Market news

-

23:27

Currencies. Daily history for Mar 01’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0546 -0,27%

GBP/USD $1,2290 -0,72%

USD/CHF Chf1,0087 +0,32%

USD/JPY Y113,72 +0,85%

EUR/JPY Y119,92 +0,57%

GBP/JPY Y139,75 +0,12%

AUD/USD $0,7675 +0,26%

NZD/USD $0,7142 -0,67%

USD/CAD C$1,3324 +0,19%

-

23:01

Schedule for today, Thursday, Mar 02’2017 (GMT0)

00:30 Australia Trade Balance January 3.51 3.8

00:30 Australia Building Permits, m/m January -1.2% -0.4%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV 1.3% 1.3%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV 0.0% 0.5%

08:15 Switzerland Retail Sales (MoM) January -2.4%

08:15 Switzerland Retail Sales Y/Y January -3.5% -2%

09:30 United Kingdom PMI Construction February 52.2 52.2

10:00 Eurozone Producer Price Index, MoM January 0.7% 0.6%

10:00 Eurozone Producer Price Index (YoY) January 1.6% 3.2%

10:00 Eurozone Unemployment Rate January 9.6% 9.6%

13:30 Canada GDP (m/m) December 0.4% 0.3%

13:30 Canada GDP QoQ Quarter IV 0.9%

13:30 Canada GDP (YoY) Quarter IV 3.5% 2%

13:30 U.S. Continuing Jobless Claims 2060 2068

13:30 U.S. Initial Jobless Claims 244 245

18:00 Canada Gov Council Member Lane Speaks

22:30 Australia AIG Services Index February 54.5

23:30 Japan Tokyo Consumer Price Index, y/y February 0.1% -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February -0.3% -0.2%

23:30 Japan Unemployment Rate January 3.1% 3%

23:30 Japan Household spending Y/Y January -0.3% -0.4%

23:30 Japan National Consumer Price Index, y/y January 0.3% 0.4%

23:30 Japan National CPI Ex-Fresh Food, y/y January -0.2% 0%

-

15:30

U.S.: Crude Oil Inventories, February 1.501 (forecast 2.85)

-

15:20

Canadian dollar hits new 5-week low vs USD, touches C$1.3351

-

15:19

BoC says recent data on global and canadian economies are consistent with bank's projection of improving growth

-

Canadian dollar, bond yields remain near levels observed in january

-

Looking through recent rise in overall inflation, since effect of higher energy prices will be temporary

-

Q4 canadian growth may have been slightly stronger than expected, says exports continue to face competitiveness challenges

-

Despite recent Canada job gains, subdued growth in wages and hours worked continue to reflect persistent economic slack uncertainties" weighing on its outlook

-

Three measures of core inflation, taken together, continue to point to material excess capacity in economy

-

-

15:17

US construction spending down 1.0%

Construction spending during January 2017 was estimated at a seasonally adjusted annual rate of $1,180.3 billion, 1.0 percent below the revised December estimate of $1,192.2 billion. The January figure is 3.1 percent above the January 2016 estimate of $1,144.9 billion.

Spending on private construction was at a seasonally adjusted annual rate of $911.6 billion, 0.2 percent above the revised December estimate of $909.4 billion. Residential construction was at a seasonally adjusted annual rate of $476.4 billion in January, 0.5 percent above the revised December estimate of $474.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $435.3 billion in January, nearly the same as the revised December estimate of $435.4 billion.

-

15:15

US economic activity in the manufacturing sector expanded in February - ISM

Economic activity in the manufacturing sector expanded in February, and the overall economy grew for the 93rd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee: "The February PMI registered 57.7 percent, an increase of 1.7 percentage points from the January reading of 56 percent. The New Orders Index registered 65.1 percent, an increase of 4.7 percentage points from the January reading of 60.4 percent. The Production Index registered 62.9 percent, 1.5 percentage points higher than the January reading of 61.4 percent. The Employment Index registered 54.2 percent, a decrease of 1.9 percentage points from the January reading of 56.1 percent".

-

15:03

The Bank of Canada announced that it is maintaining its target for the overnight rate at 1/2 per cent

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

CPI inflation rose to 2.1 per cent in January, reflecting higher energy prices due in part to carbon pricing measures introduced in two provinces. The Bank is looking through these effects, as their impact on inflation will be temporary. The Bank's three measures of core inflation, taken together, continue to point to material excess capacity in the economy.

Overall, recent data on the global and Canadian economies have been consistent with the Bank's projection of improving growth, as set out in the January Monetary Policy Report (MPR). In Canada, recent consumption and housing indicators suggest growth in the fourth quarter of 2016 may have been slightly stronger than expected. However, exports continue to face the ongoing competitiveness challenges described in the January MPR. The Canadian dollar and bond yields remain near levels observed at that time. While there have been recent gains in employment, subdued growth in wages and hours worked continue to reflect persistent economic slack in Canada, in contrast to the United States.

The Bank's Governing Council remains attentive to the impact of significant uncertainties weighing on the outlook and continues to monitor risks outlined in the January MPR. In this context, Governing Council judges that the current stance of monetary policy is still appropriate and maintains the target for the overnight rate at 1/2 per cent.

-

15:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:00

U.S.: ISM Manufacturing, February 57.7 (forecast 56)

-

15:00

U.S.: Construction Spending, m/m, January -1% (forecast 0.6%)

-

14:45

U.S.: Manufacturing PMI, February 54.2 (forecast 54.4)

-

14:35

Bank of Canada expected to hold interest rate at 0.50%. Decision in less than half an hour

-

13:56

Canada's current account deficit narrowed by $9.0 billion in the fourth quarter of 2016

Canada's current account deficit (on a seasonally adjusted basis) narrowed by $9.0 billion in the fourth quarter to $10.7 billion as the goods balance posted its first surplus in more than two years.

In the financial account (unadjusted for seasonal variation), foreign investment in Canadian private corporate securities led the inflow of funds in the economy in the quarter.

For the year 2016, the current account deficit edged up $0.1 billion to $67.7 billion. The deficit on goods expanded, mainly on lower exports of energy products. A lower deficit on services moderated the overall increase in the current account deficit in 2016.

In the financial account, transactions in securities generated a record net inflow of funds of $147.5 billion in 2016. These inflows were partially offset by outflows in direct and other investment. Direct investment abroad exceeded direct investment in Canada by $43.3 billion in 2016.

Since the return to a current account deficit in 2009, the funding of this deficit has mostly come from transactions in securities. Foreign investment in Canadian securities has steadily exceeded Canadian investment in foreign securities during this period.

-

13:55

German inflation up 2.2% on year

The inflation rate in Germany as measured by the consumer price index is expected to be 2.2% in February 2017. Such a high rate of inflation was last measured in August 2012. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.6% on January 2017.

-

13:54

US personal income rose more than expected in January

Personal income increased $63.0 billion (0.4 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $40.1 billion (0.3 percent) and personal consumption expenditures (PCE) increased $22.2 billion (0.2 percent).

Real DPI decreased 0.2 percent in January and Real PCE decreased 0.3 percent. The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.3 percent.

-

13:30

U.S.: Personal Income, m/m, January 0.4% (forecast 0.3%)

-

13:30

U.S.: Personal spending , January 0.2% (forecast 0.3%)

-

13:30

Canada: Current Account, bln, Quarter IV -10.7 (forecast -9.8)

-

13:30

U.S.: PCE price index ex food, energy, Y/Y, January 1.7% (forecast 1.8%)

-

13:30

U.S.: PCE price index ex food, energy, m/m, January 0.3% (forecast 0.2%)

-

13:00

Germany: CPI, y/y , February 2.2% (forecast 2.1%)

-

13:00

Germany: CPI, m/m, February 0.6% (forecast 0.6%)

-

12:54

French Presidential Candidate Fillon Confirms Summoned by Investigative Judge - Bloomberg

-

11:23

Far-right's Le Pen to get 25 pct (-1) in 1st round of French presidential election, Macron 24 pct (unchanged), Fillon 21 pct (unchanged) - Opinionway poll

-

11:07

Fillon would beat Le Pen in run-off vote by 60 pct to 40 pct if Fillon made it through to second round - Opinionway poll

-

10:30

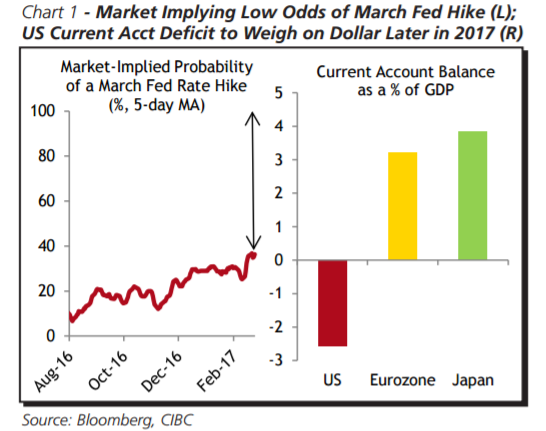

USD risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies - CIBC

"The US dollar's initial Trump bump has largely been sustained, but the President's first month in office hasn't seen any further gains on that front.

Attention has now shifted back to the central bank to give the greenback another boost, and while, on balance, Fed policymakers look like they have enough evidence to hike rates in March, the market is only assigning a 1 in 3 chance that they move at that meeting. Even if the Fed ends up passing on March, markets need to realize that another rate hike is coming soon, and that will push the US dollar stronger versus a variety of other currencies.

Risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies which could ultimately give greenback strength additional fuel. While administration officials have stated that they would like to see a weaker currency, actions speak louder than words, and trade policies remain a wild card. But as long as policymakers take a measured approach on that front, which is our base-case expectation, the US dollar is likely to begin losing ground in the second half of the year. That's when large-scale monetary stimulus could start being pulled back in other places like Japan and the Eurozone.

At the same time, the current account surpluses of those jurisdictions will begin to be seen in starker contrast to the large deficit in the US, adding another layer of pressure to the US currency.

So whether it happens within the next month, or fairly soon thereafter, the US dollar has one more bout of strength left in it before it starts a longer-term slide against a number of other majors".

Copyright © 2017 CIBC, eFXnews™

-

10:16

Romania sold non-performing loans worth 3.5 bln euros in 2015-2016, the most in CEE

-

09:46

United Kingdom: Net Lending to Individuals, bln, January 4.8 (forecast 4)

-

09:43

The UK manufacturing sector experienced further solid growth - Markit

The UK manufacturing sector experienced further solid growth of production and new orders during February. Although rates of expansion slowed, they remained well above the respective long-run averages. Increased new business inflows were underpinned by improved domestic and overseas demand, the latter aided by the continued weakness of the sterling exchange rate.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI) posted 54.6 in February, a three-month low and down further from December's two-and-a-half year high.

-

09:31

United Kingdom: Mortgage Approvals, January 69.93 (forecast 68.65)

-

09:31

United Kingdom: Purchasing Manager Index Manufacturing , February 54.6 (forecast 55.6)

-

09:30

United Kingdom: Consumer credit, mln, January 1416 (forecast 1400)

-

09:16

Eurozone manufacturing activity remains at high levels

February saw the rate of improvement in eurozone manufacturing operating conditions gather further momentum. At 55.4, up from 55.2 in January, the final Markit Eurozone Manufacturing PMI rose to its highest level since April 2011 despite posting slightly below its earlier flash estimate of 55.5.

National PMI data indicated that seven out of the eight nations covered saw operating conditions improve (the sole exception being Greece). Three countries also registered faster rates of expansion - the Netherlands, Germany and Italy

-

09:02

German manufacturing posted a strong performance in February

German manufacturing posted a strong performance in February with the best overall improvement in operating conditions since May 2011, according to the latest PMI survey data from IHS Markit and BME. Growth rates for output, new orders, exports and purchasing all accelerated since January, and employment rose sharply. The latest findings also revealed the strongest increase in input prices since May 2011, linked to metals and oil-based materials.

The PMI rose from 56.4 in January to 56.8 in February, the highest since May 2011. The increase in the headline figure reflected the output, new orders and suppliers' delivery times components, while employment and stocks of purchases also made positive overall contributions. The current 27-month sequence of improving manufacturing conditions is the longest observed in over eight-and-a-half years.

-

09:00

Eurozone: Manufacturing PMI, February 55.4 (forecast 55.5)

-

08:56

Germany: Unemployment Change, February -14 (forecast -10)

-

08:55

Germany: Manufacturing PMI, February 56.8 (forecast 57)

-

08:55

Germany: Unemployment Rate s.a. , February 5.9% (forecast 5.9%)

-

08:50

France: Manufacturing PMI, February 52.2 (forecast 52.3)

-

08:31

Spanish manufacturers continued to record growth of output and new orders during February - Markit

Spanish manufacturers continued to record marked growth of output and new orders during February, helping to generate a further sharp rise in employment. There was ongoing evidence of strengthening price pressures, with some firms reportedly building inventories in order to protect against further increases in raw material costs in coming months.

The headline PMI registered at 54.8 in February, down from 55.6 in January but still signalling a solid monthly improvement in the health of the manufacturing sector. Business conditions have now improved in each of the past 39 months.

-

08:30

Switzerland: Manufacturing PMI, February 57.8 (forecast 55.6)

-

08:08

German foreign minister Gabriel says NATO did not decide that every nation has to meet the target of 2 pct of gdp defence spending within 10 years

-

07:38

Options levels on wednesday, March 1, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0667 (2924)

$1.0636 (3618)

$1.0606 (2283)

Price at time of writing this review: $1.0541

Support levels (open interest**, contracts):

$1.0492 (4492)

$1.0446 (3769)

$1.0398 (4227)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 73937 contracts, with the maximum number of contracts with strike price $1,0900 (4657);

- Overall open interest on the PUT options with the expiration date March, 13 is 84173 contracts, with the maximum number of contracts with strike price $1,0550 (5482);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from February, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.2600 (2202)

$1.2501 (2698)

$1.2405 (913)

Price at time of writing this review: $1.2363

Support levels (open interest**, contracts):

$1.2299 (3027)

$1.2200 (1739)

$1.2100 (1622)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 34157 contracts, with the maximum number of contracts with strike price $1,2800 (3103);

- Overall open interest on the PUT options with the expiration date March, 13 is 38285 contracts, with the maximum number of contracts with strike price $1,2300 (3027);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from February, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:19

The UBS consumption indicator rose from 1.38 to 1.43 points in January

The UBS consumption indicator rose from 1.38 to 1.43 points in January and continues to signal solid growth in private consumption. Swiss consumers view the economic and financial situation with considerably more optimism than in the last quarter. New car registrations and domestic tourism have, however, fallen compared with the previous January.

Following a comprehensive data revision, the UBS consumption indicator climbed from 1.38 to 1.43 points in January. The rise owes to a clear improvement in consumer sentiment as the Consumer Sentiment Index published by the State Secretariat for Economic Affairs climbed from -13 to -3 points.

-

07:11

The Caixin China Purchasing Managers' Index improved unexpectedly

China's manufacturing activity expanded again in February as strong foreign demand pushed up overall new orders, despite concerns over trade protectionism measures from the U.S. administration, says rttnews.

The Caixin factory Purchasing Managers' Index improved unexpectedly to 51.7 in February from 51.0 in January, according to a private survey from IHS Markit, released Wednesday. The reading was forecast to drop to 50.8. A score above 50 indicates expansion in the sector.

-

07:09

UK house price index rose more than expected in February - Nationwide

-

Annual house price growth edges up to 4.5%

-

0.6% month-on-month rise in February

-

More households in England own outright than with a mortgage

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "The annual rate of house price growth was little changed in February at 4.5%, only slightly higher than the 4.3% recorded in January. House prices increased by 0.6% over the month, after taking account of seasonal factors. "Recent data suggests that the UK economy has continued to perform relatively strongly. The economy accelerated slightly in Q4, expanding by a healthy 0.7% quarter-on-quarter, and the unemployment rate remained stable at an 11-year low of 4.8%.

-

-

07:07

Trump says he will be asking congress to approve legislation that produces $1 trillion investment in infrastructure financed through both public and private capital

-

Healthcare reform should ensure people with pre-existing conditions have access to coverage

-

U.S. Should switch away from its current system of lower-skilled immigration and instead adopt a merit-based system

-

U.S. will soon begin construction of wall along border with Mexico

-

U.S. should implement legal reforms that protect patients and doctors from unnecessary costs that drive up the price of insurance

-

Does not make reference to having Mexico pay for border wall in speech to congress

-

Administration has taken steps to protect U.S. From radical islamic terrorism

-

It is reckless to allow uncontrolled entry from places where proper vetting cannot occur

-

Burdensome drug approval process at fda keeps too many medical advances from reaching those in need

-

Will shortly take new steps to keep U.S. safe and "Keep those out" who would do U.S. harm

-

People should be given freedom to purchase health insurance across state lines

-

We have to make it much, much harder for companies to leave the U.S

-

We cannot allow U.S. to become a sanctuary for extremists

-

-

07:02

BoJ's Sato: important to engineer a soft-landing from BoJ's unprecedented, massive stimulus programme

-

No consensus yet in BoJ's board on how frequently and by how much it could raise its yield targets if it were to do so in future

-

Shouldn't rule out possibility of raising BoJ's yield targets before 2 pct inflation target is achieved

-

BoJ may struggle to keep 10-yr JGB yield target around zero if consumer inflation accelerates around 1 pct later this year

-

BoJ should not raise yield targets just because long-term rates are rising in tandem with U.S. yields

-

Hard to set explicit interest rate levels in guiding yield curve to appropriate shape

-

-

07:01

United Kingdom: Nationwide house price index , February 0.6% (forecast 0.2%)

-

07:00

Switzerland: UBS Consumption Indicator, January 1.43

-

06:58

The Australian economy recorded broad-based growth of 1.1% in Q4 2016

The Australian economy recorded broad-based growth of 1.1 per cent in seasonally adjusted chain volume terms in the December quarter 2016, a rebound from the previous quarter's decline of 0.5 per cent, data from the Australian Bureau of Statistics (ABS) shows. Australia's Gross Domestic Product (GDP) has now grown 2.4 per cent through the year.

Growth was recorded in 15 out of 20 industries. Strongest growth was observed in Mining, Agriculture, forestry and fishing, and Professional scientific and technical services, each industry contributed 0.2 percentage points to GDP growth.

Household final consumption expenditure contributed 0.5 percentage points to GDP growth. Net exports contributed 0.2 percentage points. Public and private capital formation both contributed 0.3 percentage points this quarter after both detracted from GDP growth last quarter.

-

06:50

Fed's Bullard: No need to be aggressive with rate hikes @Livesquawk

-

Fed closer to goals today than any time in past 60 yrs.

-

-

01:45

China: Markit/Caixin Manufacturing PMI, February 51.7 (forecast 50.8)

-

00:59

China: Non-Manufacturing PMI, February 54.2

-

00:59

China: Manufacturing PMI , February 51.6 (forecast 51.1)

-

00:31

Japan: Manufacturing PMI, February 53.3 (forecast 53.5)

-

00:30

Australia: Gross Domestic Product (YoY), Quarter IV 2.4% (forecast 1.9%)

-

00:30

Australia: Gross Domestic Product (QoQ), Quarter IV 1.1% (forecast 0.7%)

-