- Crude Oil Futures: A sustained deeper pullback is not favoured

Market news

Crude Oil Futures: A sustained deeper pullback is not favoured

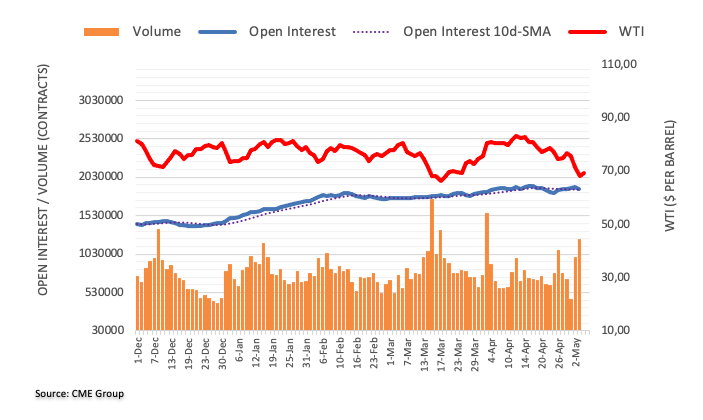

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions by around 26.5K contracts after five consecutive daily builds on Wednesday. On the flip side, volume rose for the second session in a row, this time by around 238.3K contracts.

WTI: A temporary bounce in the offing?

Wednesday’s marked retracement in prices of the barrel of the WTI was on the back of shrinking open interest, suggesting that a sustained move lower appears not favoured in the very near term. That said, the commodity could attempt a “technical” bounce in light of the current oversold condition. Immediate resistance levels appear at $70.00 ahead of the 55- and 100-day SMAs at $75.72 and $76.68, respectively.