- GBP/USD Price Analysis: Bulls holding the fort in the 1.2050s ahead of FOMC minutes

Market news

GBP/USD Price Analysis: Bulls holding the fort in the 1.2050s ahead of FOMC minutes

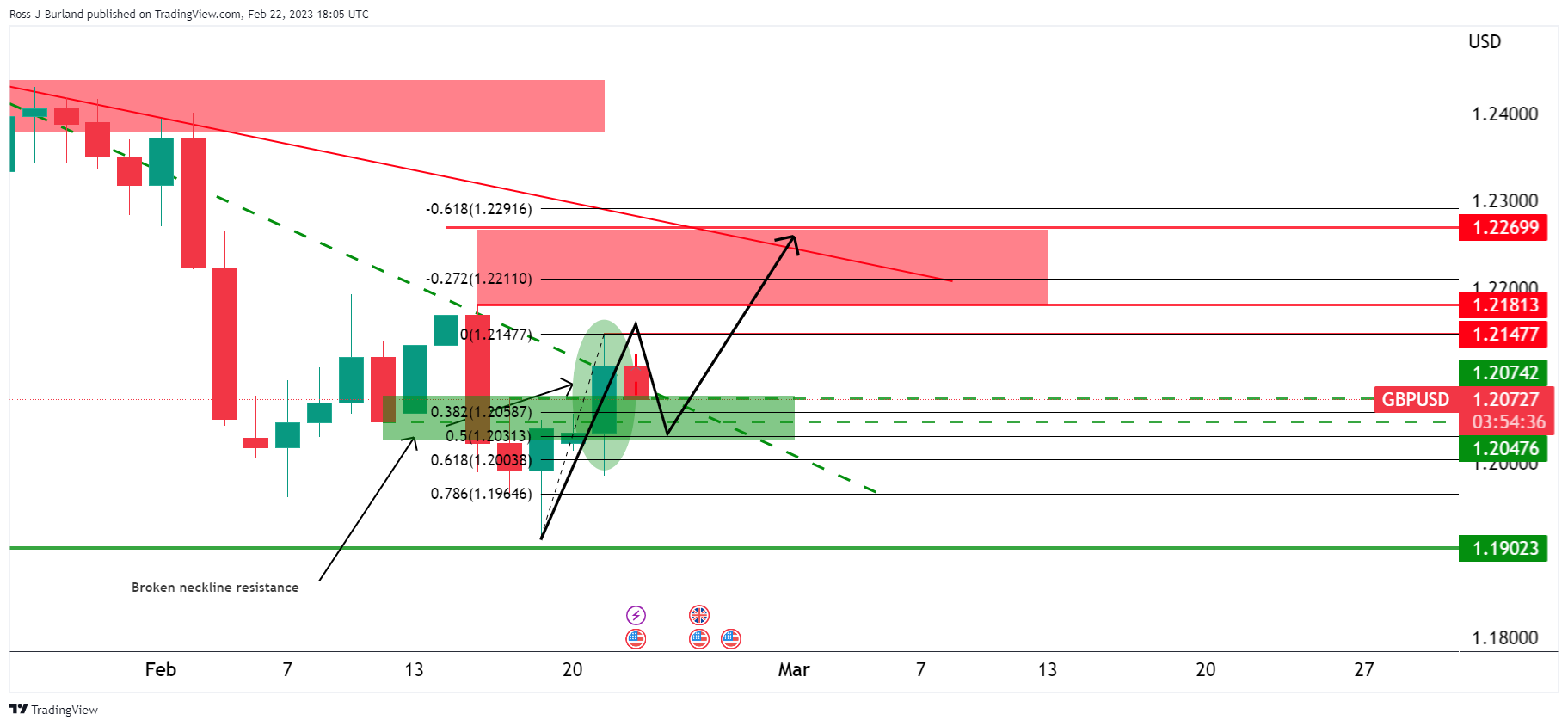

- GBP/USD bears eye a 50% mean reversion to test into the 1.2030s.

- Bulls could commit to the 38.2% support in the lows for the day so far, 1.2055.

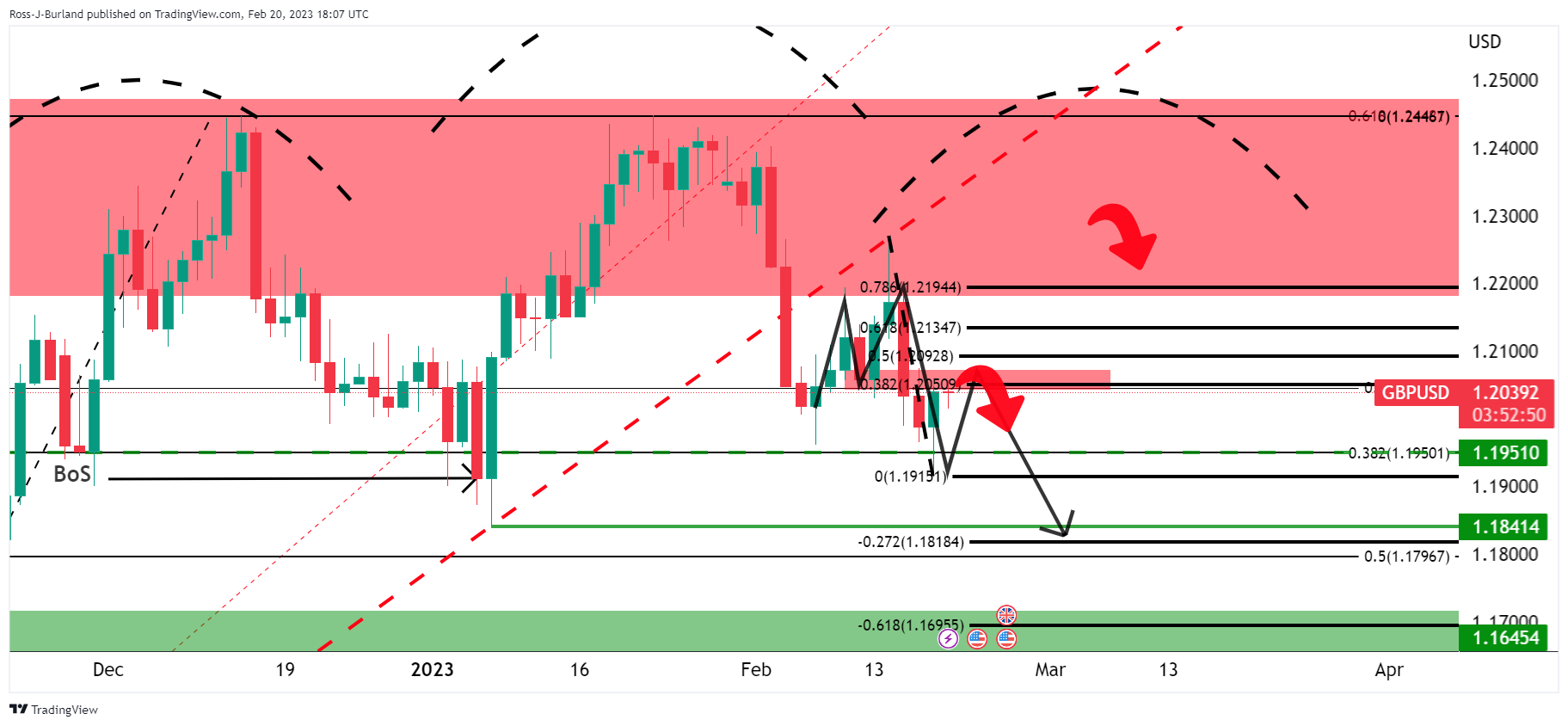

As per the prior analysis, GBP/USD Price Analysis: Bulls spring to life on backside of bear trend, GBP/USD rallied through a key resistance area on the daily chart and it is now using this as a support zone as traders await the minutes from the Federal Open Market committee.

The US Dollar gained modestly on Wednesday due to a slew of recent strong economic data that while easing recession fears, the data has reinforced concerns that the Federal Reserve’s stance will remain hawkish for longer which is capping progress in the Pound vs. the US Dollar.

GBP/USD prior analysis

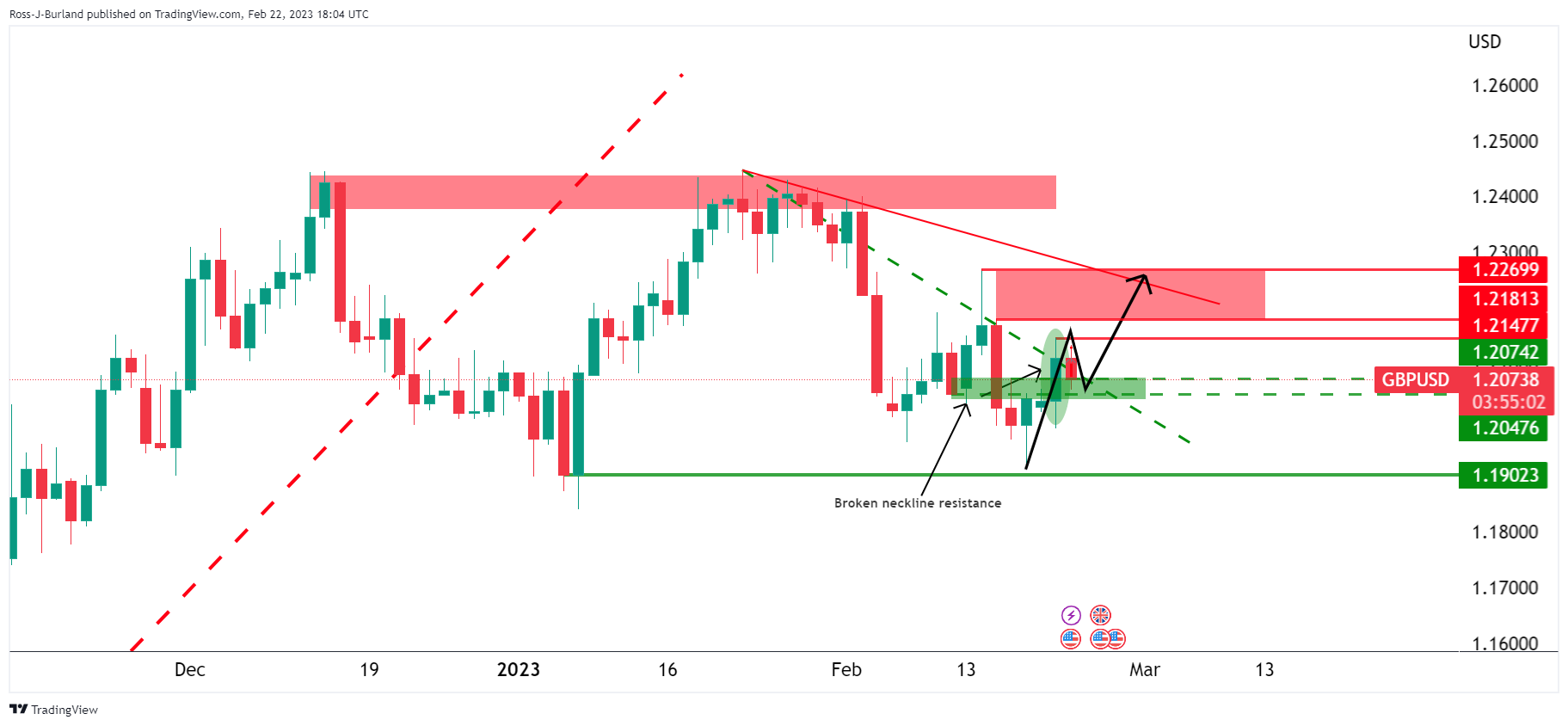

The M-formation's neckline was broken on Tuesday, invalidating a bearish thesis from the start of the week's analysis:

The bulls were in control and needed to rely on the 1.2070s as a possible newly formed support structure as illustrated below:

1.2270 was eyed as an upside target for the days ahead of the market and does not just remain in a consolidative structure bounded by 1.1900 and 1.2150.

GBP/USD update

The price is holding in the presumed support area and a 50% mean reversion is on the cards to test into the 1.2030s if the 38.2% does not hold first in the lows for the day so far, 1.2055.