Market news

-

22:25

Currencies. Daily history for Oct 23’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1748 -0,27%

GBP/USD $1,3196 +0,05%

USD/CHF Chf0,98483 +0,09%

USD/JPY Y113,47 -0,03%

EUR/JPY Y133,31 -0,29%

GBP/JPY Y149,741 +0,03%

AUD/USD $0,7808 -0,06%

NZD/USD $0,6975 +0,16%

USD/CAD C$1,26457 +0,16%

-

22:05

Schedule for today, Tuesday, Oct 24’2017 (GMT0)

03:30 Japan Manufacturing PMI (Preliminary) October 52.9 53.1

10:00 France Services PMI (Preliminary) October 57.0 56.9

10:00 France Manufacturing PMI (Preliminary) October 56.1 55.9

10:30 Germany Manufacturing PMI (Preliminary) October 60.6 60.0

10:30 Germany Services PMI (Preliminary) October 55.6 55.6

11:00 Eurozone Services PMI (Preliminary) October 55.8 55.7

11:00 Eurozone Manufacturing PMI (Preliminary) October 58.1 58.2

16:00 Belgium Business Climate October -3.5 -3.0

16:45 U.S. Manufacturing PMI (Preliminary) October 53.1 53.6

16:45 U.S. Services PMI (Preliminary) October 55.3 55.6

17:00 U.S. Richmond Fed Manufacturing Index October 19 17

-

15:54

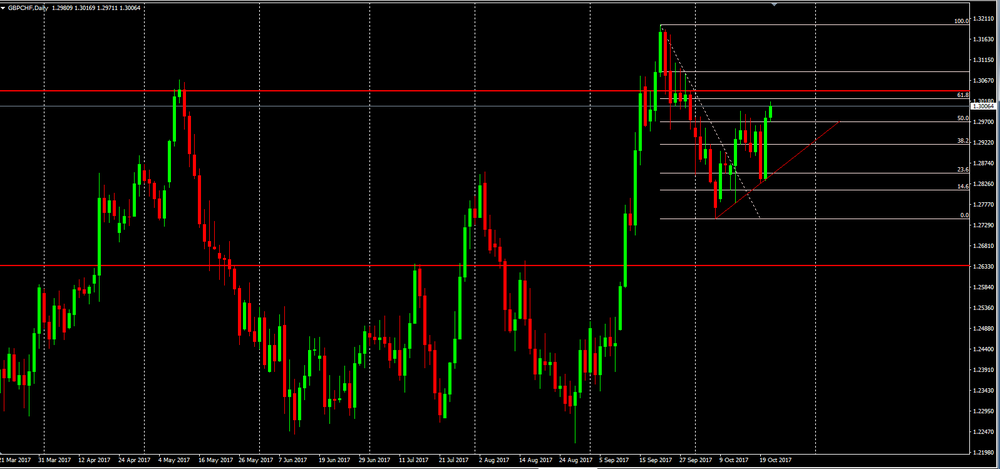

GBP/CHF DAILY TIME FRAME CHART

As we can seen on the daily chart, GBP/CHF reached new highs and since that it has been correcting his last bullish movement.

In this case, the use of fibonacci levels is useful to see if the price is showing signs of recovering its previous bullish tendency, or if in the case of rejecting the 61.8% fibonacci, a reversal of bearish.

Therefore, in this asset we have two possible bias.

Our suggestion is to wait for the closing of today's candle (Monday) and then draw conclusions for either long or short entries.

-

14:28

There are no plans for Trump to send former U.S. President Carter on mission to North Korea - White House official

-

14:00

Eurozone: Consumer Confidence, October -1 (forecast -1.1)

-

13:46

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1720 (EUR 345m) 1.1730 (895m) 1.1785 (605m) 1.1800 (505m)

1.1870 (465m) 1.1900-05 (390m) 1.1930-35 (415m) 1.1945 (645m) 1.1965 (475mn)

USDJPY: 112.85 (640m) 113.00 (445m) 113.20-25 (585m) 113.50 (400m)114.60 (415m)

GBPUSD: Ntg of note

USDCHF: 0.9695-0.9700 (USD 1.1bln)

AUDUSD: 0.7775 (AUD 395m) 0.7850 (380m)

USDCAD: 1.2520-25 (USD 490m) 1.2900 (500m)

-

13:14

Dublin - Eurogroup's Dijsselbloem says things are back on track in Greece, we stand ready to do more if they do their part

-

12:39

Canadian wholesale sales rose 0.5% to $62.8 billion in August

Wholesale sales rose 0.5% to $62.8 billion in August, led by the personal and household goods and motor vehicle and parts subsectors.

Sales were up in four of the seven subsectors, together representing 47% of total wholesale sales.

In volume terms, wholesale sales rose 0.4%.

Sales in the personal and household goods subsector rose for the ninth consecutive month-posting the largest gain in dollar terms in August, rising 3.3% to a record $9.0 billion. Sales were up in four of the six industries, with the textile, clothing and footwear industry contributing the most to the gain.

Sales in the motor vehicle and parts subsector increased for the third time in four months, up 2.0% to $11.8 billion. The growth in the subsector was attributable to higher sales in the motor vehicle industry, which recorded its second consecutive monthly gain. There were higher imports of passenger cars and light trucks in August, and motor vehicle manufacturing sales increased.

-

12:30

Canada: Wholesale Sales, m/m, August 0.5%

-

12:30

U.S.: Chicago Federal National Activity Index, September 0.17 (forecast -0.10)

-

10:00

United Kingdom: CBI industrial order books balance, October -2 (forecast 9)

-

09:41

Britain's foreign minister Johnson says should start thinking about the future and thinking more creatively in Brexit talks

-

09:00

Britain's foreign minister Johnson has absolutely no doubt that Iran nuclear deal can be preserved

-

Says should continue to demonstrate to people of Iran that they will be better off under Iran nuclear deal

-

-

08:40

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1900 (390 m), 1.1870 (460 m), 1.1800 (505 m), 1.1785 (605 m), 1.1730 (895 m), 1.1720 (340 m)

USD/JPY: 114.60 (415 m), 113.50 (353 m), 113.20/25 (585 m), 113.00 (445 m), 112.85 (640 m)

AUD/USD: 0.7850 (380 m), 0.7775 (395 m)

-

08:25

Poland's 2016 GDP growth at 2.9 pct vs 2.7 estimated in april - Stats office

-

2016 general government deficit at 2.5 pct of GDP vs. 2.4 pct estimated in april

-

Public debt at 54.1 pct of GDP in 2016 vs. 54.4 pct of GDP estimated in april

-

-

08:02

Catalonia's foreign affairs spokesman says EU democracy will not be credible if allows Spain to impose direct rule on Catalonia

-

No-one but the catalan people has the right to change catalan institutions

-

-

06:56

As widely expected, Japan Prime Minister Abe's ruling coalition is set for a sweeping victory in Sunday's general election, and may retain the two-thirds parliamentary majority needed to revise Japan's constitution - Zerohedge

-

06:36

Fed's Mester says international regulatory coordination on systemically important banks is desirable

-

06:30

10-year U.S. treasury yield at 2.380 percent vs U.S. close of 2.381 percent on friday

-

06:29

Moody's- stable outlook for australian banks underpinned by favorable domestic economic trends and strengthening capital positions, stable profitability

-

Australian banks' funding and liquidity levels will stay stable

-

Home loan repricing will prop-up net interest margins and profitability

-

Expects that australian banks will strengthen capital to meet higher minimum capital requirements

-

-

04:51

Options levels on monday, October 23, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1909 (3331)

$1.1861 (1371)

$1.1818 (277)

Price at time of writing this review: $1.1768

Support levels (open interest**, contracts):

$1.1733 (2968)

$1.1704 (2928)

$1.1670 (4898)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 101573 contracts (according to data from October, 20) with the maximum number of contracts with strike price $1,2000 (6870);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3357 (3500)

$1.3301 (3956)

$1.3263 (2367)

Price at time of writing this review: $1.3199

Support levels (open interest**, contracts):

$1.3112 (1600)

$1.3083 (2274)

$1.3050 (2213)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 40098 contracts, with the maximum number of contracts with strike price $1,3200 (3956);

- Overall open interest on the PUT options with the expiration date November, 3 is 35442 contracts, with the maximum number of contracts with strike price $1,3000 (3175);

- The ratio of PUT/CALL was 0.88 versus 0.86 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-