- Crude Oil Futures: Further losses in store near term

Market news

14 February 2023

Crude Oil Futures: Further losses in store near term

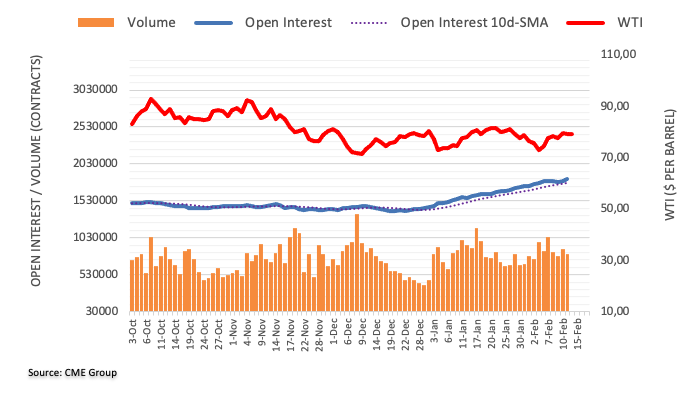

CME Group’s flash data for crude oil futures markets noted traders added around 23.4K contracts to their open interest positions on Monday, reaching the second consecutive daily build. On the other hand, volume remained erratic and went down by nearly 66K contracts.

WTI: Gains look limited above $80.00

Prices of the WTI started the week on the back foot amidst increasing open interest, which is indicative that further decline appears favoured in the very near term. There is an interim support at the 55-day SMA at $77.51, while the upside remains limited by the area above the $80.00 mark per barrel.

Market Focus

Open Demo Account & Personal Page