- Crude Oil Futures: Extra pullbacks lose traction

Market news

9 November 2023

Crude Oil Futures: Extra pullbacks lose traction

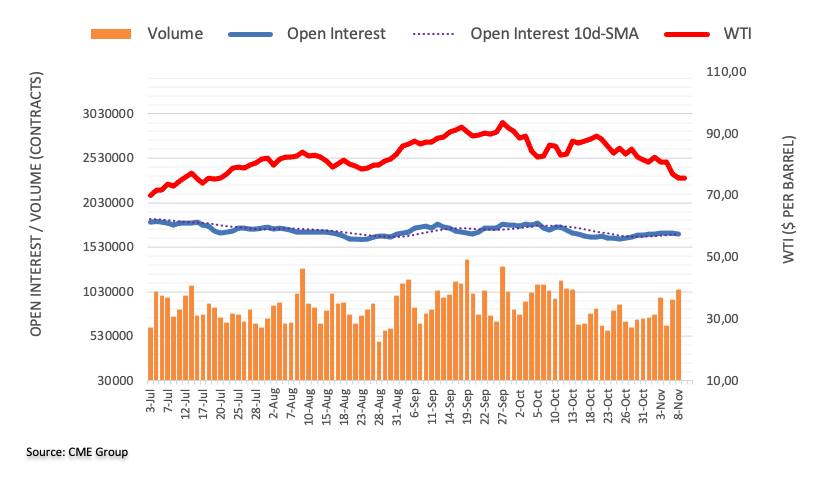

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions for the third session in a row on Wednesday, now by around 15.5K contracts. Volume, instead, added around 109.6K contracts to the previous daily build.

WTI: Immediately to the upside comes the 200-day SMA

Wednesday’s drop in prices of WTI came amidst shrinking open interest and suggests that a deeper decline looks unlikely in the very near term. That said, occasional recovery attempts should meet initial resistance at the key 200-day SMA, today at $78.11.

Market Focus

Open Demo Account & Personal Page