- USD/CAD Price Analysis: Horizontal resistance near 1.3450 is key

Market news

USD/CAD Price Analysis: Horizontal resistance near 1.3450 is key

- USD/CAD is testing horizontal resistance near 1.3450.

- The DXY index W-formation is a bearish reversion pattern which weighs on USD/CAD's outlook.

- On the other hand, should 103.50 give then USD/CAD can enjoy some time higher until next week's US Consumer Price Index.

USD/CAD rallied in the US session following the move back up in the US Dollar. The action occurred in and around the cash open on Wall Street following a combination of half-well-received US data before a risk-off move set in that sent equities off a cliff and high beta currencies packing.

The following illustrates the recent chop the pair has been caught up in and the prospects of a breakout one way or the other.

USD/CAD daily charts

The upside bias, as illustrated above, requires the bulls to commit beyond the trendline resistance in a move that sees the price close above the horizontal resistance near 1.3450 which is currently being tested.

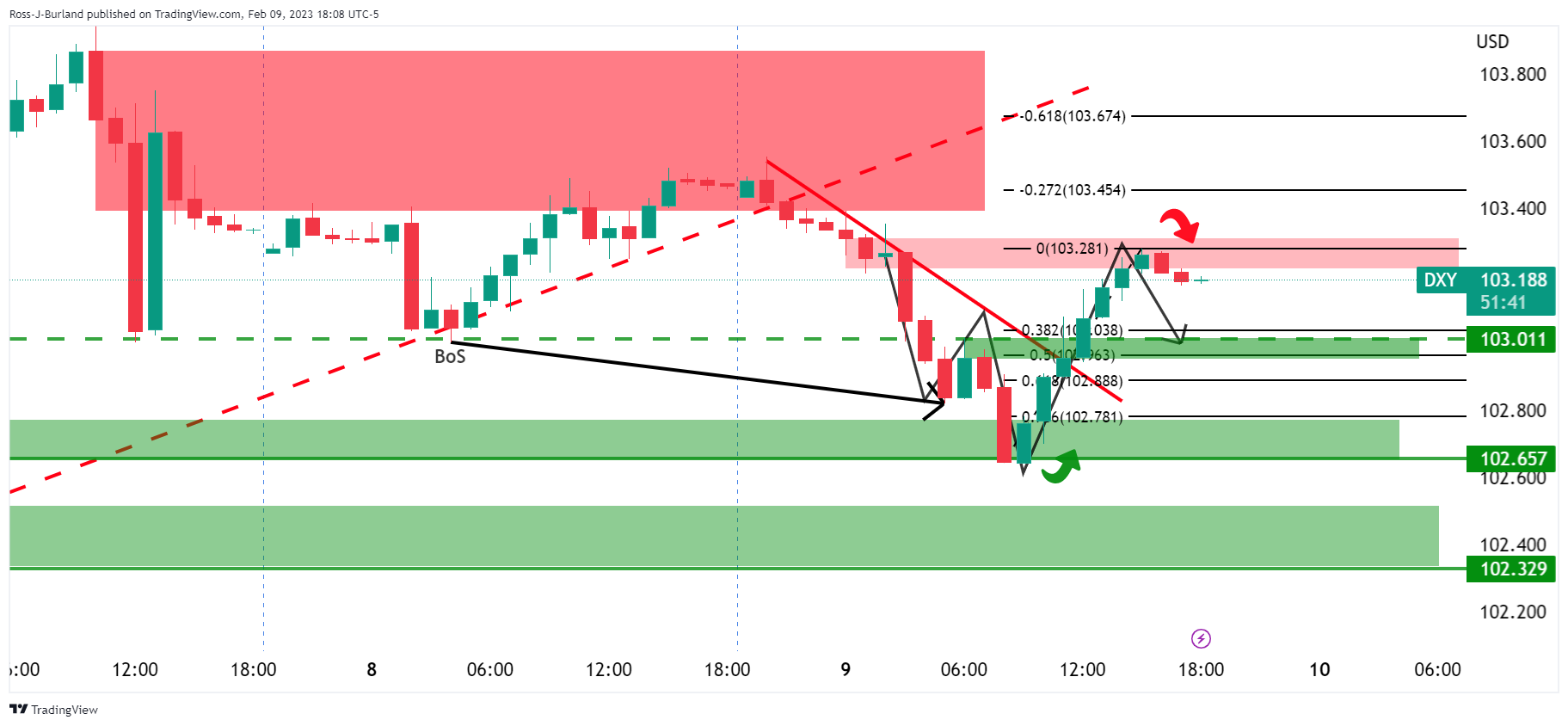

Therefore, the US Dollar's schematic needs to align. However, we are seeing a bearish prospect on DXY as follows:

The W-formation is a bearish reversion pattern and the neckline in this case aligns with a 50% mean reversion near 103.00. A break there will see a move lower towards 102.60 and given the prior break of structure, the bias is bearish for a continuation towards 102.30. This is not a good look for USD/CAD.

On the other hand, should 103.50 give then USD/CAD can enjoy some time higher until next week's Consumer Price Index event from the US calendar.