- Fed's Bostic: Comfortable moving at 25 basis points

Market news

Fed's Bostic: Comfortable moving at 25 basis points

Atlanta Federal Reserve bank president Raphael Bostic who said on Monday that it is ''fair to say that the Fed is willing to overshoot,'' is now saying that he would be comfortable moving at 25 basis points if conversations with business leaders are consistent with slowing inflation. He said that the signs of slowing wage increases "also positive".

Data showing inflation slowed in December "was really welcome news" that may allow the U.S. Federal Reserve to scale back to quarter-point rate increases at its upcoming meeting, Atlanta Federal Reserve Bank president Raphael Bostic said on Thursday.

"It really suggests inflation is moderating and that gives me some comfort that we might be able to move more slowly," Bostic said in an interview on CBS News' Prime Time with John Dickerson.

Key comments

Inflation report today was welcome news and may allow Fed to move more slowly.

Would be comfortable moving at 25 basis points if conversations with business leaders are consistent with slowing inflation.

Signs of slowing wage increases "also positive".

Economy still producing more than 200k a month, means a lot of momentum in the economy; baseline is economy will not see significant job dislocation.

Business leaders almost unanimously feel business is strong and don't expect layoffs.

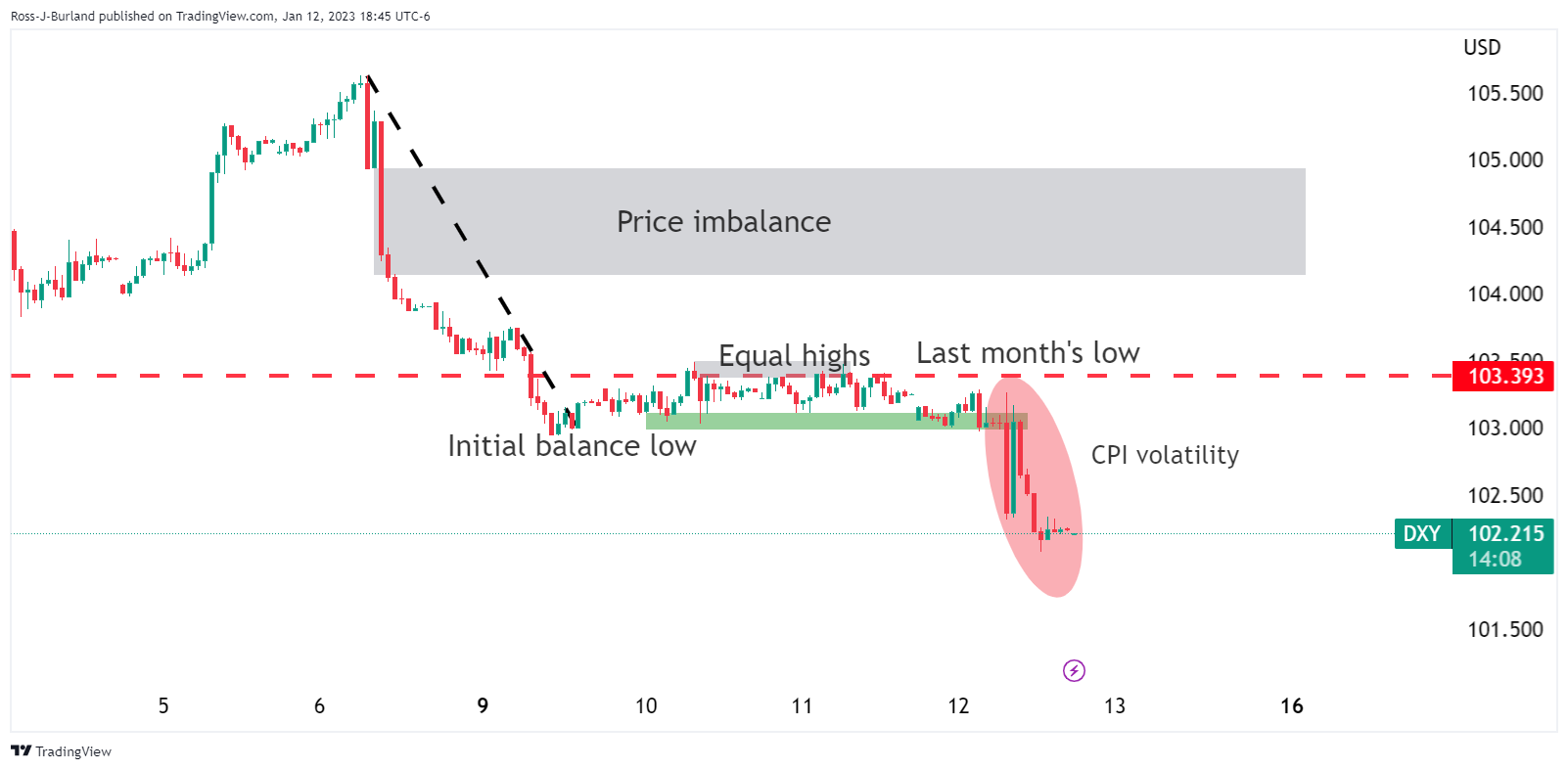

US Dollar update

The US Dollar has been falling to the lowest levels for several months following the CPI event.

However, there are observers that are sceptical of the Federal Reserve. Analysts at Brown Brothers Harriman argued that ''core PCE has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in Q2 is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening,'' the analysts added.