- NZD/USD bulls enaged and eye 0.6300 ahead of RBNZ

Market news

NZD/USD bulls enaged and eye 0.6300 ahead of RBNZ

- NZD/USD bulls have been in charge and eye 0.6300.

- The RBNZ is going to be one of the key events for the pair this week.

NZD/USD is up by some 0.2% and has risen from a low of 0.6261 to reach a high of 0.6292 so far. However, we have the Reserve Bank of New Zealand tomorrow which is likely to see the Kiwi tread water ahead of the event.

Markets are split on whether we’ll see a 25 or 50bp hike. ´´After the surprise 50bps hike in Apr, we don't expect another 50bps shocker after the softer Q1 CPI print,´´ analysts at TD Securities said.

´´However, we do acknowledge the risk of one as the budget update shows more fiscal impulse working through the economy from the cyclone rebuild. Focus turns to the new OCR track and an increase in the terminal rate will lead markets to price in further hikes,´´ the analysts added.

Meanwhile, there has been no progress seen in US debt ceiling negotiations and Fedspeak overnight was mixed and did little to shift the USD, as analysts at ANZ Bank noted,.

´´But let’s see what the Fed minutes and US core PCE deflator look like.´´

´´For the Kiwi per se, as we noted yesterday, it seems to be mostly about carry now that some short-end rates are around 6%, which is world-beating. With genuinely expansionary forces (migration/fiscal) behind the reasons most are calling for a higher OCR, higher rates should be NZD-beneficial, twin deficits (fiscal/trade) cast a dark shadow over the background,´´ the analysts added.

NZD/USD technical analysis

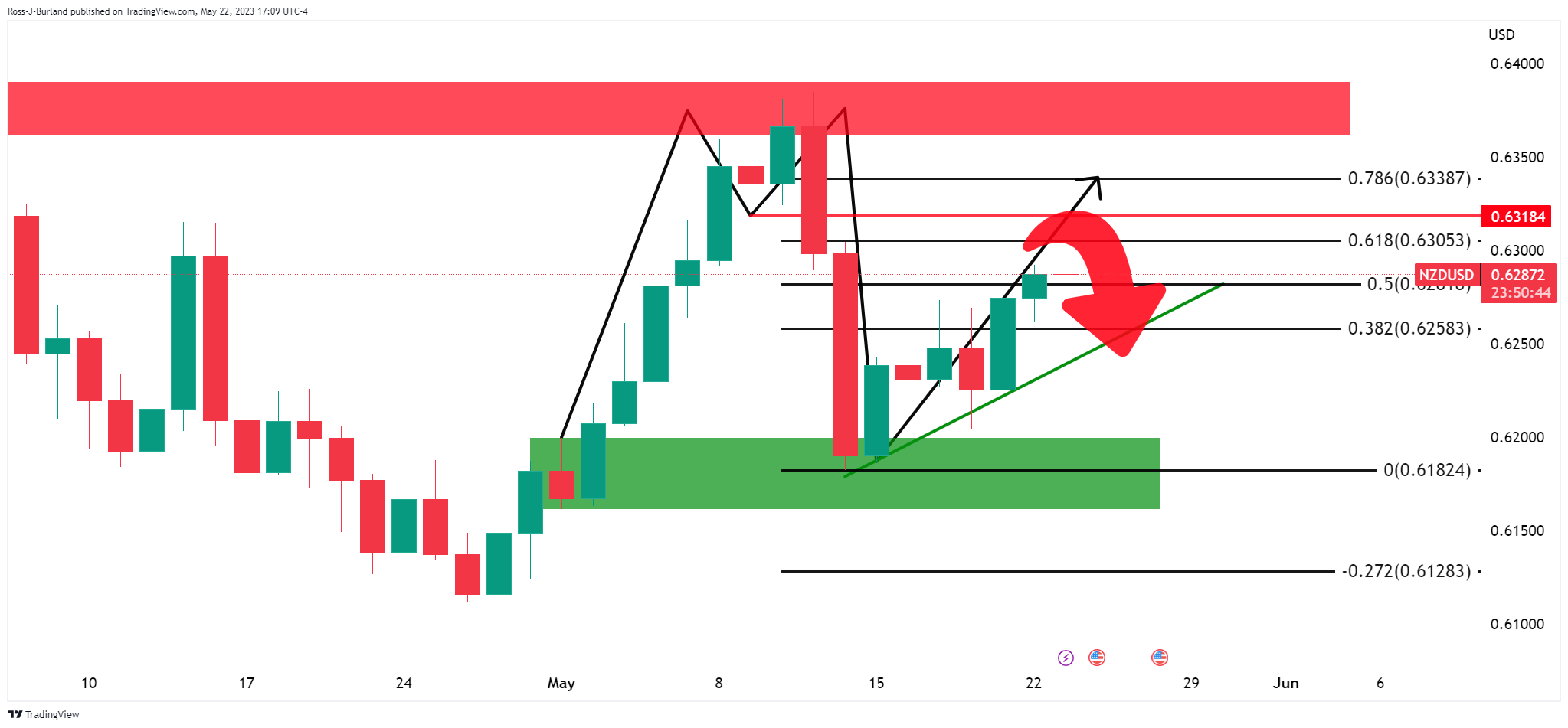

NZD/USD is completing the M-formation pattern with a move toward the neckline.

The price has already moved in on the 61.8% Fibonacci retracement level as illustrated above. This pattern´s neckline area could well hold and see a rejection to the downside in the coming days.