- EUR/USD appears offered near 1.0660, looks at Powell

Market news

EUR/USD appears offered near 1.0660, looks at Powell

- EUR/USD comes under pressure and revisits 1.0660.

- Germany’s Factory Orders surprised to the upside in January.

- Chief Powell testifies before the Congress later in the session.

Renewed selling pressure forces EUR/USD to give away part of the earlier bull run to the boundaries of 1.0700 the figure on turnaround Tuesday.

EUR/USD remains capped by 1.0700… for now

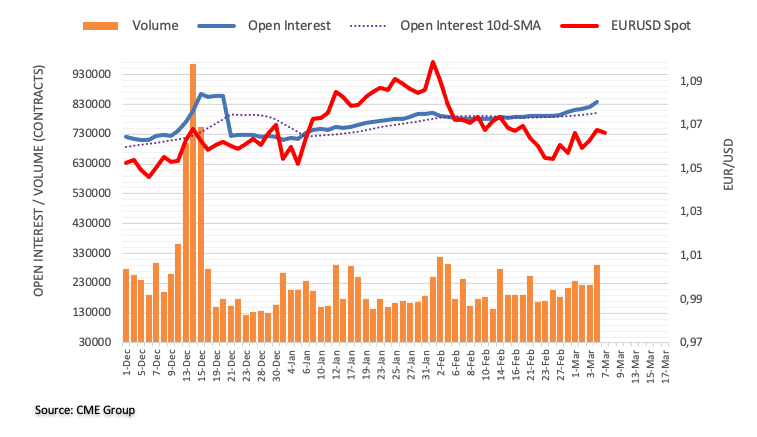

After two consecutive daily advances, EUR/USD seem to have met some tough resistance just ahead of the key barrier at 1.0700 amidst some tepid bounce in the greenback. Further upside, however, should not be ruled out in the very near term, as Monday’s uptick was underpinned by increasing open interest and volume in the futures markets.

In the meantime, cautiousness continues to prevail among market participants in light of the upcoming semiannual testimony by Fed’s Powell before the Congress in the wake of the closing bell in the Euroland on Tuesday.

No reaction in the FX universe after the ECB published its Consumer Expectations Survey, where it sees 12-month consumer inflation expectations a tad lower at 4.9% (from 5.0%) and 2.5% (from 3.0%) when it comes to the three-years’ time horizon. Regarding economic growth, the survey still points to a contraction of 1.2% in the next 12 months.

Earlier in the session, Factory Orders in Germany expanded at a monthly 1.0% in January.

In the US data space, Wholesale Inventories, the IBD/TIPP Economic Optimism index and Consumer Credit Change are all due later.

What to look for around EUR

EUR/USD seems to have met a solid resistance near the 1.0700 neighbourhood against the backdrop of persistent prudence ahead of Powell’s testimony later in the day.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Factory Orders (Tuesday) – Germany Retail Sales, EMU Advanced Q4 GDP Growth Rate, ECB Lagarde (Wednesday) – Germany Final Inflation Rate, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.15% at 1.0657 and faces the next support at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0326 (200-day SMA). On the other hand, the breakout of 1.0716 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2).