- USD/CNH Price Analysis: Yuan sellers look set to challenge 7.2370 hurdle as US PMIs loom

Market news

USD/CNH Price Analysis: Yuan sellers look set to challenge 7.2370 hurdle as US PMIs loom

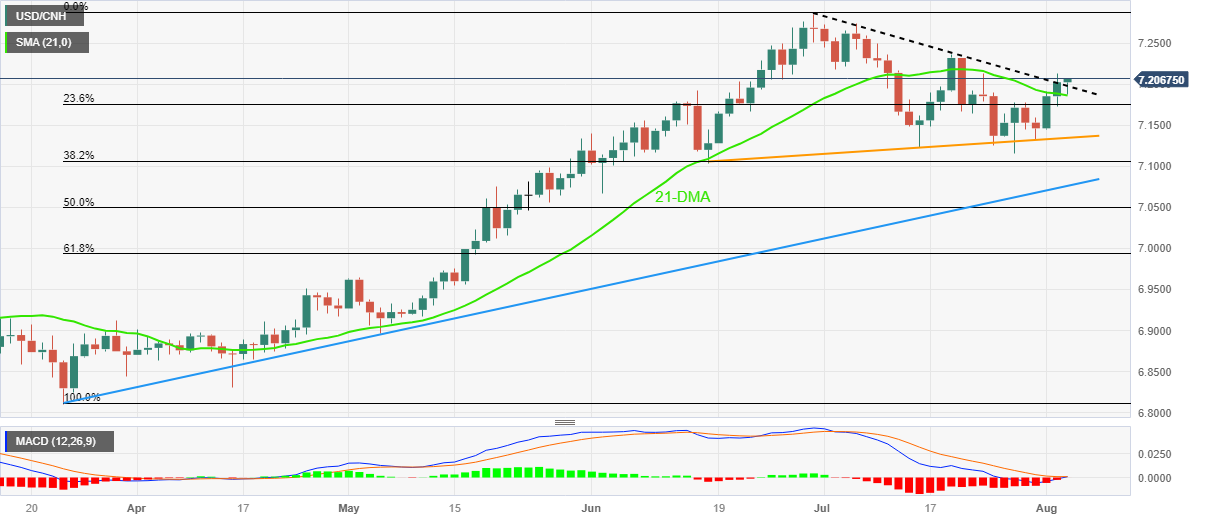

- USD/CNH remains sidelined at one-week high, stays firmer for the third consecutive day.

- Upside beak of 21-DMA, previous resistance line from late June joins looming bull cross on MACD to favor Yuan sellers.

- Pair bears need validation from seven-week-old rising support line to retake control.

USD/CNH bulls take a breather at the highest level in eight days, picking up bids to 7.2080 heading into Thursday’s European session. In doing so, the offshore Chinese Yuan (CNH) pair ignores the upbeat China Caixin Services PMI by tracing the firmer US Dollar ahead of the key data.

Also read: US Dollar Index: DXY traces yields to refresh multi-day top below 103.00 ahead of US ISM Services PMI

That said, China’s Caixin Services PMI jumps to 54.1 in July from 53.9 prior and 52.5 market expectations.

It’s worth noting, however, that the previous day’s upside break of a five-week-old descending trend line and the 21-DMA, respectively around 7.1970 and 7.1860, joins the impending bull cross on the MACD to keep the Yuan sellers hopeful.

However, the mid-July swing high of around 7.2370 will be a key hurdle to cross for the USD/CNH bulls to dominate further.

In that case, the yearly high marked in July around 7.2860 will be in the spotlight.

On the contrary, a daily closing below the previous resistance line and the 21-DMA, close to 7.1970 and 7.1860 in that order, will recall the USD/CNH sellers.

Even so, the USD/CNH bear’s dominance will depend upon how well they can conquer an upward-sloping support line from mid-June, close to 7.1350.

Above all, the USD/CNH pair remains on the bull’s radar unless it stays beyond an ascending trend line stretched from late March, close to 7.0760 at the latest.

USD/CNH: Daily chart

Trend: Further upside expected