- Gold Futures: Door open to extra losses

Market news

3 August 2023

Gold Futures: Door open to extra losses

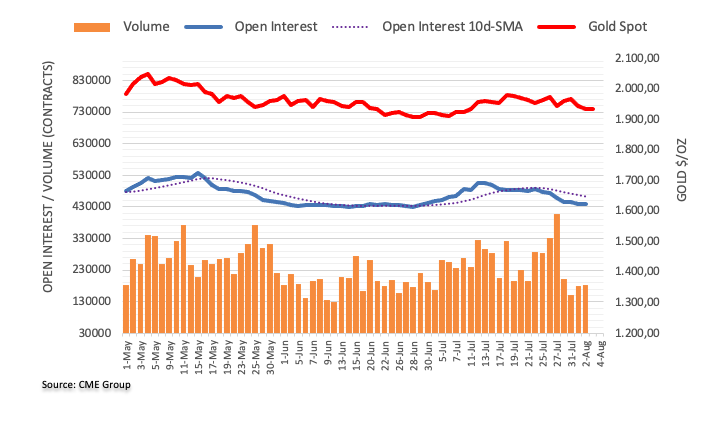

Open interest in gold futures markets increased by just 691 contracts after six consecutive daily pullbacks on Wednesday, according to preliminary readings from CME Group. Volume followed suit and went up for the second session in a row, this time by nearly 1.5K contracts.

Gold: Next on the downside comes $1893

Wednesday’s downtick in gold prices was on the back of increasing open interest and volume, hinting at the idea that extra decline could be in the pipeline for the yellow metal in the very near term. Against that, the next support of note comes at the round level of $1900 per troy ounce prior to the June low of $1893 (June 29).

Market Focus

Open Demo Account & Personal Page