- Crude Oil Futures: A deeper pullback seems off the table

Market news

9 June 2023

Crude Oil Futures: A deeper pullback seems off the table

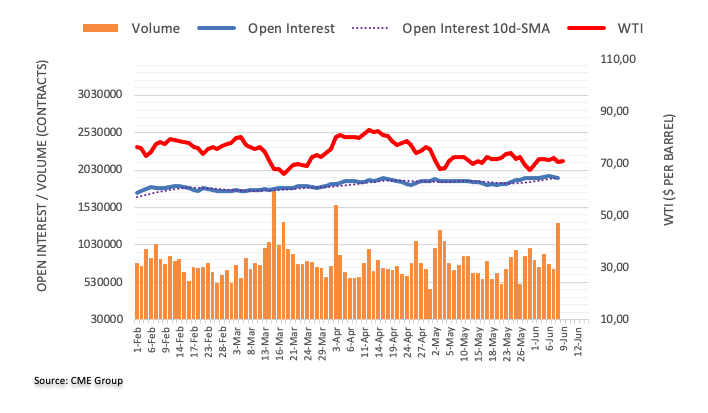

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for the second session in a row on Thursday, this time by around 15.3K contracts. Volume, instead, went up sharply by around 609.4K contracts, the largest single-day build since early April.

WTI: Recovery remains focused on $75.00

Prices of the WTI retreated markedly on Thursday on the back of shrinking open interest, which removes some strength for the prospects for a deeper drop in the very near term. In the meantime, further rebound is expected to meet the next hurdle around the monthly high near the $75.00 mark per barrel (June 5).

Market Focus

Open Demo Account & Personal Page