Market news

-

22:28

Commodities. Daily history for Aug 03’2017:

(raw materials / closing price /% change)

Oil 48.93 -0.20%

Gold 1,274.40 0.00%

-

22:27

Stocks. Daily history for Aug 03’2017:

(index / closing price / change items /% change)

Nikkei -50.78 20029.26 -0.25%

TOPIX -0.56 1633.82 -0.03%

Hang Seng -76.37 27531.01 -0.28%

CSI 300 -33.02 3727.83 -0.88%

Euro Stoxx 50 +7.05 3466.37 +0.20%

FTSE 100 +63.34 7474.77 +0.85%

DAX -26.76 12154.72 -0.22%

CAC 40 +23.24 5130.49 +0.46%

DJIA +9.86 22026.10 +0.04%

S&P 500 -5.41 2472.16 -0.22%

NASDAQ -22.30 6340.34 -0.35%

S&P/TSX -73.67 15191.96 -0.48%

-

22:26

Currencies. Daily history for Aug 03’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1869 +0,13%

GBP/USD $1,3135 -0,67%

USD/CHF Chf0,96811 -0,17%

USD/JPY Y109,96 -0,69%

EUR/JPY Y130,53 -0,56%

GBP/JPY Y144,451 -1,37%

AUD/USD $0,7950 -0,19%

NZD/USD $0,7435 +0,10%

USD/CAD C$1,258 +0,12%

-

21:58

Schedule for today, Friday, Aug 04’2017 (GMT0)

00:00 Japan Labor Cash Earnings, YoY June 0.7% 0.6%

01:30 Australia Retail Sales, M/M June 0.6% 0.2%

01:30 Australia RBA Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) June 1.0% 0.5%

12:30 Canada Trade balance, billions June -1.09 -1.35

12:30 Canada Unemployment rate July 6.5% 6.5%

12:30 Canada Employment July 45.3 10

12:30 U.S. Government Payrolls July 35

12:30 U.S. Average workweek July 34.5 34.5

12:30 U.S. Manufacturing Payrolls July 1 5

12:30 U.S. Private Nonfarm Payrolls July 187 180

12:30 U.S. Labor Force Participation Rate July 62.8%

12:30 U.S. Average hourly earnings July 0.2% 0.3%

12:30 U.S. International Trade, bln June -46.5 -45

12:30 U.S. Unemployment Rate July 4.4% 4.3%

12:30 U.S. Nonfarm Payrolls July 222 183

14:00 Canada Ivey Purchasing Managers Index July 61.6 59.2

17:00 U.S. Baker Hughes Oil Rig Count August 766

-

20:07

The main US stock indexes mostly fell on the results of today's trading

The main US stock indexes ended the session mainly in the red on the back of a significant decline in the shares of the main materials sector, as well as reports relating to the investigation of Russia's interference in the presidential elections in the US in 2016

The WSJ reported that the special prosecutor Robert Mueller called on the Grand Jury in Washington to investigate Russia's interference in the US presidential elections in 2016. This shows that the investigation is becoming more intense and is entering a new stage, according to two people familiar with this issue.

A certain influence on the dynamics of trading was also provided by US statistics. Research data in July showed a marked improvement in business activity among US service providers. Seasonally adjusted index of business activity in the US services sector from IHS Markit rose to 54.7 in July from 54.2 in June. The last reading meant the strongest expansion of business activity since January and marked the fourth consecutive month of accelerated growth.

At the same time, the index of business activity in the US services sector, calculated by the Institute for Supply Management, fell to 53.9 points in July from 57.4 points in June. According to the forecast, the figure should be 57 points. Recall, the value of the index, exceeding 50, is considered as an indicator of growth in activity.

In addition, data released by the US Department of Commerce showed that new orders for US manufactured goods increased significantly in June, exceeding forecasts. Production orders rose 3.0% after falling 0.3% in May (revised from -0.8 %). It was expected that orders will increase by 2.9%.

Most components of the DOW index recorded a rise (19 out of 30). Leader of growth were the shares of Pfizer Inc. (PFE, + 1.59%). Outsider were shares of McDonald's Corporation (MCD, -1.34%).

Most sectors of the S & P index finished trading in the red. The main material sector showed the greatest decrease (-0.9%). The conglomerate sector grew most (+ 0.6%).

At closing:

DJIA + 0.05% 22,026.17 +9.93

Nasdaq -0.35% 6.340.34 -22.31

S & P-0.22% 2.472.13 -5.44

-

19:00

DJIA +0.06% 22,028.92 +12.68 Nasdaq -0.29% 6,343.93 -18.72 S&P -0.22% 2,472.05 -5.52

-

16:00

European stocks closed: FTSE 100 +63.34 7474.77 +0.85% DAX -26.76 12154.72 -0.22% CAC 40 +23.24 5130.49 +0.46%

-

15:00

US factory orders show biggest increase in 8 months in June

The U.S. Commerce Department's data revealed that the value of new factory orders rose by a seasonally adjusted 3 percent m-o-m in June, while economists had forecast factory orders gaining 2.9 percent m-o-m. That followed a revised 0.3 percent m-o-m decline in May (originally a 0.8 percent m-o-m decrease) and marked the first increase in new orders for US-made goods in three months and the biggest gain since last October.

According to the report, new orders for durable goods climbed by 6.4 percent m-o-m in June, supported by a 19 percent m-o-m surge in orders for transportation equipment, which in turn reflected a 131.1 percent m-o-m boost in civilian aircraft orders. Meanwhile, orders for non-durable goods fell by 0.3 percent in June.

Orders for nondefense capital goods excluding aircraft orders, seen as a measure of business confidence and spending plans, edged down 0.1 percent m-o-m in June, recording the first drop since December. Shipments of these so-called core capital goods rose 0.1 percent, while total shipments of manufactured goods dropped 0.2 percent m-o-m.

-

14:18

ISM report shows US services sector growth slows in July

The Institute for Supply Management (ISM) announced its non-manufacturing index came in at 53.9 in July, which was 3.5 percentage points lower than unrevised June figure of 57.4. That represented continued growth in the non-manufacturing sector at a slower rate. Economists had expected the ISM non-manufacturing index to ease to 57 last month. A reading above 50 signals expansion, while a reading below 50 indicates contraction.

15 of the non-manufacturing industries reported growth in July, while two recorded decline, the report said.

According to the report, the ISM's non-manufacturing business activity measure decreased to 55.9 percent in July, 4.9 percentage points lower than the June reading of 60.8 percent. That reflected growth for the 96th consecutive month, at a slightly slower rate last month. The ISM's new orders gauge fell 5.4 percentage points to 55.1 percent in July, while the inventories indicator dropped 1 percentage point to 56.5 percent, and the employment index declined 2.2 percentage points to 53.6. At the same time, the prices gauge gained 3.6 percentage points to 55.7, indicating prices increased in July for the second consecutive month.

-

14:00

U.S.: ISM Non-Manufacturing, July 53.9 (forecast 57)

-

14:00

U.S.: Factory Orders , June 3% (forecast 2.9%)

-

13:45

U.S.: Services PMI, July 54.7 (forecast 54.2)

-

13:32

U.S. Stocks open: Dow +0.02%, Nasdaq 40.04%, S&P -0.10%

-

13:31

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1595-1.1600 (EUR 770m) 1.1650 (330m) 1.1685-95 (430m) 1.1800 (355m) 1.1855-65 (335m)

USDJPY: 109.00 (USD 395m) 110.00-10 (1.02bln) 110.70 (480m) 111.50 (420m) 111.75-80 ($1.02bln) 112.10-15 (635m)

GBPUSD: 1.3250 (GBP 250m)

AUDUSD: 0.7700 (AUD 445m) 0.7800 (428m)

AUDNZD: 1.1000 (AUD 1.8bn)

-

13:19

Before the bell: S&P futures -0.04%, NASDAQ futures +0.11%

U.S. stock-index futures were flat, a day after the Dow Jones Industrial Average passed the 22,000 threshold for the first time. Investors await the key U.S. labor market data, set to be published tomorrow.

Global Stocks:

Nikkei 20,029.26 -50.78 -0.25%

Hang Seng 27,531.01 -76.37 -0.28%

Shanghai 3,273.41 -11.65 -0.35%

S&P/ASX 5,735.12 -9.08 -0.16%

FTSE 7,462.68 +51.25 +0.69%

CAC 5,129.89 +22.64 +0.44%

DAX 12,148.32 -33.16 -0.27%

Crude $49.79 (+0.40%)

Gold $1,272.70 (-0.45%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

205.75

0.34(0.17%)

324

ALCOA INC.

AA

37.19

-0.09(-0.24%)

7610

ALTRIA GROUP INC.

MO

65.9

0.35(0.53%)

1029

Amazon.com Inc., NASDAQ

AMZN

996.5

0.61(0.06%)

8943

American Express Co

AXP

85.15

-0.15(-0.18%)

200

Apple Inc.

AAPL

156.85

-0.29(-0.18%)

102309

AT&T Inc

T

38.25

-0.02(-0.05%)

13809

Boeing Co

BA

237.7

-0.25(-0.11%)

4247

Caterpillar Inc

CAT

113.5

0.41(0.36%)

2101

Cisco Systems Inc

CSCO

31.5

-0.02(-0.06%)

21256

Citigroup Inc., NYSE

C

68.68

-0.42(-0.61%)

103496

Ford Motor Co.

F

11.02

0.02(0.18%)

49454

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.3

-0.07(-0.49%)

5300

General Electric Co

GE

25.53

0.01(0.04%)

7831

Goldman Sachs

GS

225.28

-0.99(-0.44%)

1194

Google Inc.

GOOG

930

-0.39(-0.04%)

929

Intel Corp

INTC

36.41

0.04(0.12%)

6356

JPMorgan Chase and Co

JPM

92.75

-0.36(-0.39%)

6346

McDonald's Corp

MCD

156.49

-0.10(-0.06%)

1112

Microsoft Corp

MSFT

72.28

0.02(0.03%)

3230

Nike

NKE

59.7

-0.09(-0.15%)

2006

Pfizer Inc

PFE

32.89

-0.03(-0.09%)

133961

Starbucks Corporation, NASDAQ

SBUX

55.44

0.01(0.02%)

2555

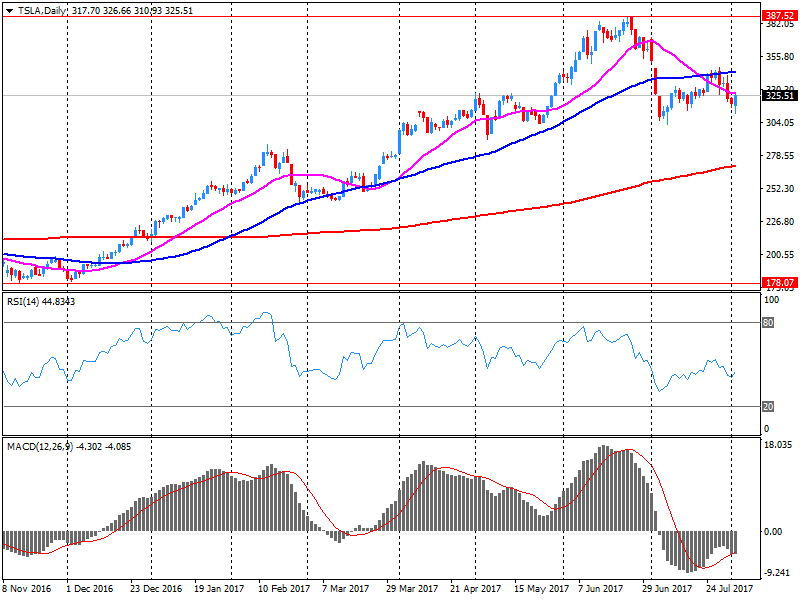

Tesla Motors, Inc., NASDAQ

TSLA

347.8

21.91(6.72%)

523618

Twitter, Inc., NYSE

TWTR

16.05

-0.02(-0.12%)

6539

UnitedHealth Group Inc

UNH

194

1.00(0.52%)

3234

Verizon Communications Inc

VZ

48.16

-0.05(-0.10%)

1225

Visa

V

101.27

-0.01(-0.01%)

4699

Wal-Mart Stores Inc

WMT

81.21

0.68(0.84%)

1330

Walt Disney Co

DIS

108.8

0.13(0.12%)

608

Yandex N.V., NASDAQ

YNDX

28.54

0.18(0.63%)

23980

-

12:48

Target price changes before the market open

Tesla (TSLA) target raised to $345 from $314 at RBC Capital Mkts

Tesla (TSLA) target raised to $200 from $190 at JP Morgan

Tesla (TSLA) target raised to $386 from $368 at Piper Jaffray

-

12:47

Upgrades before the market open

Caterpillar (CAT) upgraded to Neutral from Underweight at Atlantic Equities

Yandex N.V. (YNDX) upgraded to Buy from Hold at VTB Capital

-

12:45

US jobless claims fall more than expected

The data from the Labor Department revealed the number of applications for unemployment benefits fell more than expected last week, continuing to point to a tightening labor market.

According to the report, the initial claims for unemployment benefits declined by 5,000 to a seasonally adjusted 240,000 for the week ended July 29. Economists had expected 242,000 new claims last week.

Claims for the prior week were revised upwardly to 245,000 from the initial estimate of 244,000.

Meanwhile, the four-week moving average of claims fell by 2,500 to 241,750 last week. That was the 126th straight week that claims remained below the 300,000 threshold, the longest streak since 1970.

Economists believe that labor market tightness could encourage the Fed to announce a plan to start shrinking its huge balance sheet in September.

-

12:30

U.S.: Continuing Jobless Claims, 1968 (forecast 1955)

-

12:30

U.S.: Initial Jobless Claims, 240 (forecast 242)

-

12:20

BoE Governor warns Brexit-related uncertainty weighs on UK economy

The Bank of England (BoE) Governor Mark Carney, who held a press conference on Thursday after the central bank kept interest rates at 2.5 percent and cut forecasts for the UK growth in 2017 and 2018, noted that Brexit uncertainty continued to weigh on the UK economy. He estimated the level of investment in the UK economy to be 20 percentage points lower in 2020 than the BoE forecast before the Brexit vote.

Mr. Carney also said that any increases in the BoE rate should to be at a gradual pace and to a limited extent.

He also repeated a call for a Brexit transition arrangement.

-

11:41

Bank of England keeps its interest rate at 0.25 percent; cuts growth forecast

The Bank of England (BoE) announced that its Monetary Policy Committee (MPC) decided to leave its rates and asset purchase program unchanged, as widely expected.

The BoE's monetary policy statement revealed that, at its meeting, which ended today, the committee voted by a majority of 6-2 to maintain the bank rate steady at its record low of 0.25 percent. The decision was widely expected by the markets.

At the same time, the BoE's policymakers voted unanimously to leave its quantitative easing (QE) program unchanged at a total of 435 billion pounds.

The BoE also published the August Inflation Report, which contained its officials' latest assessment of the outlook for output, unemployment and inflation, etc. The report showed the MPC had slashed forecasts for UK growth in 2017 to 1.7 percent from its previous forecast of 1.9 percent, while 2018 growth projection was cut to 1.6 percent from its previous estimate of 1.7 percent. According to the report, GDP growth remains sluggish in the near term as the squeeze on households' real incomes continues to weigh on consumption.

At the same time, assessment of the outlook for inflation was broadly similar to that in May. "The MPC expects inflation to rise further in coming months and to peak around 3 percent in October, as the past depreciation of sterling continues to pass through to consumer prices", the report said.

-

11:01

-

11:00

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

11:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

10:54

Company News: Tesla (TSLA) Q2 results beat analysts’ estimates

Tesla (TSLA) reported Q2 FY 2017 losses of $1.33 per share (versus -$1.06. in Q2 FY 2016), better than analysts' consensus estimate of -$1.92.

The company's quarterly revenues amounted to $2.789 bln (+119.6% y/y), beating analysts' consensus estimate of $2.496 bln.

TSLA rose to $346.30 (+6.26%) in pre-market trading.

-

09:41

Eurozone retail sales rise faster than expected in July

Eurostat, the statistical office of the European Union (EU) reported that the seasonally adjusted volume of retail trade in the Eurozone rose by 0.5 percent m-o-m in June, following an unrevised 0.4 increase m-o-m in May.

In y-o-y terms, adjusted retail sales grew by 3.1 percent, following a revised 2.4 percent gain in May (originally a 2.6 percent increase). That was the highest growth rate since last October.

Economists had forecast the Eurozone's retail sales in June would rise 0.1 percent m-o-m and 2.6 percent y-o-y.

According to the report, the June increase was attributable to the higher sales of automotive fuel (+1 percent m-o-m), food, drinks and tobacco (+0.7 percent m-o-m) and non-food products (+0.3 percent m-o-m).

In y-o-y terms, retail sales of automotive fuel boosted by 3.5 percent, sales of non-food products rose by 3.2 percent and sales food, drinks and tobacco increased by 2.6 percent.

-

09:21

UK Services PMI indicates marginal improvement in the sector growth in July

The report from IHS Markit and Chartered Institute of Procurement & Supply (CIPS) showed that activity in the services sector of the UK's economy picked up slightly in July from June's four-month low.

According to the report, the Markit/CIPS UK Services Purchasing Managers' Index (PMI) rose to 53.8 in July from an unrevised 53.4 in June. Economists had forecast the indicator to edge up to 53.6. The 50 mark divides contraction and expansion.

The latest reading, however, signaled a slower rate of business activity expansion than the post-crisis trend as heightened economic uncertainty and fragile confidence among clients suppressed the growth.

According to the report, new business expanded at solid rate in July, although the improvement was one of the weakest seen since last autumn. Meanwhile, employment numbers rose at fastest pace since January 2016. Input cost inflation remained strong in July, driven by rising food prices, energy bills and salary payments. Higher operating expenses led to the fastest increase in average prices charged by service sector firms for three months.

Chris Williamson, Chief Business Economist at HIS Markit, which compiles the survey, noted: "The service sector PMI indicates that businesses remain in expansion-mode despite heightened uncertainty about the outlook, but also highlights how the risks to future growth remain firmly biased to the downside". He also added that "taken together, the three PMI surveys are broadly consistent with economic growth of just over 0.3%, putting the country on course for another steady but sluggish expansion in the third quarter."

-

09:00

Eurozone: Retail Sales (YoY), June 3.1% (forecast 2.6%)

-

09:00

Eurozone: Retail Sales (MoM), June 0.5% (forecast 0.1%)

-

08:30

United Kingdom: Purchasing Manager Index Services, July 53.8 (forecast 53.6)

-

08:00

Eurozone: Services PMI, July 55.4 (forecast 55.4)

-

07:55

Germany: Services PMI, July 53.1 (forecast 53.5)

-

07:50

France: Services PMI, July 56 (forecast 55.9)

-

07:25

Fed’s Mester says Fed should keep to its gradual tightening pace

Cleveland Federal Reserve Bank President Loretta Mester stated in her speech to Ohio community bankers in Cincinnati Wednesday that she thought the Fed should keep to its slow tightening pace, even with softened inflation.

"The gradual path that the FOMC has communicated for some time is appropriate given the outlook will help prolong the expansion, not curtail it. A gradual removal of accommodation helps avoid a build-up of risks to macroeconomic stability that could arise if the economy is allowed to overheat, as well as risks to financial stability if interest rates remain too low and encourage investors to take on excessively risky investments in a search for yield," she said.

At the same time, she noted that the gradual path she anticipated did not entail an increase at each FOMC meeting.

-

07:03

Fed’s Rosengren says tight labor market bolsters plans to keep raising rates

Federal Reserve Bank of Boston President Eric Rosengren said in an interview to WSJ Wednesday that increasingly tight labor markets should keep the U.S. regulator on its path to gradually raise rates and start slowly shrinking its balance sheet, despite an unexpected weakness in inflation pressures seen this spring. At the same time, Mr. Rosengren noted that he saw "some reasonable risk" that the unemployment rate could drop below 4 percent in the next two years. While the Fed's preferred inflation indicator had shown price pressures had eased since March, Mr. Rosengren said he was more focused on longer-run trends in labor markets, which argued for continued rate hikes, than on monthly inflation data.

-

06:34

Options levels on thursday, August 3, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1968 (1533)

$1.1936 (2360)

$1.1901 (4837)

Price at time of writing this review: $1.1843

Support levels (open interest**, contracts):

$1.1788 (2179)

$1.1744 (1526)

$1.1696 (3482)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 103716 contracts (according to data from August, 2) with the maximum number of contracts with strike price $1,1800 (4837);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3296 (1762)

$1.3276 (2601)

$1.3256 (2966)

Price at time of writing this review: $1.3226

Support levels (open interest**, contracts):

$1.3173 (527)

$1.3136 (1065)

$1.3093 (1040)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 32925 contracts, with the maximum number of contracts with strike price $1,3100 (2966);

- Overall open interest on the PUT options with the expiration date August, 4 is 32794 contracts, with the maximum number of contracts with strike price $1,2800 (3023);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from August, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:53

China services PMI indicates slower pace of expansion in the sector in July

Markit/Caixin's survey revealed that China's services sector in July demonstrated the slowest increase in activity since May 2016. The Caixin/Markit services purchasing managers' index (PMI) came in at 51.5 last month on a seasonally adjusted basis, down from 51.6 in June. Economist forecast the indicator to increase to 51.9. The 50 mark divides contraction and expansion.

According to the survey, new order growth slowed edged down to the least marked for 16 months, and the level of service providers' optimism was the lowest since last November. At the same time, the rate of job creation at services companies held close to June's ten-month low and remained marginal. Average input costs continued to grow across China's service sector in July, though the rate of inflation eased since June and was the weakest seen for nearly a year.

Dr. Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, noted: "The Caixin China General Services Business Activity Index fell 0.1 point from the previous month to 51.5 in July, on par with April's reading that marked the weakest pace of expansion since May 2016. The index of new business edged down and the input costs index fell to its lowest level for nearly a year, while prices charged rose marginally. The Composite Output Index came in at 51.9, up 0.8 points from a month ago and the highest figure since March. China's economic performance in July was stronger than expected, mainly due to sustained recovery in the manufacturing sector. However, downward pressure on the economy likely remains as the index gauging companies' confidence towards the 12-month business outlook dropped in both the manufacturing and services industries."

-

05:29

Global Stocks

Geopolitics helped prompt profit-taking in Asian shares Thursday following this week's strength. As expected, President Donald Trump signed a bill on Wednesday that imposed fresh sanctions on Russia, North Korea and Iran even as he expressed concern that the "seriously flawed" legislation "will drive China, Russia, and North Korea much closer together."

European equity benchmarks ended lower Wednesday, as bank shares slumped after France's Société Générale SA posted a drop in profit and metal's related stocks declined after an update from Rio Tinto PLC. The Stoxx Europe 600 SXXP, -0.43% dropped 0.4% to 378.63, partly erasing a 0.6% gain from Tuesday.

The Dow Jones Industrial Average on Wednesday notched a psychological milestone at 22,000, highlighting a steady record ascent for the blue-chip benchmark. The 30-component Dow industrials DJIA, +0.24% hit the latest in a string of all-time highs on Tuesday finishing at a record and was powered on Wednesday by a rally in shares of Apple Inc. AAPL, +4.73% which trading in record territory, following better-than-expected results late-Tuesday.

-

05:14

Australia trade surplus narrows more-than-expected in June

The Australian Bureau of Statistics (ABS) reported Australia's trade surplus decreased 2.4-times m-o-m in June. According to the ABS, a surplus of AUD 0.856 billion was recorded in seasonally adjusted terms in June compared to a downwardly revised AUD 2.024 billion surplus in May (initially AUD 2.471 billion). Economists had expected a surplus of AUD 1.8 billion.

According to the report, the value of exports slid 1.4 percent m-o-m to AUD 31.779 billion in June, following a 7.2 percent m-o-m surge in May. Imports grew 2.4 percent m-o-m to AUD 30.923 billion in June, following 0.2 percent m-o-m increase in the previous month.

-

01:45

China: Markit/Caixin Services PMI, July 51.5 (forecast 51.9)

-

01:30

Australia: Trade Balance , June 0.86 (forecast 1.8)

-