- Gold Futures: Further losses unlikely

Market news

20 April 2023

Gold Futures: Further losses unlikely

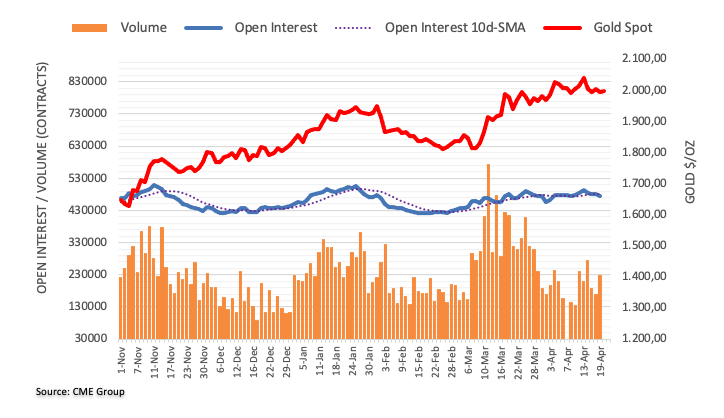

CME Group’s flash data for gold futures markets noted traders reduced their open interest positions by nearly 8K contracts on Wednesday. Volume, instead, reversed two daily pullbacks in a row and went up by around 40.8K contracts.

Gold: Next on the upside comes the 2023 high

Gold prices remain side-lined so far this week. Wednesday’s downtick, however, was on the back of shrinking open interest and is suggestive that a deeper drop is not favoured in the very near term. That said, occasional bouts of strength are still seen targeting the YTD peak near $2050 per ounce troy (April 13).

Market Focus

Open Demo Account & Personal Page