- EUR/USD Price Analysis: Bulls attempt to crack key resistance ahead of US PCE

Market news

EUR/USD Price Analysis: Bulls attempt to crack key resistance ahead of US PCE

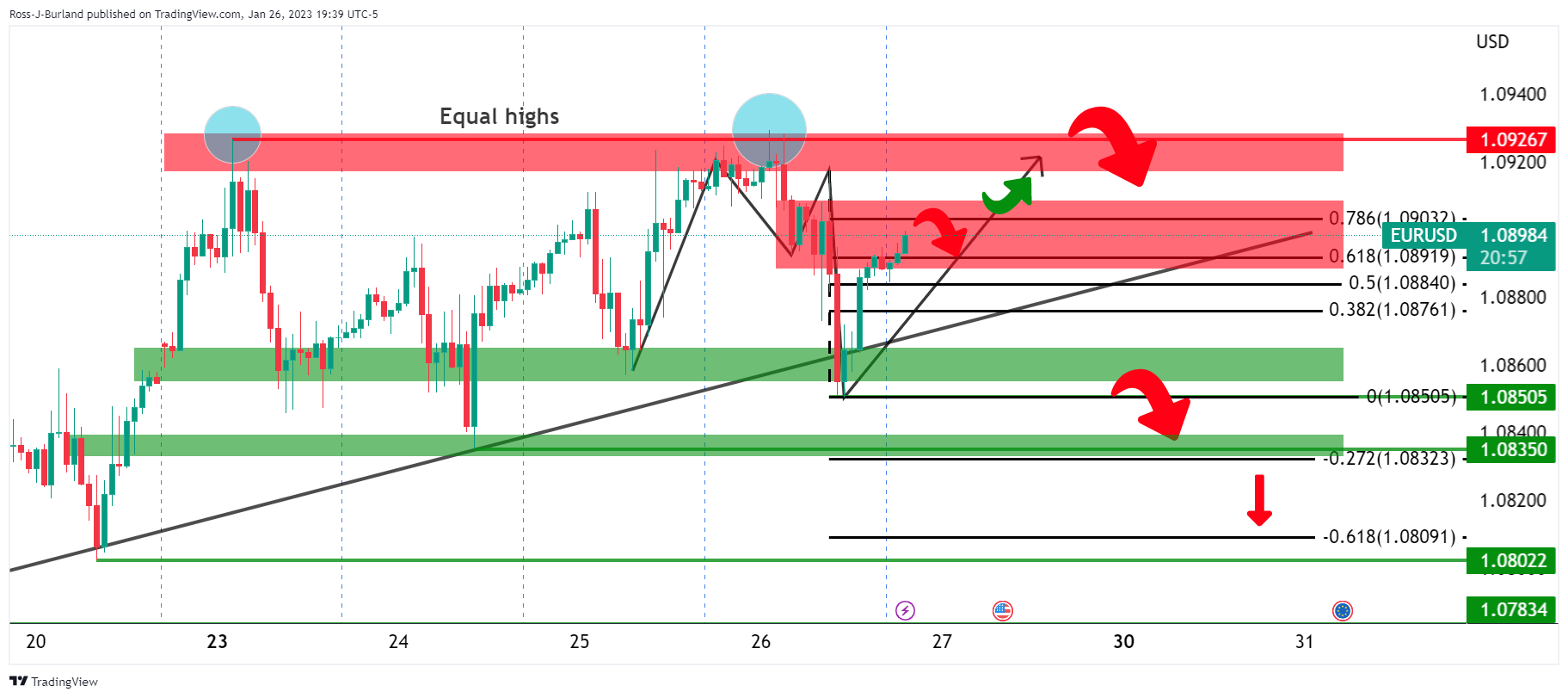

- The US Dollar is moving into the 78.6% Fibonacci retracement of Thursday's bullish impulse.

- EUR/USD is attempting to run higher in a solid correction of the US session's drop.

The US Dollar was higher against the Euro on Thursday after data showed the US economy maintained a strong pace of growth, however, the tables were soon turned resulting in a rally in EUR/USD to test the neckline of an M-formaiton on the hourly and 4-houir charts as the following illustrates.

EUR/USD H1 chart

A test of stops above 1.0950 could be on the cards for the day ahead as we move into another key event on the US calendar. This could be a move to go high before coming down so the London session will be key. In Asia, we are putting in a potential low that if London takes it out before the US opens, there will be prospects of a continuation lower depending on the outcome of the US data. On Thursday, we had a similar scenario, whereby the Londson session cracked the Asian lows and thus gave the bears a target in the US data following the release and positive vibes for the greenback.

US Dollar, DXY, technical analysis

The US Dollar is moving into the 78.6% Fibonacci retracement of Thursday's bullish impulse. If the bulls commit to here, then the Euro will struggle to gain much more ground ahead of the US event. A break of the trendline will seal the deal for the Euro's downside.