- Gold Futures: Further correction on the cards

Market news

Gold Futures: Further correction on the cards

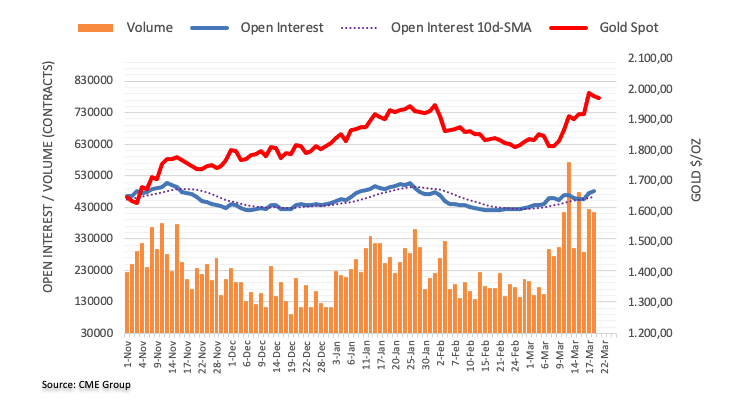

Open interest in gold futures markets rose for the third straight session on Monday, this time by around 6.1K contracts according to preliminary readings from CME Group. Volume, instead, shrank by around 10.6K contracts, partially reversing the previous daily build.

Gold: Interim support comes at the 55-day SMA near $1880

Gold prices started the week on the defensive after hitting new 2023 highs past the key $2000 mark per ounce troy. The knee-jerk came in tandem with rising open interest and indicates that the continuation of the decline appears likely in the very near term. That said, the 55-day SMA at $1881 emerges as the a temporary support for the time being.