- AUD/USD retreats from daily highs post-Fed decision

Market news

AUD/USD retreats from daily highs post-Fed decision

- Fed left rates unchanged at 5.00%-5.25% as expected.

- An upwards revision of the median terminal rates hints at more hikes in 2023.

- The AUD/USD faced volatility, initially retreating from 0.6835 to 0.6755, and then stabilized around 0.6800.

The AUD/USD cleared part of its daily gains, retreating to 0.6800 after the Federal Reserve (Fed) decision to hold rates steady. Additionally, an upward revision of the terminal rate to 5.6% was confirmed, indicating the likelihood of two additional 25 basis points (bps) increases. In their statement, the Fed clarified that keeping rates unchanged during this meeting would enable the members of the Federal Open Market Committee to evaluate further information regarding its impact on monetary policy.

US yields recovered some ground as the Fed hinted at more hikes

Following the statement, the 10-year US bond yield recovered to 3.80%. On the other hand, the US stock market weakened, as all three major indices are in negative territory. The S&P 500 index (SPX) is seeing a 0.6% slide, the Dow Jones Industrial Average (DJI) a 1.19% loss, and the Nasdaq Composite (NDX) a 0.58% decrease.

For the following sessions, investors' assessment of the monetary policy statement, macro forecasts and Chair Powell’s comment will dictate the pace of the markets. That being said, the economic projections indicate a slower growth pace, a robust labour market and slower progress on inflation. Regarding the press conference, Powell focused on the need to pause following a consecutive 500 bps hike since last year to asses further information.

AUD/USD Levels to watch

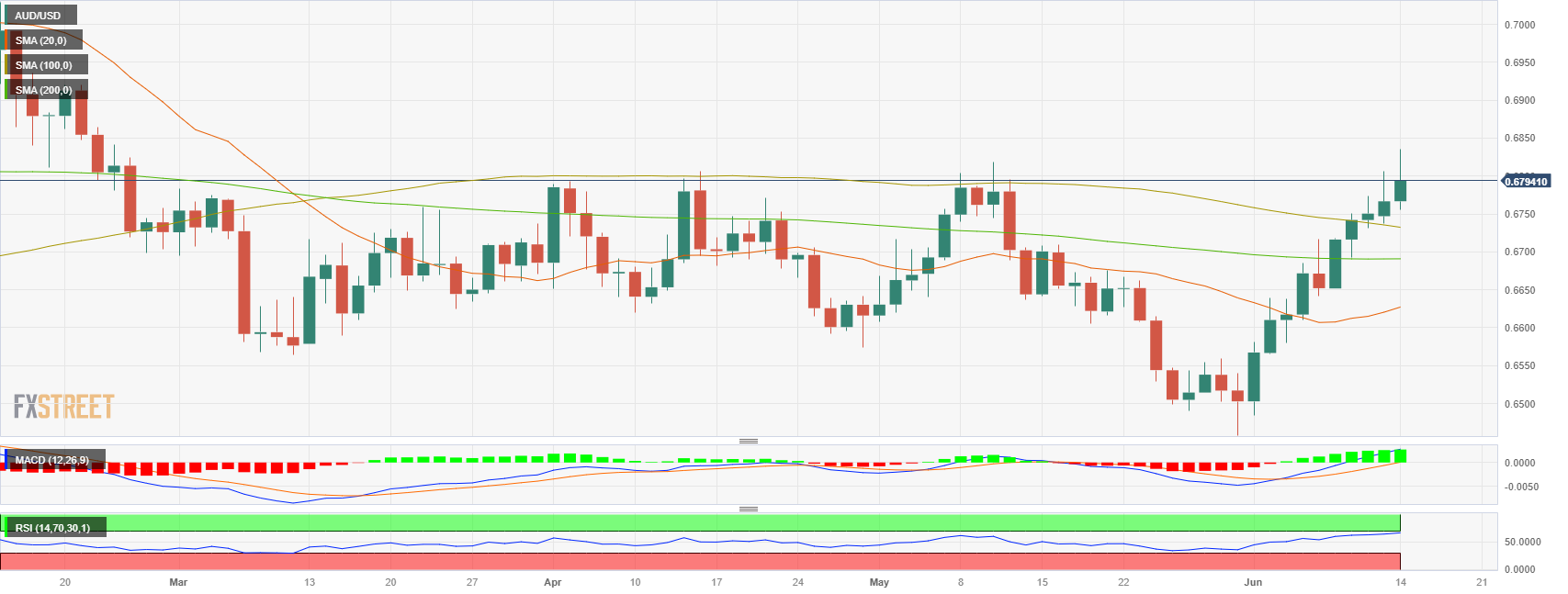

According to the daily chart, the AUD/USD holds a neutral to bearish outlook for the short term as the bulls seemed to have taken a step back. However, technical indicators remain positive, indicating that the market may be preparing for another leg up.

If AUD/USD manages to move higher, the next resistances to watch are at the daily high at 0.6838, followed by the 0.6850 area and the psychological mark at 0.6900. On the other hand, the 100-day Simple Moving Average (SMA) at 0.6730 level is key for AUD/USD to maintain its upside bias. If breached, the pair could see a steeper decline towards the 200-day SMA at 0.6690 and the 20-day SMA at 0.6630.

AUD/USD Daily Chart