- GBP/JPY Price Analysis: Retreats from YTD highs nearby 187.00, as Yen flexes muscles

Market news

GBP/JPY Price Analysis: Retreats from YTD highs nearby 187.00, as Yen flexes muscles

- GBP/JPY dropped 0.34%, trading at 185.80, influenced by a dip in US 10-year Treasury bond yield.

- Despite a daily low of 185.52, GBP/JPY is poised to challenge the 187.00 mark amid potential Yen intervention.

- Short-term analysis shows support at Senkou Span B (185.50); a close below 186.00 may signal further declines.

GBP/JPY hits a new year-to-date (YTD) high but retraces as the Japanese Yen (JPY) strengthens during Tuesday’s session and remains the second strongest currency in the day. A drop in the US 10-year Treasury bond yield undermined the USD/JPY pair; hence the GBP/JPY dropped. At the time of writing, the GBP/JPY is trading at 185.80, with losses of 0.34%.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY remains upward biased, though it seems that some buyers book profits, as Japanese authorities remain vocal about a possible intervention to boost the Yen. Despite dipping to a daily low of 185.52, the pair would likely test the 186.00 figure, followed by a challenge of the 187.00 psychological level.

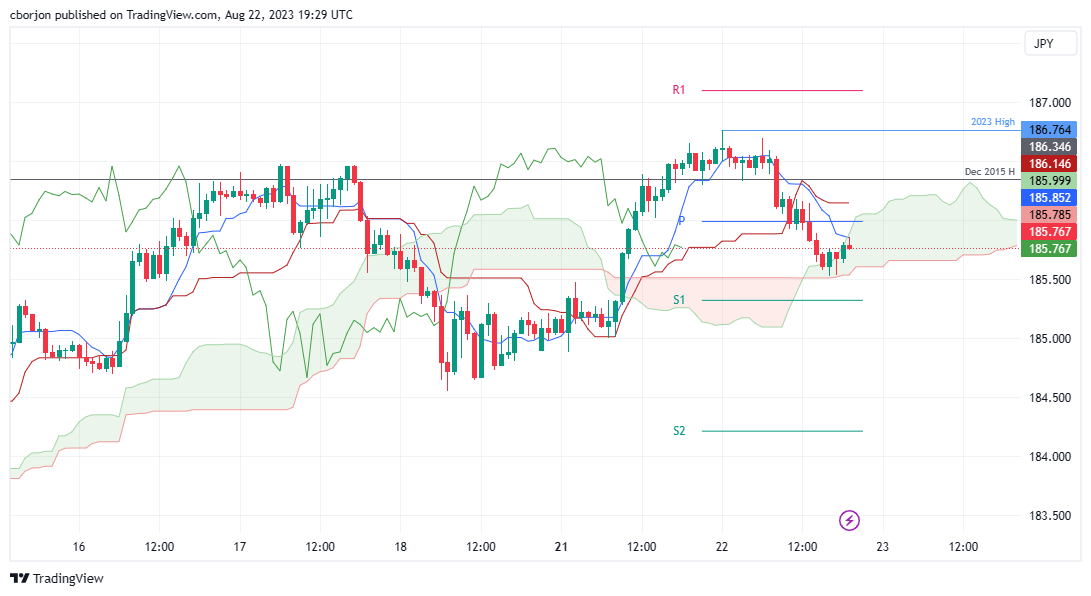

In the short term, the GBP/JPY hourly chart portrays the pair peaked around the new YTD high and retraced below the Asian session low of 186.29, plunging 70 pips toward its daily low. It should be said the GBP/JPY dive was cushioned by the Senkou Span B support at around 185.50; since then, the cross-currency pair edged towards the confluence of the top of the Ichimoku Cloud (Kumo) and the Tenkan-Sen line at 185.85. Once those levels are cleared, the next stop would be the daily pivot point at 185.99. A daily close below 186.00 could pave the way for further losses.

GBP/JPY Price Action – Hourly chart