- US Dollar remains on the front side of the trend into the Fed, 102.50 eyed on hawkish outcome

Market news

US Dollar remains on the front side of the trend into the Fed, 102.50 eyed on hawkish outcome

- DXY bulls eye102.50 that guard 103.00 and a 38.2% Fibonacci retracement of the weekly bearish impulse.

- The Federal Reserve and US Nonfarm Payrolls will be this week's highlight.

The US Dollar has made some modest gains in the build-up to the Federal Reserve this week and is starting out on the front foot on Monday and this was despite the data that showed falling US Consumer Spending and cooling inflation. The Commerce Department reported the Federal Reserve's preferred gauge for inflation, the Personal Consumption Expenditures (PCE) price index, rose 0.1% last month after a similar rise in November.

The market remains of the mind that the Federal Reserve will pivot in H2 and only hike one more time following this week's 0.25% rate hike before stopping. The current target range is 4.25% to 4.5%. ''However, the hard part for the Fed will be convincing the markets that they are wrong about its perceived pivot,'' analysts at Brown Brothers Harriman argued, adding:

''The Fed will leave the door wide open for further rate hikes and Chair Powell will stress that the Fed is prepared to continue hiking rates beyond 5% and keep them there until 2024, as the December Dot Plots showed. As things stand, the Fed is seen starting an easing cycle in H2 and we view that as highly unlikely. New Dot Plots and macro forecasts won’t come until the March 21-22 meeting. We will send out a more detailed FOMC Preview Monday morning.''

As for the US Nonfarm Payrolls, while it is expected to have continued to rise in January, the 175,000 increase in payrolls expected would be the smallest gain since a drop in December 2020. ''The labour market remains tight and layoffs are still very low. But the number of job openings has been edging lower and we look for a tick up in the unemployment rate to 3.6% from 3.5% in December,'' analysts at RBC Economics argued.

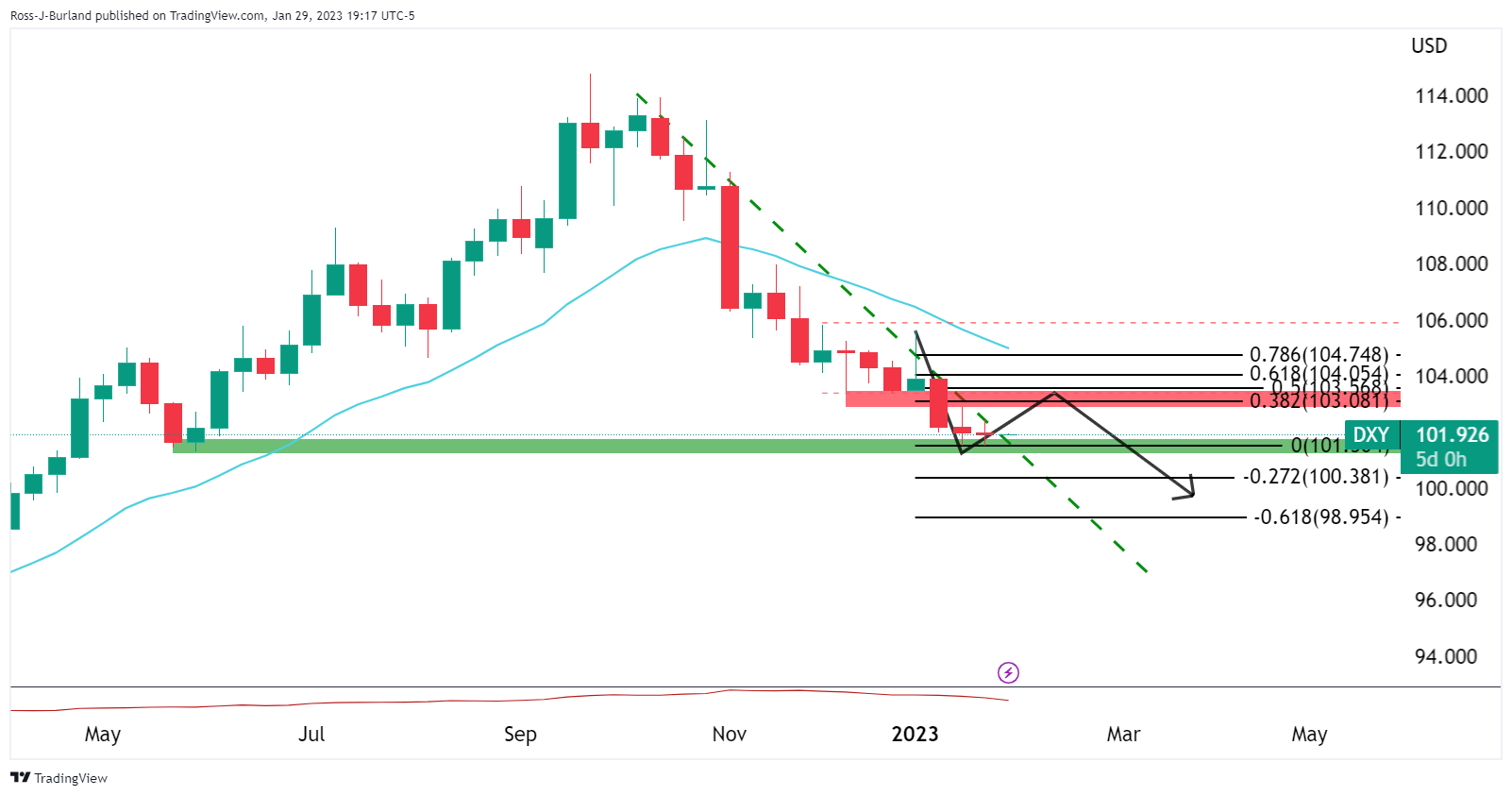

Meanwhile, from a technical perspective, the US dollar has been drifting sideways within the range of between 101.50 and 102.20, Friday's high, or 102.40 as per last week's highs as the following technical analysis illustrates:

US dollar technical analysis

A break of the trendline would be a significant development for the week ahead with 102.50 eyed that guard 103.00 and a 38.2% Fibonacci retracement of the weekly bearish impulse: