- AUD/JPY Price Analysis: Oscillates around 94.50s, but dragonfly-doji warrants further upside

Market news

AUD/JPY Price Analysis: Oscillates around 94.50s, but dragonfly-doji warrants further upside

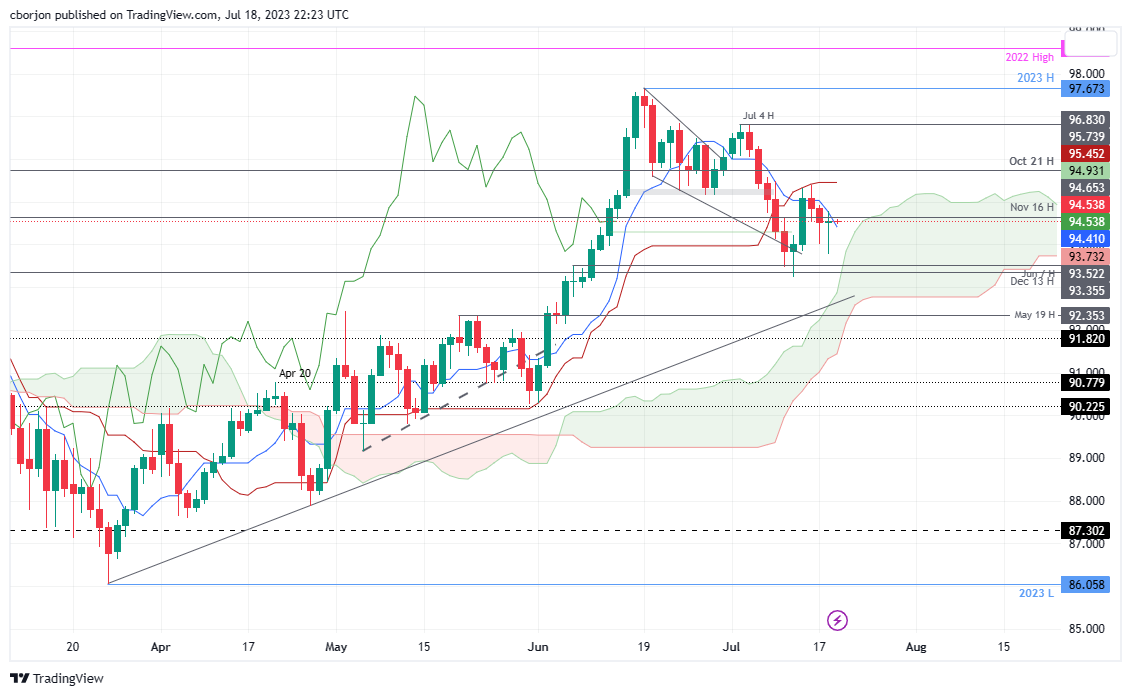

- AUD/JPY hovers around 94.54, with upcoming releases of the Westpac Leading Index and Reuters Tankan Index set to impact the pair.

- Tuesday's price movement formed a dragonfly-doji, suggesting a potential upside, especially if AUD/JPY can reclaim 95.00.

- A breach below the 94.00 level could initiate a bearish continuation for AUD/JPY, with further support levels at 93.44, 93.23, and 93.00.

AUD/JPY is almost unchanged as Wednesday’s Asian session commences, which will showcase the release of the Westpac Leading Index on the Australian front and the Reuters Tankan Index for July, a sentiment index for manufacturers in Japan. As of writing, the AUD/JPY is trading at 94.54, below its opening price by 0.01%, with sellers eyeing a break below the Tenkan-Sen line at 94.41.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chat portrays the pair as neutral biased after diving towards its current week low of 93.77 on Tuesday, but words from the Bank of Japan (BoJ) Governor Kazuo Ueda, weighed on the Japanese Yen (JPY), bolstering the AUD/JPY, which closed above its opening price. That formed a dragonfly-doji, opening the door for further upside late in the European session.

An AUD/JPY bullish resumption would occur when the pair claims the 95.00 figure. Break above would expose the July 14 and the Kijun-Sen confluence at around 95.38/95.45, immediately followed by the October 21 daily high at 95.74. Once those levels are surpassed, the AUD/JPY’s next goal would be 96.00.

Conversely, for an AUD/JPY bearish continuation, the pair must get below the 94.00 handle. A breach of the latter will expose the weekly low of 93.44, followed by the July 12 low of 93.23, before getting to the 93.00 mark.

AUD/JPY Price Action – Daily chart