- Gold Price Forecast: XAU/USD grinds higher past $1,895 support as PMI data looms – Confluence Detector

Market news

Gold Price Forecast: XAU/USD grinds higher past $1,895 support as PMI data looms – Confluence Detector

- Gold Price braces for the first weekly gain in five despite positing mild daily gains of late.

- Cautious optimism joins positioning for PMI data to weigh on US Treasury bond yields, US Dollar and underpin XAU/USD rebound.

- Softer preliminary PMIs from top-tier economies can prod central bankers from turning hawkish at Jackson Hole and favor Gold buyers.

- Sustained trading beyond key support confluence keeps XAU/USD bulls hopeful.

Gold Price (XAU/USD) stays on the front foot for the fourth consecutive day despite lacking upside momentum ahead of the top-tier statistics.

That said, the XAU/USD’s latest run-up could be linked to the US Dollar’s retreat amid softer Treasury bond yields and slightly positive market sentiment.

Furthermore, expectations of improving US-China ties and mixed concerns about the dedollarization at the BRICS Summit, currently held in South Africa to facilitate diplomatic discussion among Brazil, Russia, India, China and South Africa, also favor the Gold buyers.

On the same line could be the market’s heavy bets, per the interest rate futures, suggesting no change in the Fed rate in September, as well as expectations favoring the lack of hawkish bias in Fed Chair Jerome Powell’s speech at Friday’s Jackson hole Symposium.

It’s worth noting, however, that the recently firmer US data and the Federal Reserve policymakers’ hesitance in welcoming the rate-cut bias seems to guard the XAU/USD rebound as markets await preliminary readings of the August month Purchasing Managers Indexes (PMIs) for major economies.

Also read: Gold Price Forecast: Will XAU/USD recapture 200 DMA? Focus on EU/ US PMIs

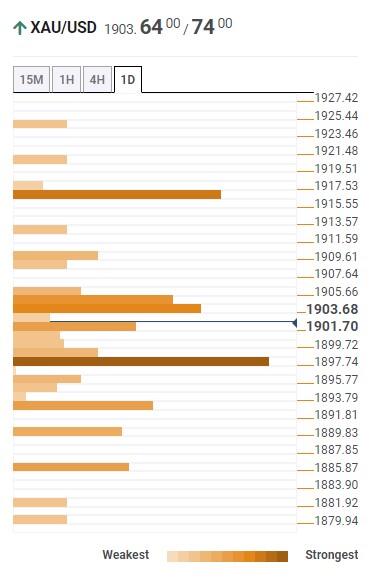

Gold Price: Key levels to watch

As per our Technical Confluence indicator, the Gold Price stays firmer past the $1,895 support confluence comprising Fibonacci 38.2% on one day and one week, as well as 10-SMA on the four-hour (4H) chart.

That said, the previous highs on the daily and monthly chart join the upper line of the Bollinger on the four-hour play to restrict the immediate upside of the XAU/USD price near $1,905.

Following that, Pivot Point one-month S1, previous weekly high and 100-SMA on 4H, close to $1,918, appears the last defense of the Gold sellers.

On the contrary, a downside break of the $1,895 key support won’t open doors for the Gold sellers as Fibonacci 23.6% on one-week and the lower band of the Bollinger, around $1,892, precedes the previous weekly low of around $1,885 to restrict short-term downside of the XAU/USD.

In a case where the Gold Price remains weak past $1,885, the odds of witnessing a slump toward the early March swing high of around $1,858 can’t be ruled out.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.