month’s low, golden Fibonacci ratio eyed during fresh downside.

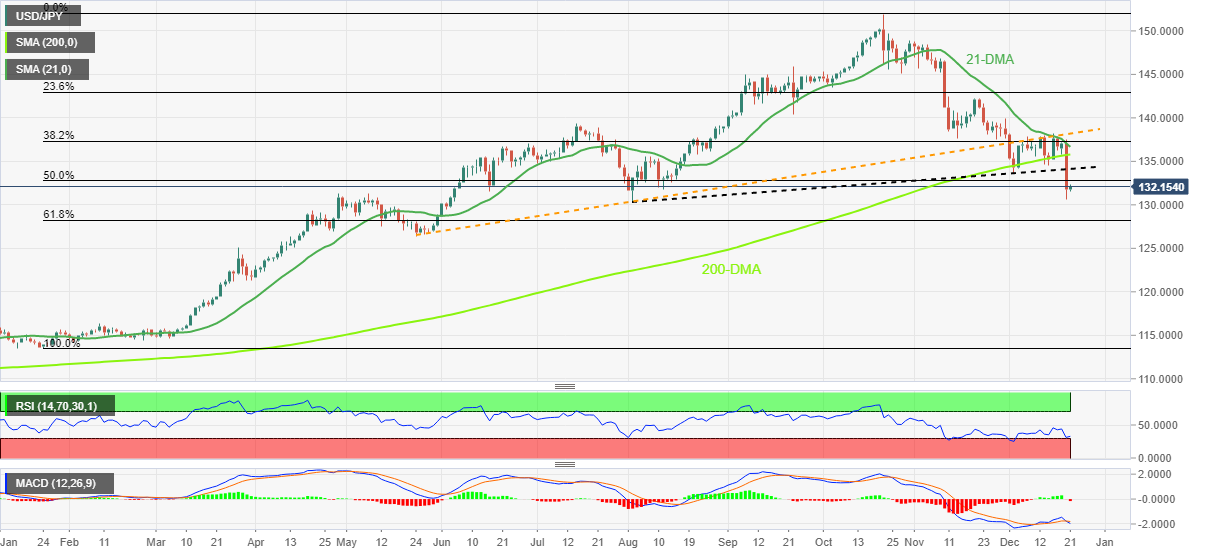

USD/JPY licks its wounds above 132.00, up 0.30% intraday near 132.20 heading into Wednesday’s European session. That said, the Yen pair dropped the most in 24 years and refreshed a four-month low after the Bank of Japan (BOJ) shocked the markets.

The quote’s latest rebound seemed to have justified the oversold RSI (14) conditions as bulls approach the 50% Fibonacci retracement level of the pair’s January-October upside near 132.80.

It’s worth noting, however, that the previous support line from August and the 200-DMA, respectively near 134.00 and 135.80, could challenge the USD/JPY buyers afterward.

Even if the quote manages to stay firmer past 135.80, the 21-DMA and a seven-month-old support-turned-resistance line, around 136.70 and 138.60, will be in focus for the bulls.

On the flip side, April’s low near 130.40 and the 130.00 psychological magnet could challenge the short-term USD/JPY downside.

Following that, the 61.8% Fibonacci retracement level of 128.20, also known as the “Golden Ratio”, should test the bears. Also acting as a downside filter is May’s low near 126.35.

Overall, USD/JPY is likely to remain off the buyer’s radar unless trading below 138.60 while the sellers need to wait for a break below the 130.00 level to retake control. Even so, an upside break of the immediate resistance could extend the latest recovery.

USD/JPY: Daily chart

Trend: Limited recovery expected