- Crude Oil Futures: Recovery could lose momentum

Market news

25 April 2023

Crude Oil Futures: Recovery could lose momentum

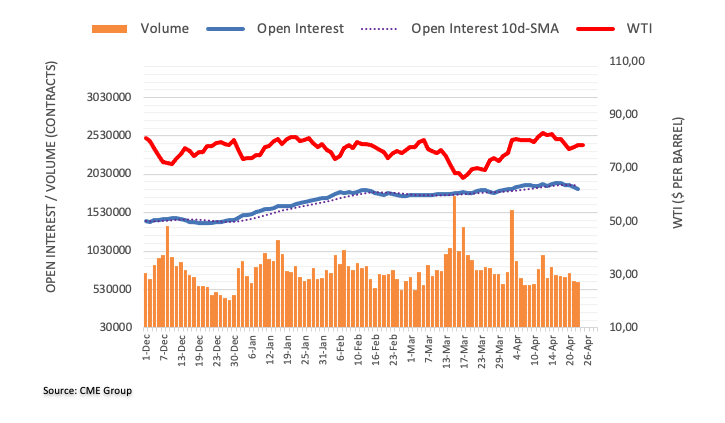

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions by around 22.1K contracts at the beginning of the week, adding to the ongoing downtrend. Volume followed suit and went down for the second straight session, this time by around 20.2K contracts.

WTI faces the next up barrier around $80.00

Monday’s uptick in prices of the WTI came on the back of diminishing open interest and volume and poured cold water over expectations of further gains in the very near term. On the upside, the key $80.00 mark per barrel emerges as a key initial barrier for bulls.

Market Focus

Open Demo Account & Personal Page