- Crude Oil Futures: Further upside in the pipeline

Market news

Crude Oil Futures: Further upside in the pipeline

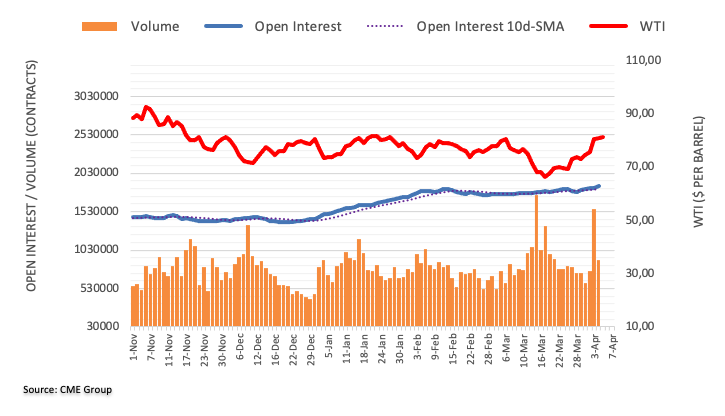

Considering advanced prints from CME Group for crude oil futures markets, open interest extended the uptrend and increased by around 17.8K contracts on Tuesday. Volume, instead, reversed two daily builds in a row and shrank by around 669.6K contracts.

WTI: Solid resistance comes at the 200-day SMA

Prices of the barrel of the WTI maintained the bid bias on Tuesday and added to the ongoing rally amidst rising open interest. The latter underpins the view that the commodity could extend the upside in the very near term, although the sharp decline in volume and the proximity of the overbought territory (as per the daily RSI) could spark some fresh selling. In the meantime, there is a firm hurdle at the 200-day SMA around $83.80, an area coincident with the December 2022 peaks.