- Crude Oil Futures: Scope for further consolidation

Market news

19 May 2023

Crude Oil Futures: Scope for further consolidation

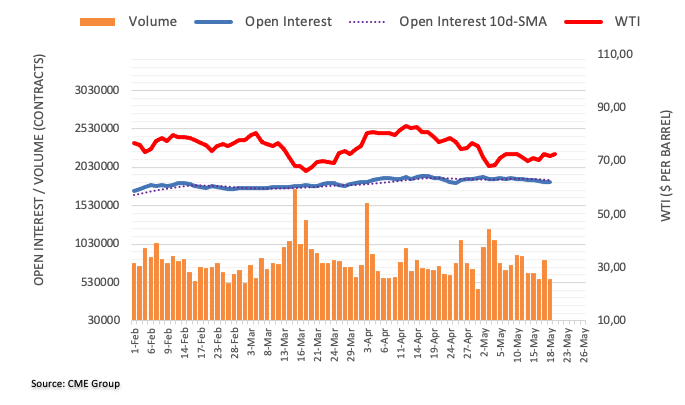

CME Group’s flash data for crude oil futures markets noted traders added nearly 9K contracts to their open interest positions on Thursday, reversing at the same time six consecutive daily pullbacks. Volume, on the other hand, dropped sharply by around 244.8K contracts, partially reversing the previous daily build.

WTI points to some range bound so far

Thursday’s negative price action in WTI was accompanied by rising open interest and declining volume. Against that, the commodity appears poised to keep the weekly consolidative mood in the very near term at least. So far, the $70.00 mark per barrel seems quite a decent contention area.

Market Focus

Open Demo Account & Personal Page