- WTI Price Analysis: Oil remains vulnerable to further downside past $70.00

Market news

WTI Price Analysis: Oil remains vulnerable to further downside past $70.00

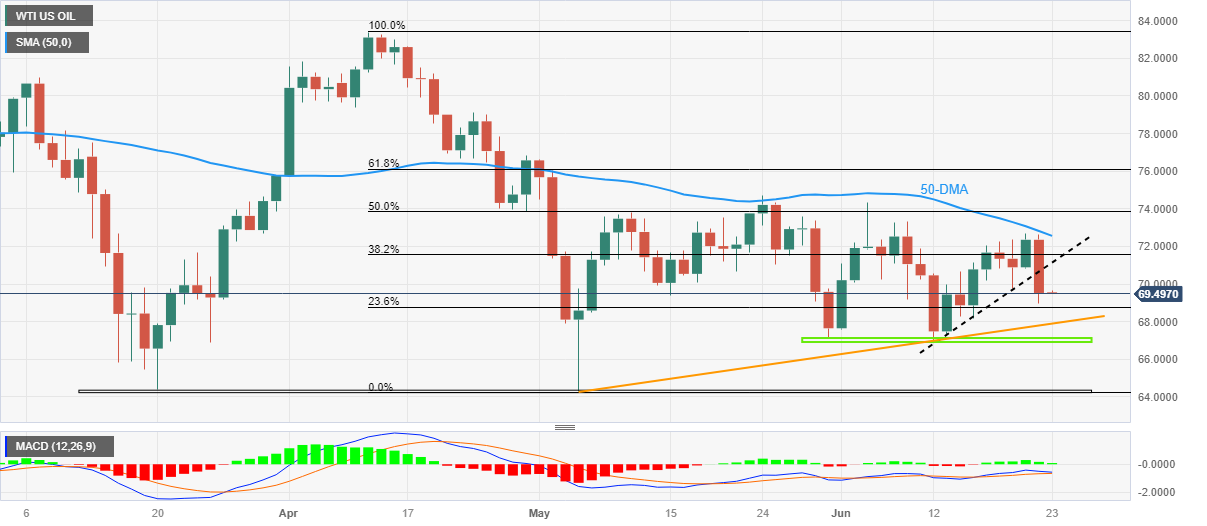

- WTI crude oil holds lower ground near the weekly bottom after falling the most in a fortnight.

- Clear downside break of two-week-old ascending support line, looming bear cross on MACD favor Oil sellers.

- 50-DMA adds to the upside filters; ascending trend line from early May lures black gold bears.

WTI crude oil returns to the bear’s radar, with Thursday’s heavy fall, even as the black gold traders lick their wounds near $69.50 amid the early hours of Friday’s Asian session. In doing so, the energy benchmark reverses the previous week’s corrective bounce, as well as prepares for the third weekly loss in four.

That said, WTI dropped the most in two weeks the previous day and broke an ascending support line from June 12, now immediate resistance near $71.10. Adding strength to the downside bias is the impending bear cross on the MACD indicator.

With this, the Oil price is likely to decline towards an upward-sloping support line from May 04, close to $67.90 by the press time. However, the 23.6% Fibonacci retracement of its April-May fall, around $68.75, may act as immediate support for the black gold.

It should be noted that the quote’s weakness past $67.90 trend line support will be challenged by the monthly horizontal support of around $67.10-67.00 before dragging the quote towards the yearly low marked in May, around $64.30.

Meanwhile, an upside break of the support-turned-resistance of near $71.10 isn’t a welcome note for the WTI crude oil buyers as the 50-DMA hurdle of $72.555 stands tall to challenge the Oil bulls afterward.

WTI crude oil: Daily chart

Trend: Further downside expected