- USD/JPY Price Analysis: Bears in the market, eye the 133.20s

Market news

USD/JPY Price Analysis: Bears in the market, eye the 133.20s

- USD/JPYs 1-hour chart shows the price is on the front side of the bearish trendline.

- The 133.70s and resistance could see any correction back under pressure.

- A subsequent move to the 133.20s could be on the cards.

Risk sentiment has soured and combined with falling longer-term US Treasury yields has led to a bid in the Yen that has started to see a topping in USD/JPY´s rally. However, as the following analysis illustrates, the price is still on the front side of the bullish trend on the longer-term outlook which leaves 132.00 key in this regard,

USD/JPY daily charts

Nevertheless, the price is meeting daily resistance and the bears are in the market. A break of the daily micro trendline support opens risks of a test of 132.00 and then the 130.60s. Below there, 129.60s and 127.20s will be eyed.

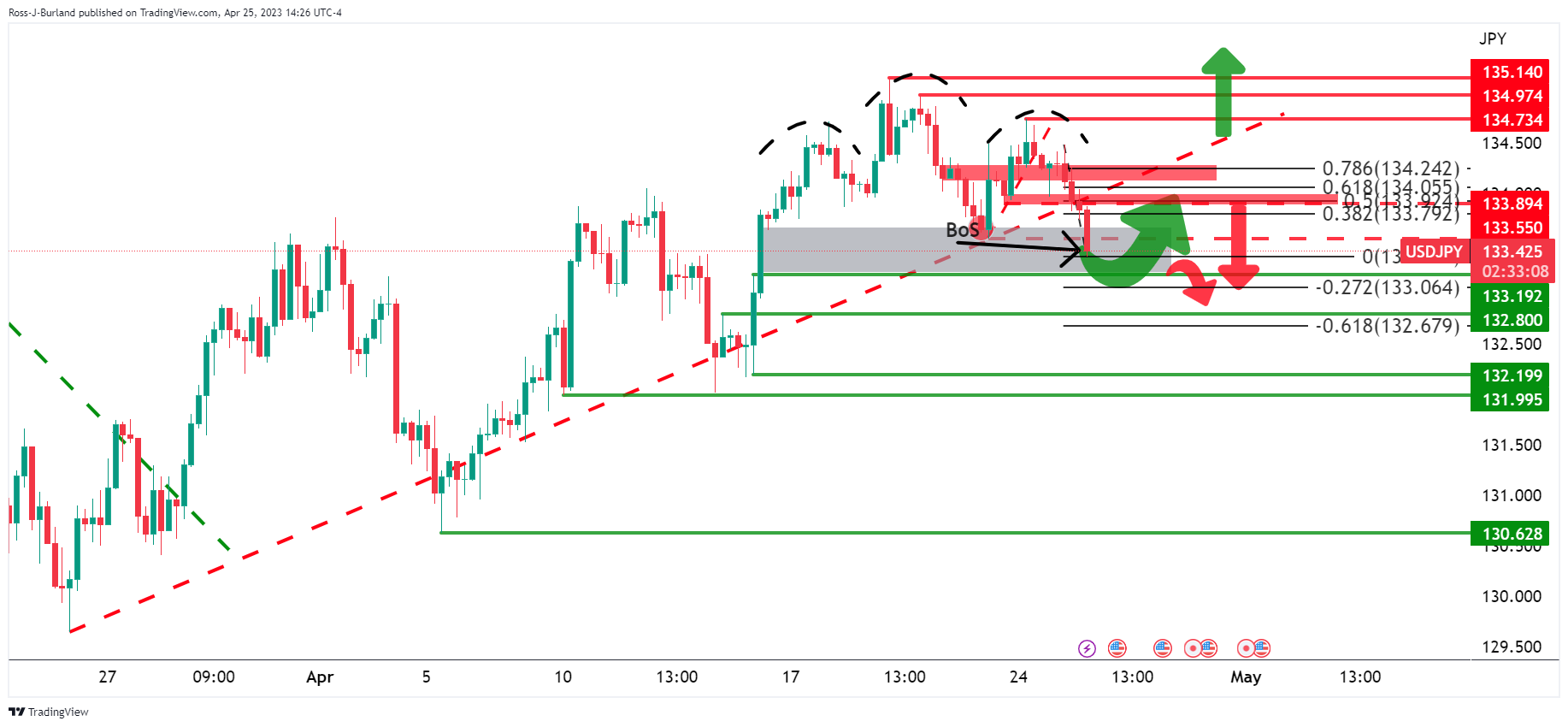

USD/JPY H4 charts

The market is still front side, of the bullish trend as shown above.

However, we have seen a break in structure, BoS, 133.42. The head and shoulders leave the outlook bearish for the meanwhile while below the 78.6% Fibonacci near 134.25. Nevertheless, bears could be encouraged to reengage below there.

A correction into the 50% mean reversion area near 133.90 could be met by supply for an onward bearish breakdown.

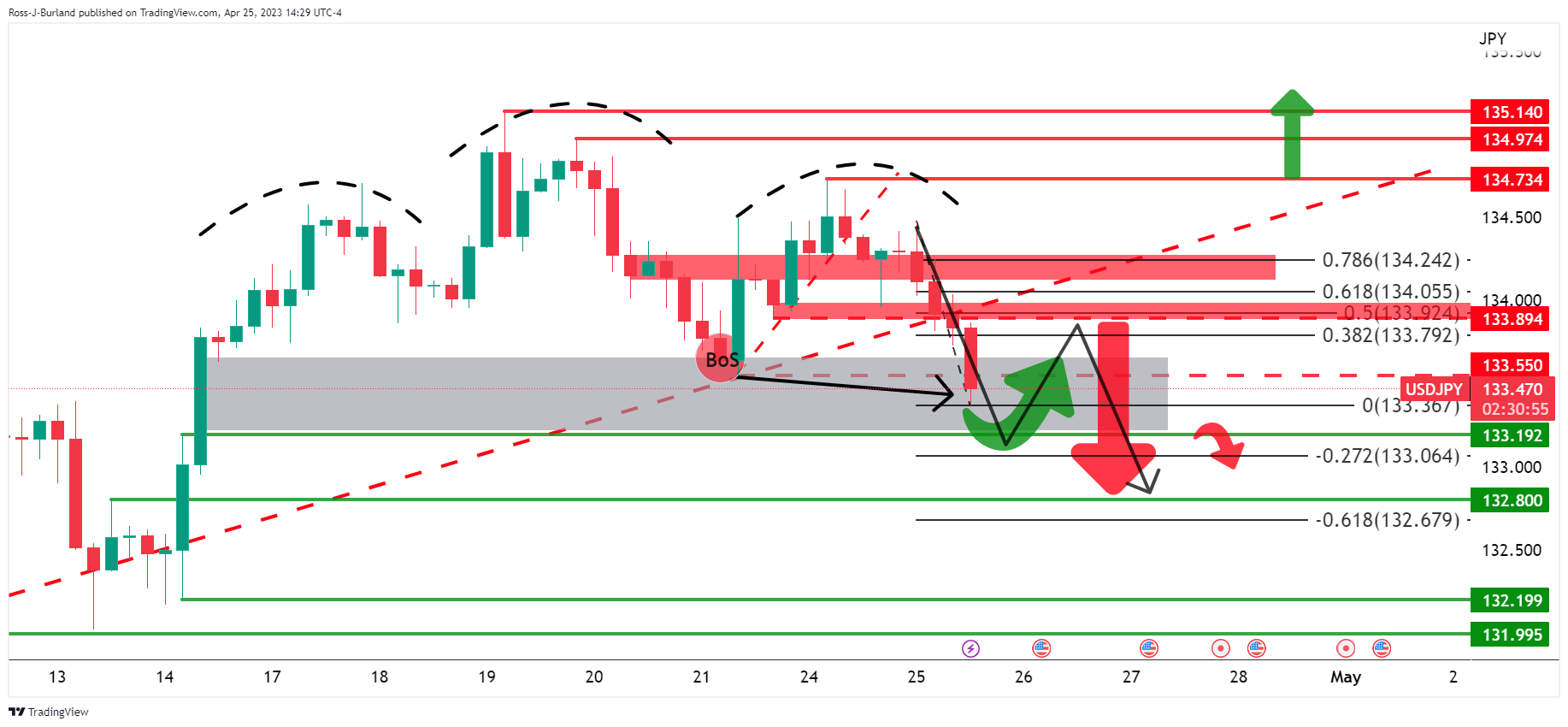

USD/JPY H1 chart

On the 1-hour chart, the price is on the front side of the bearish trendline and the M-formation´s neckline aligns with the 133.70s and resistance. A subsequent move to the 133.20s could be on the cards if the bears stay committed over the coming sessions.