- USD/JPY Price Analysis: Bears are in the market with a view to take out 133.50

Market news

USD/JPY Price Analysis: Bears are in the market with a view to take out 133.50

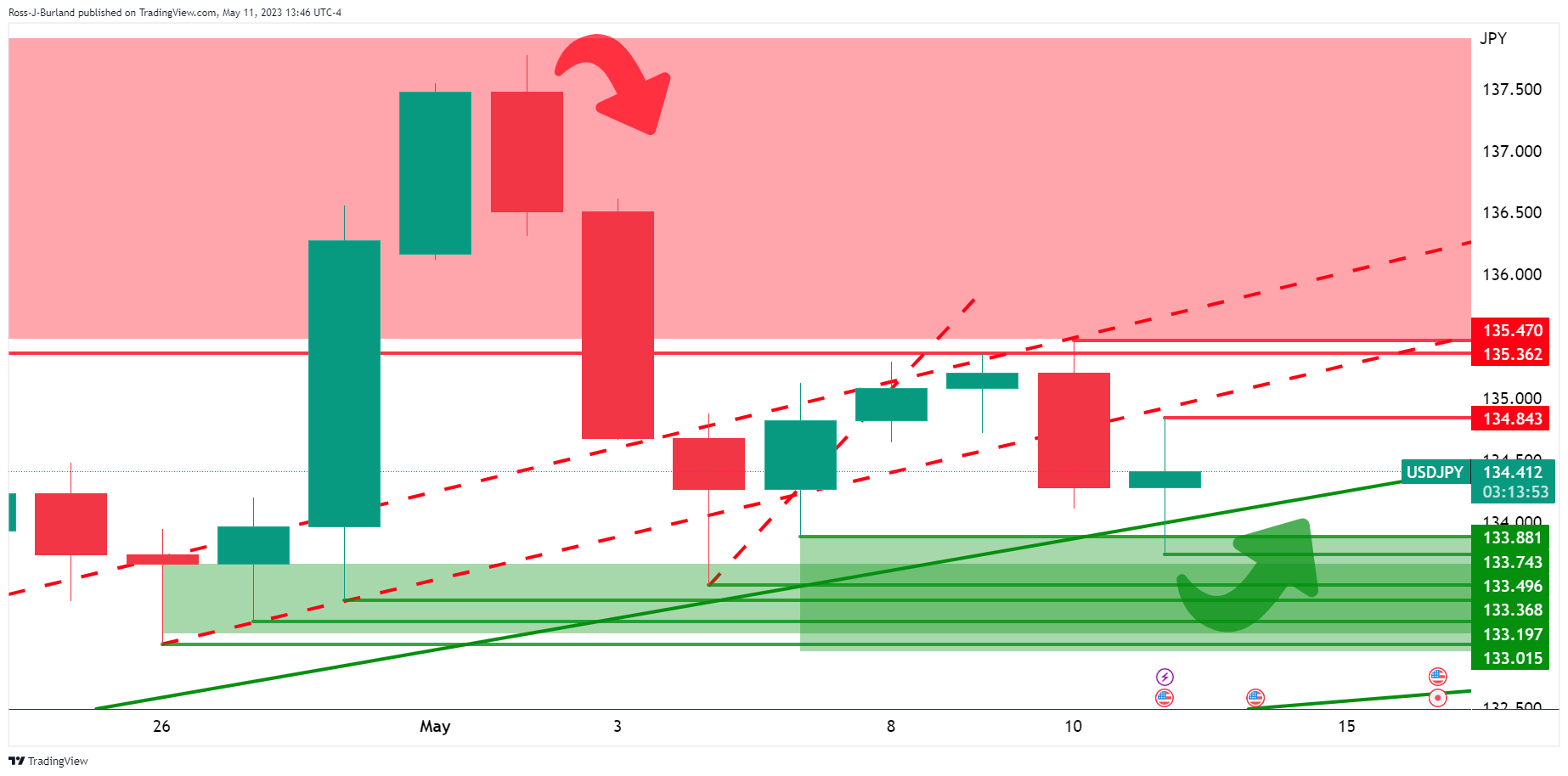

- USD/JPY is bearish while below 135.00 and being on the backside of the bullish trend.

- A break of 133.50 would be a significant bearish development.

The Japanese yen has appreciated in recent times while the BoJ removed forward guidance which pledges to keep interest rates at current or low levels. Also, US headline inflation slowed last month, supporting bets that the Federal Reserve will pause its interest rate hikes in June. Fed funds futures traders are pricing in a pause before expected rate cuts in September.

This is playing out bearishly on the charts as follows:

USD/JPY daily charts

USD/JPY H4 chart

The price is bound by resistance and support zones, with a bearish bias while below 135.00 and being on the backside of the bullish trend. A break of 133.50 would be a significant bearish development.