- USD/JPY Price Analysis: Bears eye a test of 130.00 pre Federal Reserve

Market news

USD/JPY Price Analysis: Bears eye a test of 130.00 pre Federal Reserve

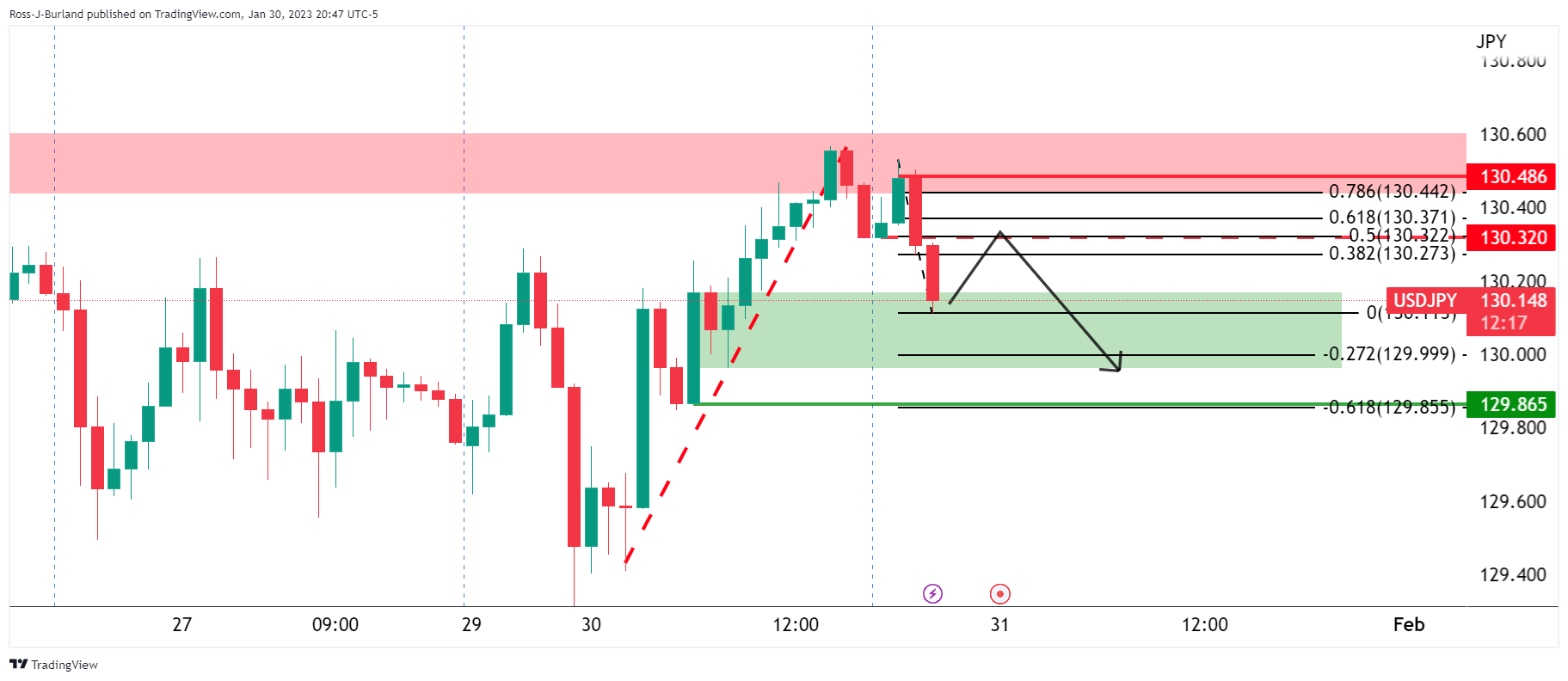

- USD/JPY bulls eye a 50% mean reversion towards 130.30 that meets the prior support.

- The outlook is bearish for the day ahead with a test of 130.00 eyed ahead of the Federal Reserve on Wednesday.

USD/JPY is under pressure in Tokyo but the bulls are moving in from a support area as the following charts will illustrate. Meanwhile, the US Dollar rose on Monday, ahead of the Federal Reserve's two-day policy meeting which is likely to keep traders at bay and USD/JPY range bound until the outcome of the meeting. Nevertheless, the market structure is as follows:

USD/JPY H1 charts

The price is on the backside of the rising trend and the bears are keenly awaiting a discount to move in again:

USD/JPY M15 chart

As seen, the bulls have steppe din in the 15-minute candle rotation and eye a 50% mean reversion towards 130.30 that meets the prior support that was broken in early Asian trade. This does leave the outlook bearish for the day ahead with a test of 130.00 eyed ahead of the Federal Reserve on Wednesday.