- Gold Futures: Outlook shifts to the downside

Market news

8 March 2023

Gold Futures: Outlook shifts to the downside

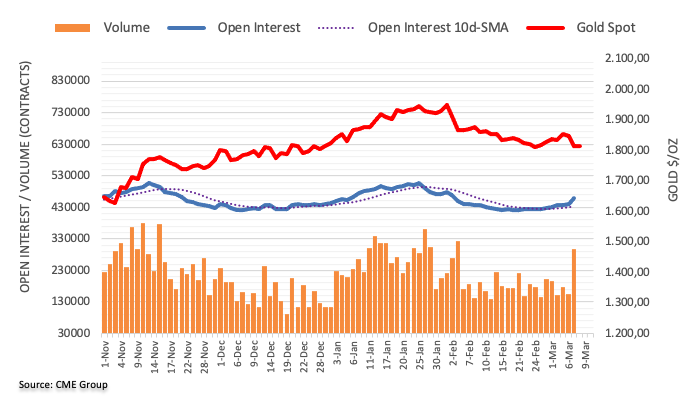

CME Group’s flash data for gold futures markets noted open interest extended the uptrend and rose by around 17.4K contracts on Tuesday, the largest single day build since July 22, 2022. Volume followed suit and went up sharply by nearly 143K contracts, also the highest level since late July 2022.

Gold could put the $1800 region to the test

Tuesday’s pronounced sell-off in gold prices was amidst increasing open interest and volume and opened the door to a deeper drop to, initially, the key $1800 zone per ounce troy, an area reinforced by the 100-day SMA. The loos of this zone could pave the way for a decline to the 200-day SMA, today at $1775.

Market Focus

Open Demo Account & Personal Page