Market news

-

23:50

Japan: Retail sales, y/y, January 1% (forecast 0.9%)

-

23:50

Japan: Industrial Production (MoM) , January -0.8% (forecast 0.3%)

-

23:27

Currencies. Daily history for Feb 27’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0585 +0,23%

GBP/USD $1,2440 -0,12%

USD/CHF Chf1,0088 +0,15%

USD/JPY Y112,70 +0,55%

EUR/JPY Y119,30 +0,78%

GBP/JPY Y140,18 +0,42%

AUD/USD $0,7672 -0,05%

NZD/USD $0,7192 -0,08%

USD/CAD C$1,3178 +0,54%

-

22:59

Schedule for today,Tuesday, Feb 28’2017 (GMT0)

00:00 Australia HIA New Home Sales, m/m January 0.2%

00:00 New Zealand ANZ Business Confidence January 21.7

00:05 United Kingdom Gfk Consumer Confidence February -5 -6

00:30 Australia Private Sector Credit, m/m January 0.7%

00:30 Australia Private Sector Credit, y/y January 5.6%

00:30 Australia Current Account, bln Quarter IV -11.4 -3.6

05:00 Japan Housing Starts, y/y January 3.9% 3.2%

05:00 Japan Construction Orders, y/y January 7.1%

08:00 Switzerland KOF Leading Indicator February 101.7 102

13:30 Canada Industrial Product Price Index, m/m January 0.4%

13:30 Canada Industrial Product Price Index, y/y January 2.2%

13:30 U.S. PCE price index, q/q (Revised) Quarter IV 1.5% 2.2%

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter IV 1.7%

13:30 U.S. Goods Trade Balance, $ bln. January -65

13:30 U.S. GDP, q/q (Revised) Quarter IV 3.5% 2.1%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December 5.3% 5.3%

14:45 U.S. Chicago Purchasing Managers' Index February 50.3 53

15:00 U.S. Richmond Fed Manufacturing Index February 12

15:00 U.S. Consumer confidence February 111.8 111

22:30 Australia AIG Manufacturing Index February 51.2

23:50 Japan Capital Spending Quarter IV -1.3%

-

21:45

New Zealand: Trade Balance, mln, January -285

-

15:09

Donald Trump: Tuesday’s speech to have big statement on infrastructure - Reuters

-

15:03

US pending home sales down 2.8% in January

Insufficient supply levels led to a lull in contract activity in the Midwest and West, which dragged down pending home sales in January to their lowest level in a year, according to the National Association of Realtors.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 2.8 percent to 106.4 in January from an upwardly revised 109.5 in December 2016. Although last month's index reading is 0.4 percent above last January, it is the lowest since then.

-

15:00

U.S.: Pending Home Sales (MoM) , January -2.8% (forecast 1%)

-

13:56

US durable goods orders rose in line with expectations in January

New orders for manufactured durable goods in January increased $4.0 billion or 1.8 percent to $230.4 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 0.8 percent December decrease. Excluding transportation, new orders decreased 0.2 percent. Excluding defense, new orders increased 1.5 percent. Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $4.3 billion or 6.0 percent to $76.4 billion.

Shipments of manufactured durable goods in January, down following two consecutive monthly increases, decreased $0.2 billion or 0.1 percent to $238.3 billion. This followed a 1.6 percent December increase. Machinery, also down following two consecutive monthly increases, drove the decrease, $0.5 billion or 1.6 percent to $30.7 billion.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0490-1.0501 (EUR 1,442 M) 1.0520-1.0525 (EUR 710 M) 1.0550 (EUR 1,513 M) 1.0575 (EUR 970 M) 1.0585-1.0600 (EUR 403 M) 1.0650-1.0655 (EUR 419 M) 1.0665-1.0675 (EUR 251 M) 1.0700-1.0715 (EUR 1,449 M)

GBP/USD 1.2450-1.2461 (GBP 352 M) 1.2500 (GBP 473 M) 1.2580-1.2590 (GBP 314 M) 1.2600-1.2615 (GBP 213 M)

EUR/GBP 0.8485-0.8500 (EUR 187 M)

USD/JPY 111.00-111.05 (USD 376 M) 111.45-111.55 (USD 330 M) 111.95-112.00 (USD 643 M) 112.20-112.35 (USD 880 M) 112.50 (USD 550 M) 112.75 (USD 970 M) 113.15-113.25 (USD 361 M) 113.50-113.65 (USD 700 M) 113.70-113.75 (USD 245 M) 114.00-114.10 (USD 1,063 M)

USD/CHF 1.0100-1.0115 (USD 300 M)

AUD/USD 0.7525-0.7540 (AUD 664 M) 0.7600-0.7610 (AUD 396 M) 0.7640-0.7655 (AUD 242 M)

USD/CAD 1.3080-1.3095 (USD 605 M) 1.3100-1.3112 (USD 603 M) 1.3120 (USD 365 M) 1.3150-1.3165 (USD 381 M) 1.3185-1.3200 (USD 330 M) 1.3215-1.3220 (USD 270 M) 1.3285-1.3300 (USD 262 M)

NZD/USD 0.7150-0.7155 (NZD 208 M) 0.7400 (NZD 277 M)

-

13:30

U.S.: Durable goods orders ex defense, January 1.5%

-

13:30

U.S.: Durable Goods Orders , January 1.8% (forecast 1.6%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , January -0.2% (forecast 0.5%)

-

13:01

Orders

EUR/USD

Offers: 1.0600-05 1.0620 1.0635 1.0650 1.0680 1.0700

Bids: 1.0555-60 1.0530 1.0500 1.0480-85 1.0450

GBP/USD

Offers: 1.2430 1.2450 1.2480 1.2500 1.2520 1.2550

Bids: 1.2375-80 1.2350 1.2330 1.2300 1.2285 1.2265 1.2250

EUR/GBP

Offers: 0.8535 0.8550 0.8585 0.8600

Bids: 0.8520 0.8500 0.8485 0.8450 0.8420 0.8400

EUR/JPY

Offers: 118.80 119.00 119.20 119.50 119.85 120.00

Bids: 118.20-25 118.00 117.80 117.50 117.00

USD/JPY

Offers: 112.35 112.50-55 112.85 113.00 113.25-30 113.50

Bids: 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers: 0.7720 0.7735 0.7750 0.7780 0.7800

Bids: 0.7680 0.7665 0.7650 0.7620 0.7600

-

12:50

UK PM May's spokesman says any timetable for migration controls is speculative

-

LSE/Deutsche Boerse merger breakdown is a commercial matter between the two parties

-

PM clear she wants EU citizens rights to be addressed as a priority in Brexit talks

-

-

12:37

Russian finance minister Siluanov says Russian fx market is still experiencing effect of privatistion deals done in late 2016

-

12:09

The SNB is likely to be active in the FX market says Nomura

"Recently, the market has been paying more attention to the Swiss franc as EUR/CHF heads lower.

The SNB is likely to be active in the FX market as EUR/CHF depreciation pressures increase ahead of euro area political events.

Further accumulation of SNB reserves is likely, and its diversification may attract market interest.

Our analysis shows that, historically, a month after SNB intervention, JPY and USD tend to outperform, while NOK and NZD tend to underperform".

Copyright © 2017 Nomura, eFXnews™

-

11:42

Eurozone economic confidence improved

Eurozone economic confidence improved to the highest level in almost six years in February, survey results from the European Commission showed, cited by rttnews.

The economic sentiment index rose marginally to 108.0 in February from 107.9 in January. The reading came in line with expectations and reached its highest level since March 2011, when the score was 108.3.

The improvement in confidence among industrial, services and construction companies outweighed the slippage in sentiment among consumers and retailers.

-

10:30

Hungary and Slovakia to ask EU Commission in joint motion to consider legal means to ensure food producers sell same quality in eastern europe as in west- Hungarian Ministry of Agriculture

-

10:11

GBP/USD set to recover some of the losses seen on Friday. High volume reversal in the 1.24 area

-

10:01

Eurozone: Business climate indicator , February 0.82 (forecast 0.79)

-

10:01

Eurozone: Economic sentiment index , February 108 (forecast 108)

-

10:00

Eurozone: Consumer Confidence, February -6.2 (forecast -6.2)

-

10:00

Eurozone: Industrial confidence, February 1.3 (forecast 1.2)

-

09:52

Gold trading lower as political tensions eased

Gold price declines since the beginning of the session after reaching on Friday its highest level in three and a half months.

On Friday, April gold futures on Comex closed up 0.6%, at $ 1,258.30 per ounce. The rise of gold has been associated with the publication of the US Federal Reserve meeting minutes. According to the minutes, the regulator may increase the benchmark interest rate soon enough, as the situation in the economy is improving.

Today, the price of gold futures for April delivery on the New York Stock Exchange fell to $ 1252.30 dollars per ounce.

-

09:37

Swiss total sight deposits at 548.167 bln CHF in week ending february 24 versus 543.458 bln CHF a week earlier

-

09:08

The annual growth rate of the Euro area broad monetary aggregate M3 stood at 4.9% in January 2017

The annual growth rate of the broad monetary aggregate M3 stood at 4.9% in January 2017, after 5.0% in December 2016.

The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 8.4% in January, from 8.8% in December.

The annual growth rate of adjusted loans to households increased to 2.2% in January, from 2.0% in December.

The annual growth rate of adjusted loans to non-financial corporations stood at 2.3% in January, unchanged from the previous month.

-

09:01

Eurozone: Private Loans, Y/Y, January 2.2% (forecast 2.2%)

-

09:00

Eurozone: M3 money supply, adjusted y/y, January 4.9% (forecast 4.8%)

-

08:36

Sterling falls to 1-week low of 85.35 pence per euro , down 0.7% on day

-

08:21

Spanish CPI up 3% y/y, lower than expected

The estimated annual inflation in February 2017 is 3.0%, according to the advance indicator prepared by INE. This indicator provides an advance of the CPI which, if confirmed, would Maintenance in its annual rate, since in January this variation was 3.0%. In this behavior, the drop in electricity prices stands out. On the other hand, the annual variation of the leading indicator of the HICP is in February in the 3.0%. If this data is confirmed, the annual rate of the HICP would increase by one tenth last month.

-

07:58

Today’s events

-

At 10:00 GMT Italy will hold an auction of 10-year bonds

-

At 12:30 GMT SNB Vice Chairman Fritz Zurbrugg will deliver a speech

-

At 16:00 GMT FOMC member Robert Kaplan will deliver a speech

-

-

07:32

Euro registered the biggest increase in short positions for a second consecutive week among its peers as the short positions got raised by 11,487 contracts to -58.3K contracts - CFTC

-

07:28

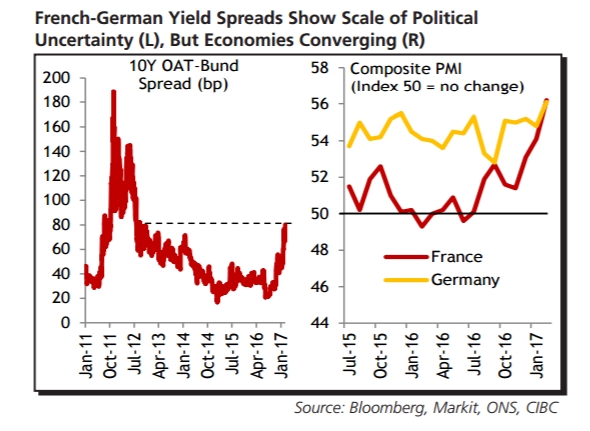

The euro is caught at the moment between an improving economic trajectory and populist political trends - CIBC

"The euro is caught at the moment between an improving economic trajectory and populist political trends.

In the short term the latter appears to be winning, with concerns regarding Marine Le Pen's polling performance seeing French-German yield spreads widen and weakening the euro.

However, on the assumption that she doesn't win the Presidency come May 7th, markets should then start to focus on the better economic climate. That was signposted recently by the Eurozone composite PMI reaching its highest level since April 2011. And encouragingly, that growth is more broad-based, with France catching up with the normal head of class Germany.

So after a near-term dip, EURUSD should recover to 1.12 by year-end.

CIBC targets EUR/USD at 1.04. 1.07, 1.10, and 1.12 by the end of Q1, Q2, Q3, and Q4 respectively".

y

Copyright © 2017 CIBC, eFXnews™

-

07:17

A record 71,300 more migrants arrived in New Zealand in January

A record 71,300 more migrants arrived in New Zealand than left in the January 2017 year, Statistics New Zealand said today. This surpassed the previous annual record set in December 2016. The net gain reflected an increasing number of people arriving here and fewer leaving to live overseas.

Migrant arrivals numbered 128,300 in the January 2017 year, a new annual record.

"About a fifth of all migrant arrivals were from Australia," population statistics senior manager Peter Dolan said. "Almost two-thirds of the migrant arrivals from Australia were New Zealand citizens."

-

07:15

Australian business inventories rose 0.3% in Q4

The trend estimate for inventories rose 0.7% in the December quarter 2016. The seasonally adjusted estimate rose 0.3% this quarter.

The trend estimate for Manufacturing sales of goods and services fell 0.7% this quarter. The seasonally adjusted estimate rose 0.1% this quarter.

The trend estimate for Wholesale trade sales of goods and services rose 2.1% this quarter. The seasonally adjusted estimate rose 3.1%.

-

07:13

Great optimism for future of U.S. business, AND JOBS, with the DOW having an 11th straight record close. Big tax & regulation cuts coming! @realDonaldTrump

-

07:11

UK said to prepare for new Scottish independence vote: Times. GBP/USD down 170 pips

-

05:59

Options levels on monday, February 27, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0707 (3303)

$1.0666 (2855)

$1.0631 (3615)

Price at time of writing this review: $1.0563

Support levels (open interest**, contracts):

$1.0513 (5397)

$1.0479 (4536)

$1.0439 (3597)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 74351 contracts, with the maximum number of contracts with strike price $1,0900 (4676);

- Overall open interest on the PUT options with the expiration date March, 13 is 84258 contracts, with the maximum number of contracts with strike price $1,0600 (5542);

- The ratio of PUT/CALL was 1.13 versus 1.14 from the previous trading day according to data from February, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.2700 (2520)

$1.2601 (2209)

$1.2504 (2689)

Price at time of writing this review: $1.2433

Support levels (open interest**, contracts):

$1.2397 (1650)

$1.2299 (3356)

$1.2199 (1487)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33976 contracts, with the maximum number of contracts with strike price $1,2800 (3103);

- Overall open interest on the PUT options with the expiration date March, 13 is 37622 contracts, with the maximum number of contracts with strike price $1,2300 (3356);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from February, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: Company Gross Profits QoQ, Quarter IV 20.1% (forecast 8%)

-