- AUD/USD Price Analysis: Bears are dominating the bias with eyes on break of 0.6900

Market news

AUD/USD Price Analysis: Bears are dominating the bias with eyes on break of 0.6900

- AUD/USD bears are gathering with volume up high within the recent range.

- A breakout could be imminent and 0.6950/00 is the key.

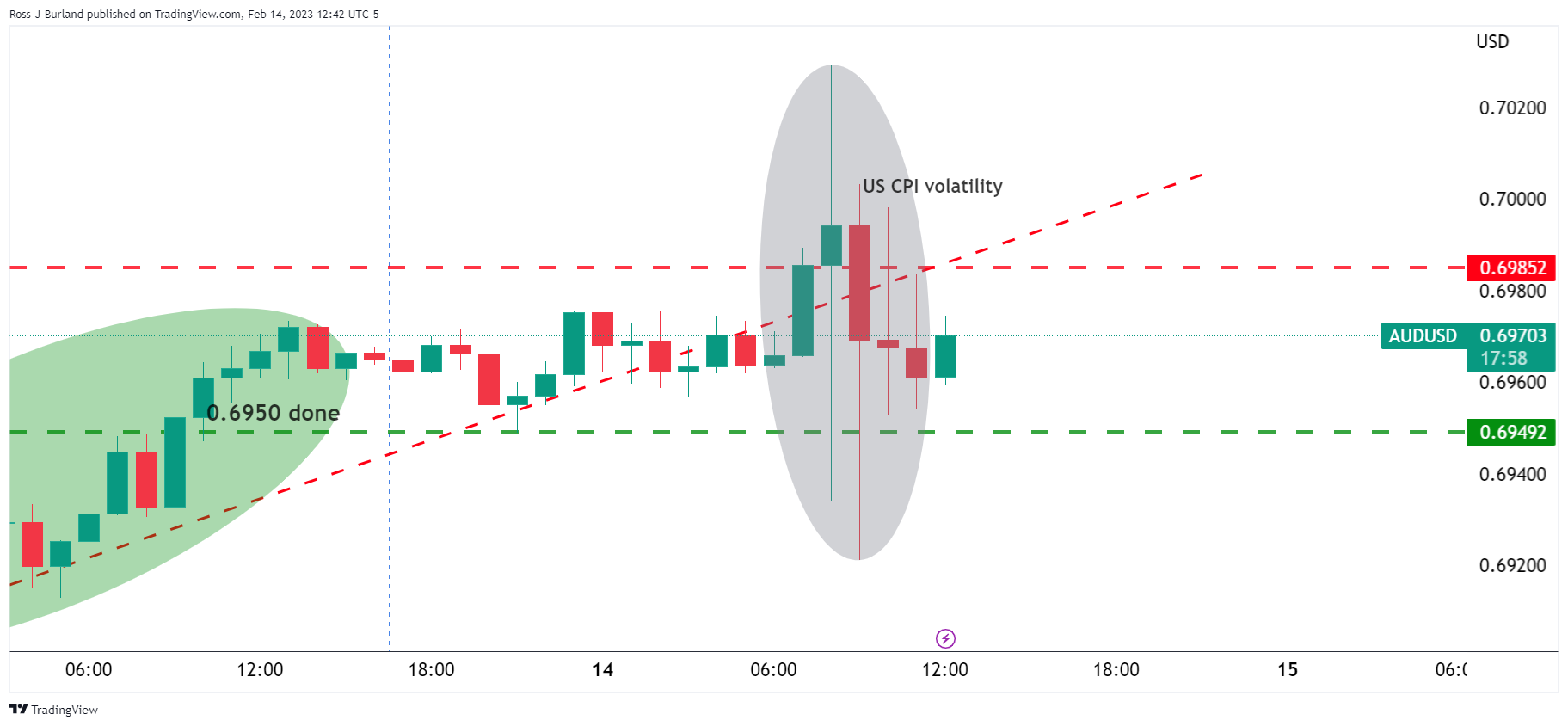

In the opening article for the week on AUD/USD, AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range, it was stated that on the hourly chart, ''we have 0.6950 to clear before a bullish thesis can be solidified, so it is a case of seeing how the opening range on Monday develops.''

However, while holding above the trendline and said support, there were prospects of a short squeeze to test 0.6950 for Monday and p[prospects of a move into low-hanging fruit below 0.6900 and into the 0.6880s beforehand:

AUD/USD updates

The target areas were done as illustrated above ahead of US CPI volatility on Tuesday:

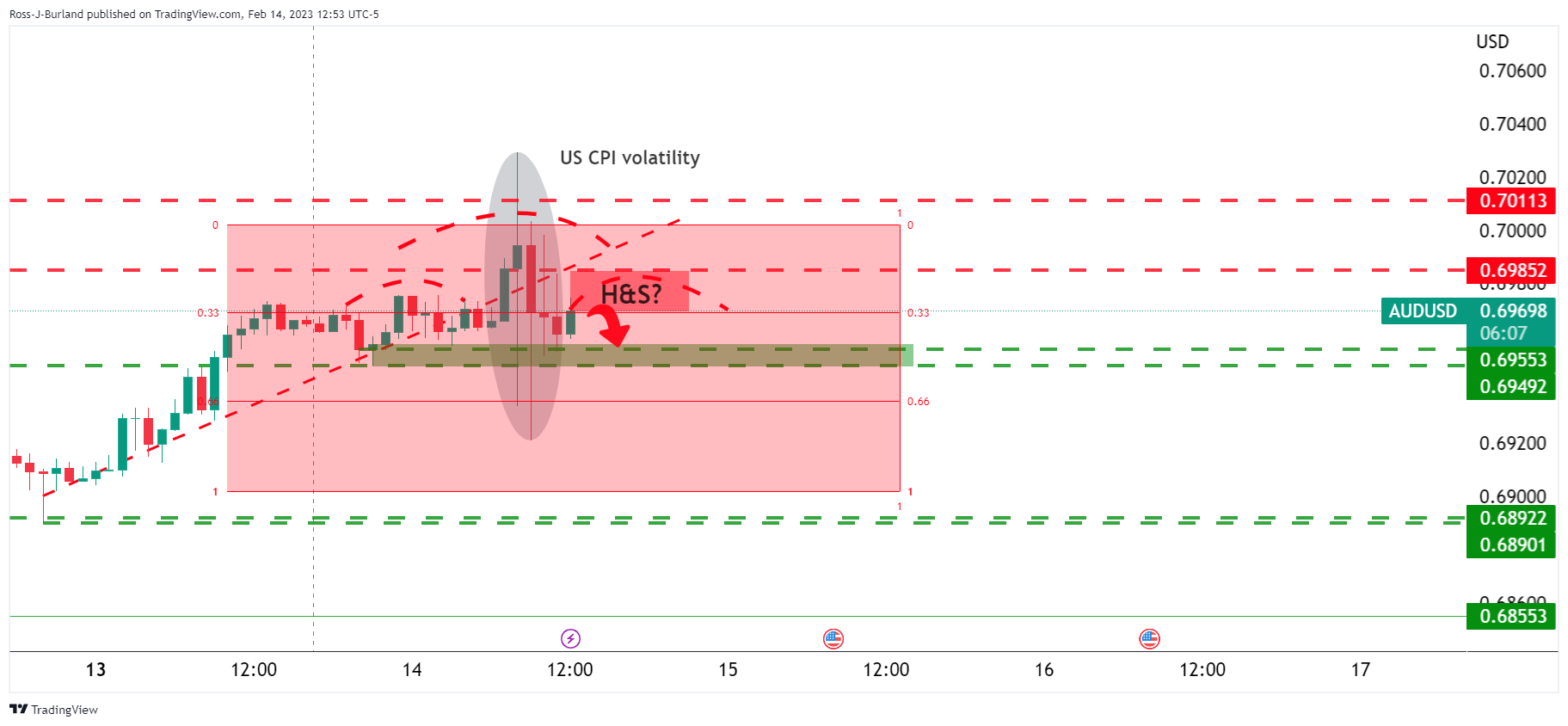

The market was essentially stuck in a range into the data so picking which side to bias one way or the other was a task of improbable outcomes unless hedging your bets. However, with the dust settling, the price is up high in the consolidative range and there could be a bearish thesis drawn as follows:

We have a possible bearish head and shoulders up high within the range:

A break below 0.6950 opens risk of a test of 0.6900 again and from a daily perspective, this could be the most probable outcome for the days head:

There has already been a move to test the neckline of the M-formation neckline and a test of the 61.8% Fibonacci retracement level. We also have a W-formation which is also a bearish feature as follows: