- USD/JPY Price Analysis: Bulls and bears greet at key resistance

Market news

USD/JPY Price Analysis: Bulls and bears greet at key resistance

- USD/JPY bulls could be about to throw in the towel.

- Bears are a correction although note the bullish trend remains solid.

The Japanese yen held near 143 per dollar and at the bullish cycle's weakest levels while the BOJ is expected to keep ultra-low interest rates unchanged and maintain its current yield curve control policy. Bank of Japan Governor Kazuo Ueda reiterated the bank’s resolve to maintain an ultra-loose monetary policy to sustainably achieve the 2% inflation target which leaves the Yen vulnerable. However, there are prospects of a meanwhile correction as the following illustrates.

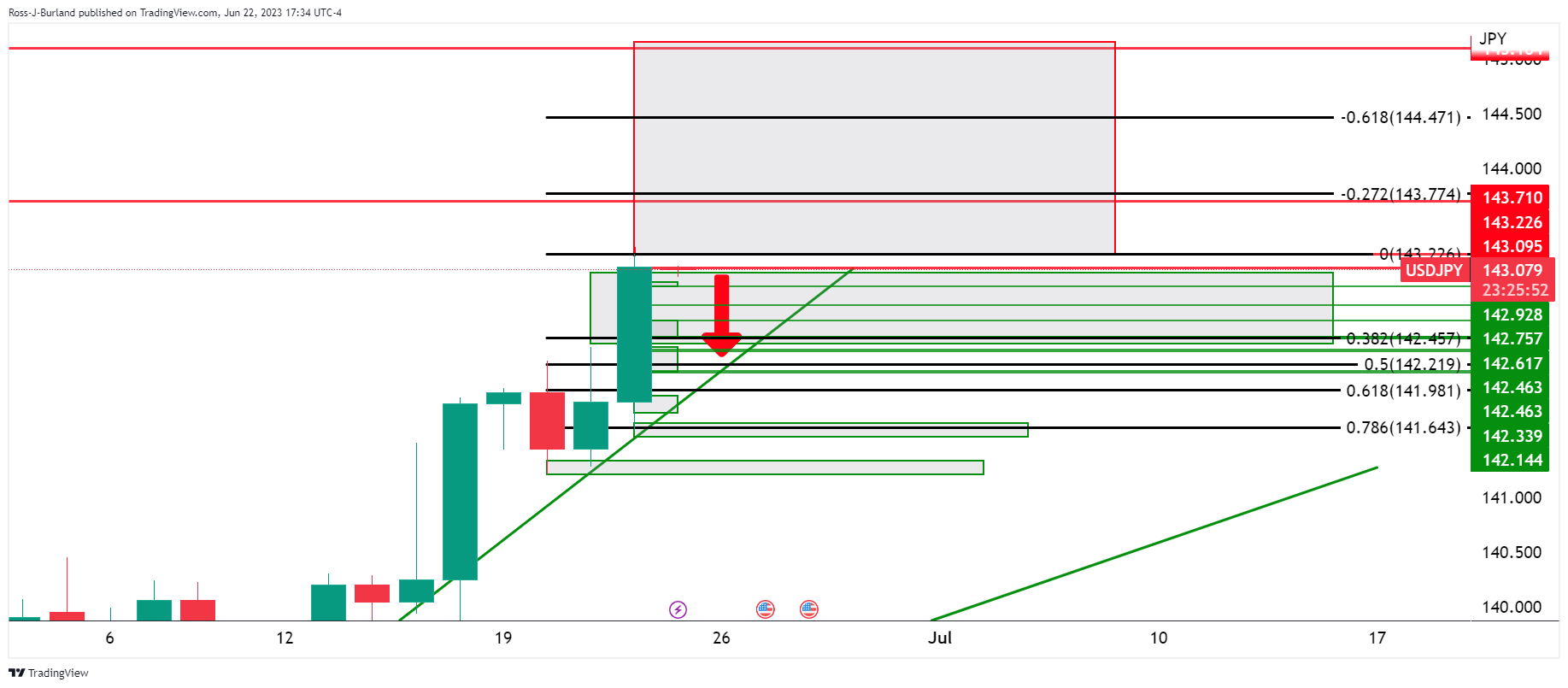

USD/JPY daily charts

Bulls are riding a bullish cycle into the 143 area with eyes on 145.00 higher up. However, a correction could be on the cards.

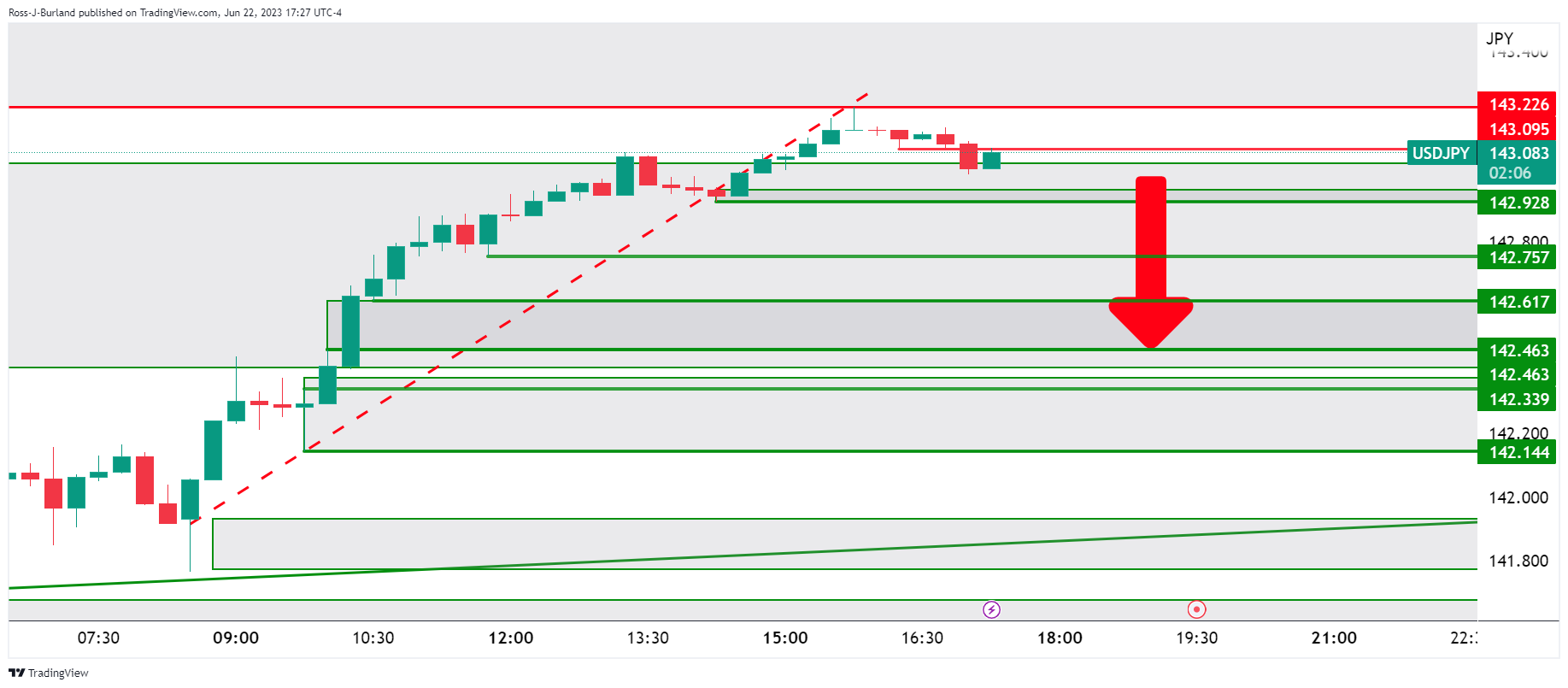

USD/JPY M15 chart

On a meanwhile downside scenario, on the 15-minute chart, we can map out the structures around 142.93 and 142.76 for levels that might guard against a significant correction over the coming day(s).

The daily chart's 38.2% Fibonacci retracement and the 50% mean reversion levels align with the 15-minute structure near 142.50 and 142.20 as potential downside targets, albeit, still on the front side of the bullish trend: