Market news

-

23:51

Japan: Current Account, bln, March 2908 (forecast 2590)

-

22:46

New Zealand: Food Prices Index, y/y, April 0.2%

-

22:33

Commodities. Daily history for May 10’2017:

(raw materials / closing price /% change)

Oil 47.34 +0.02%

Gold 1,219.10 +0.02%

-

22:31

Stocks. Daily history for May 10’2017:

(index / closing price / change items /% change)

Nikkei +57.09 19900.09 +0.29%

TOPIX +3.42 1585.19 +0.22%

Hang Seng +126.39 25015.42 +0.51%

CSI 300 -14.83 3337.70 -0.44%

Euro Stoxx 50 -3.34 3645.74 -0.09%

FTSE 100 +43.03 7385.24 +0.59%

DAX +8.34 12757.46 +0.07%

CAC 40 +2.45 5400.46 +0.05%

DJIA -32.67 20943.11 -0.16%

S&P 500 +2.71 2399.63 +0.11%

NASDAQ +8.56 6129.15 +0.14%

S&P/TSX +64.01 15633.21 +0.41%

-

22:28

Currencies. Daily history for May 10’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0868 -0,07%

GBP/USD $1,2933 -0,02%

USD/CHF Chf1,0085 +0,15%

USD/JPY Y114,27 +0,26%

EUR/JPY Y124,19 +0,19%

GBP/JPY Y147,78 +0,24%

AUD/USD $0,7333 -0,14%

NZD/USD $0,6848 -0,74%

USD/CAD C$1,3667 -0,34%

-

21:57

Schedule for today, Thursday, May 11’2017 (GMT0)

01:00 Australia Consumer Inflation Expectation May 4.1%

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

05:00 Japan Eco Watchers Survey: Outlook March 48.1

05:00 Japan Eco Watchers Survey: Current April 47.4 47.9

07:00 Eurozone ECB's Vitor Constancio Speaks

07:15 Switzerland Consumer Price Index (YoY) April 0.6% 0.5%

07:15 Switzerland Consumer Price Index (MoM) April 0.2% 0.2%

08:00 Eurozone ECB Economic Bulletin

08:30 United Kingdom Total Trade Balance March -3.66

08:30 United Kingdom Industrial Production (YoY) March 2.8% 2.1%

08:30 United Kingdom Manufacturing Production (MoM) March -0.1% 0%

08:30 United Kingdom Manufacturing Production (YoY) March 3.3% 3.1%

08:30 United Kingdom Industrial Production (MoM) March -0.7% -0.2%

09:00 Eurozone EU Economic Forecasts

10:25 U.S. FOMC Member Dudley Speak

11:00 United Kingdom BOE Inflation Letter

11:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 435 435

12:00 United Kingdom NIESR GDP Estimate April 0.5%

12:30 Canada New Housing Price Index, MoM March 0.4% 0.3%

12:30 U.S. Continuing Jobless Claims 1964 1980

12:30 U.S. Initial Jobless Claims 238 245

12:30 U.S. PPI excluding food and energy, Y/Y April 1.6% 1.7%

12:30 U.S. PPI excluding food and energy, m/m April 0% 0.2%

12:30 U.S. PPI, m/m April -0.1% 0.2%

12:30 U.S. PPI, y/y April 2.3% 2.2%

14:30 Canada Bank of Canada Review

16:30 Eurozone ECB's Peter Praet Speaks

22:30 New Zealand Business NZ PMI April 57.8

-

21:00

New Zealand: RBNZ Interest Rate Decision, 1.75% (forecast 1.75%)

-

20:06

Major US stock indexes completed the session in different directions

Major US stock indexes finished trading without a single dynamic, as investors evaluated the batch of weak corporate reports and the step of US President Donald Trump to dismiss the head of the FBI.

The president said that he fired Komi, who led the investigation into the possible collusion of representatives of his presidential campaign with Russia in 2016, for a bad investigation of the scandal with the publication of the electronic correspondence of US presidential candidate Hillary Clinton.

In addition, the Ministry of Labor reported that import prices in the US rose more than expected in April, due to rising prices for petroleum products and a number of other goods, which could contribute to the growth of domestic inflation. Import prices jumped 0.5 percent after a revised increase of 0.1 percent in March (originally reported a fall of 0.2 percent). Economists predicted that import prices will rise by 0.2 percent. During the 12 months to April, import prices increased by 4.1 percent, slowing from 4.3 percent in March. Export prices rose 0.2 percent after an increase of 0.1 percent in March. In annual terms, export prices increased by 3.0 percent after an increase of 3.4 percent in March.

The cost of oil futures jumped about 3.2% after Iraq and Algeria joined Saudi Arabia, supporting the extension of the oil production agreement. Additional support for prices was provided by data from the US Energy Ministry, indicating a sharp drop in oil reserves over the past week.

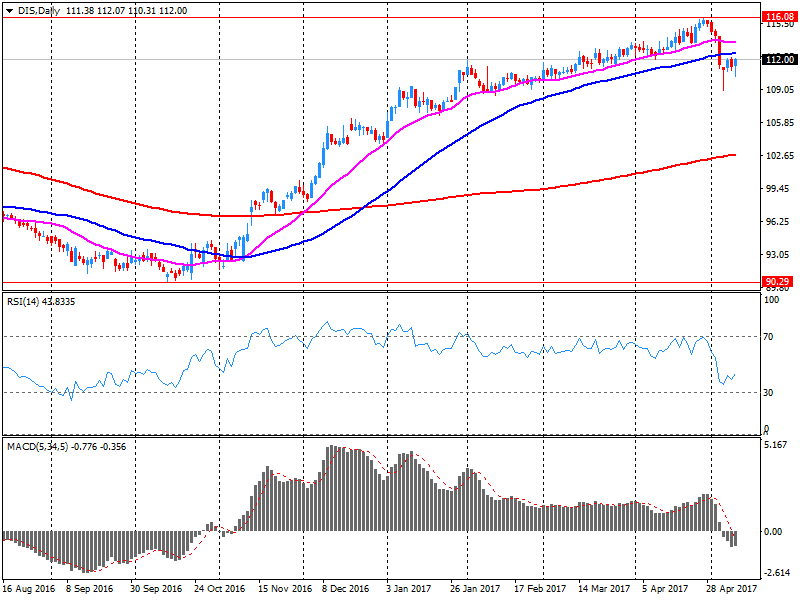

Components of the DOW index finished trading mixed (15 in positive territory, 15 in negative territory). More shares fell The Walt Disney Company (DIS, -2.43%). The leader of growth was shares of Chevron Corporation (CVX, + 1.40%).

Most sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 1.2%). The sector of industrial goods fell most of all (-0.3%).

At closing:

DJIA -0.16% 20.941.96 -33.82

Nasdaq + 0.14% 6.129.14 + 8.55

S & P + 0.11% 2,399.48 + 2.56

-

19:00

DJIA -0.23% 20,926.91 -48.87 Nasdaq +0.12% 6,128.07 +7.48 S&P +0.08% 2,398.95 +2.03

-

18:01

U.S.: Federal budget , April 182 (forecast -175.8)

-

16:00

European stocks closed: FTSE 100 +43.03 7385.24 +0.59% DAX +8.34 12757.46 +0.07% CAC 40 +2.45 5400.46 +0.05%

-

14:32

U.S. commercial crude oil inventories decreased by 5.2 million barrels

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.2 million barrels from the previous week. At 522.5 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories decreased by 0.2 million barrels last week, but are above the upper limit of the average range. Finished gasoline inventories increased while blending components inventories decreased last week.

Distillate fuel inventories decreased by 1.6 million barrels last week but are in the upper half of the average range for this time of year. Propane/propylene inventories increased by 2.0 million barrels last week but are in the lower half of the average range. Total commercial petroleum inventories decreased by 3.6 million barrels last week.

-

14:31

U.S.: Crude Oil Inventories, May -5.247 (forecast -1.750)

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0800 (EUR 200m) 1.0900 (412m) 1.0920-30 (EUR 1.4bln) 1.1000 (387m)

USDJPY: 112.20-30 (USD 301m) 113.50 (220m)

EURGBP: 0.8300 (EUR 300m)

AUDUSD: 0.7375 (AUD 251m) 0.7480 (807m) 0.7500 (350m)

NZDUSD: 0.6920-30 (NZD 290m)

EURJPY: 123.00 (EUR 521m) 123.50 (195m)

-

13:34

U.S. Stocks open: Dow -0.24%, Nasdaq -0.04%, S&P -0.07%

-

13:28

Before the bell: S&P futures -0.05%, NASDAQ futures -0.01%

U.S. stock-index futures were flat as President Donald Trump's firing of his FBI chief set off a political storm that could make passage of his pro-growth plans more difficult.

Stocks:

Nikkei 19,900.09 +57.09 +0.29%

Hang Seng 25,015.42 +126.39 +0.51%

Shanghai 3,051.75 -28.78 -0.93%

S&P/ASX 5,875.44 +35.54 +0.61%

FTSE 7,379.17 +36.96 +0.50%

CAC 5,399.77 +1.76 +0.03%

DAX 12,771.46 +22.34 +0.18%

Crude $46.47 (+1.29%)

Gold $1,222.20 (+0.50%)

-

12:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

70

-0.29(-0.41%)

6777

Amazon.com Inc., NASDAQ

AMZN

952.52

-0.30(-0.03%)

9587

Apple Inc.

AAPL

152.99

-1.00(-0.65%)

304720

AT&T Inc

T

38.16

-0.06(-0.16%)

2950

Barrick Gold Corporation, NYSE

ABX

16.48

0.20(1.23%)

61309

Boeing Co

BA

185.1

-0.39(-0.21%)

2622

Caterpillar Inc

CAT

99

-0.29(-0.29%)

650

Chevron Corp

CVX

105.63

0.55(0.52%)

1148

Cisco Systems Inc

CSCO

33.74

-0.16(-0.47%)

4600

Citigroup Inc., NYSE

C

60.15

-0.08(-0.13%)

4170

Exxon Mobil Corp

XOM

82.05

0.51(0.63%)

16857

Facebook, Inc.

FB

150.2

-0.28(-0.19%)

44150

Ford Motor Co.

F

11.15

-0.01(-0.09%)

5834

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.78

0.15(1.29%)

28942

General Electric Co

GE

28.86

-0.07(-0.24%)

4095

General Motors Company, NYSE

GM

34.15

-0.11(-0.32%)

1268

Goldman Sachs

GS

223.48

-0.28(-0.13%)

8242

Home Depot Inc

HD

157.8

0.12(0.08%)

1878

Intel Corp

INTC

36.35

-0.02(-0.06%)

9031

International Business Machines Co...

IBM

151.99

-0.12(-0.08%)

1160

JPMorgan Chase and Co

JPM

86.6

-0.15(-0.17%)

2203

McDonald's Corp

MCD

143

-1.36(-0.94%)

2739

Microsoft Corp

MSFT

69.02

-0.02(-0.03%)

357

Nike

NKE

55.35

0.46(0.84%)

112965

Pfizer Inc

PFE

32.96

-0.10(-0.30%)

54229

Tesla Motors, Inc., NASDAQ

TSLA

321.5

0.24(0.07%)

27215

The Coca-Cola Co

KO

43.4

-0.11(-0.25%)

1140

Twitter, Inc., NYSE

TWTR

18.3

-0.07(-0.38%)

33395

Wal-Mart Stores Inc

WMT

76.4

0.19(0.25%)

1403

Walt Disney Co

DIS

109.47

-2.60(-2.32%)

59376

Yahoo! Inc., NASDAQ

YHOO

49.51

0.02(0.04%)

1041

Yandex N.V., NASDAQ

YNDX

27.47

0.09(0.33%)

910

-

12:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) reiterated with an Outperform at FBR Capital; target $116

Walt Disney (DIS) reiterated with a Hold at Needham

Walt Disney (DIS) reiterated with an Outperform at RBC Capital Mkts; target $130

-

12:40

US export and import prices rose in April

The price index for U.S. imports advanced 0.5 percent in April, the U.S. Bureau of Labor Statistics reported today, after ticking up 0.1 percent the previous month. Higher fuel prices and nonfuel prices each contributed to the increase in April. U.S. export prices rose 0.2 percent in April following a 0.1-percent

advance in March. Prices for U.S. exports have not recorded a monthly decline since the index fell 0.8 percent in August 2016.

U.S. export prices continued to rise in April, increasing 0.2 percent. Higher prices for both agricultural and nonagricultural exports contributed to the overall advance in export prices. Prices for U.S. exports rose 3.0 percent over the past 12 months following a 5.1-percent drop for the year ended April 2016.

-

12:30

U.S.: Import Price Index, April 0.5% (forecast 0.2%)

-

12:07

Company News: Walt Disney (DIS) Q2 EPS beat analysts’ estimate

Walt Disney (DIS) reported Q2 FY 2017 earnings of $1.50 per share (versus $1.36 in Q2 FY 2016), beating analysts' consensus estimate of $1.41.

The company's quarterly revenues amounted to $13.336 bln (+2.8% y/y), generally in-line with analysts' consensus estimate of $13.445 bln.

DIS fell to $109.20 (-2.56%) in pre-market trading.

-

12:03

Hungary Central Bank says ready to loosen monetary conditions further if needed using unconventional tools - April minutes

-

12:01

Orders

EUR/USD

Offers: 1.0900 1.0920-30 1.0950 1.0985 1.1000 1.1030 1.1050 1.1080 1.1100

Bids: 1.0870 1.0850 1.0820 1 .0800 1.0780 1.0750 1.0700

GBP/USD

Offers: 1.2980-85 1.3000 1.3020 1.3050 1.3080 1.3100

Bids: 1.2950 1.2930 1.2900 1.2880 1.2850 1.2830 1.2800

EUR/JPY

Offers: 124.30 124.50 124.80 125.00

Bids: 123.80 123.50 123.20 123.00 122.80 122.50

EUR/GBP

Offers: 0.8400 0.8420 0.8450 0.8465 0.8480-85 0.8500

Bids: 0.8380-85 0.8365 0.8350 0.8330 0.8300

USD/JPY

Offers: 114.20 114.50 114.70 115.00 115.30 115.50

Bids: 113.80 113.60 113.20 113.00 112.80 112.45-50

AUD/USD

Offers: 0.7385 0.7400 0.7425 0.7550-55 0.7480 0.7500

Bids: 0.7350 0.7335 0.7320 0.7300 0.7285 0.7250 0.7200

-

11:31

ECB's Draghi says it is too early to declare success, underlying inflation pressures continue to remain subdued and have yet to show a convincing upward

-

Monetary policy measures always have side effects

-

We do see that real estate dynamics or high household debt levels in some countries signal the risk of increasing imbalances

-

We do not currently see compelling evidence of overstretched asset valuations at the euro area level

-

Maintaining the current very substantial degree of monetary accommodation is still needed

-

We are monitoring these various effects carefully

-

-

10:25

We continue to expect USD/CAD will reach the 1.40 level through the middle of the year before USD gains moderate again - Scotiabank

Investors have perhaps been persuaded that recent domestic data trends, especially on the trade and employment fronts, spelled better times ahead for the Canadian economy. We think it is important to keep expectations in check, however. Recent job trends have been heavily skewed by exceptionally strong job growth in December and January, which may unwind somewhat in the months ahead.

Trade data has improved, with the late 2016 headline numbers reporting trade surpluses for the first time since 2014, but underlying export volume growth remains weak (-1.1% in the December year). Firmer crude oil prices, reflecting OPEC's production discipline, have helped support the CAD. But scope for additional crude oil gains appears limited for now, we think, and broader trends in commodity prices are tracking a somewhat weaker in the short run at least, with the TR-CRB index easing to its lowest levels since November.

"The policy gap is already at levels that we consider very USD-supportive. We continue to expect USDCAD will reach the 1.40 level through the middle of the year before USD gains moderate again," Scotiabank commented in its latest research report.

-

09:35

The UK gilts gained as investors wait to watch the Bank of England’s (BoE) monetary policy meeting, scheduled to be held on May 11

The yield on the benchmark 10-year gilts, slumped 1-1/2 basis points to 1.18 percent, the super-long 30-year bond yields plunged 2-1/2 basis points to 1.82 percent.

-

09:10

Ruling liberal party wins election in Canadian province of British Columbia but loses majority in tight election - CBC television projects

-

09:09

Minutes - Swedish Central Bank's Ingves says too early to change the direction of monetary policy at present

-

Skingsley says decision to not support further bond purchases should not be perceived as excluding the need for stimulation at a later stage

-

Jansson wondered whether, with a lower inflation outcome than expected and a proposed forecast entailing poorer inflation prospects in coming years, it was enough to ease monetary policy merely by extending the government bond purc

-

Ingves says a rapid krona appreciation that threatens rising inflation must not take place

-

Jansson says activity abroad continued to strengthen, but said that there is considerable uncertainty over economic and political developments

-

Jochnick says the effects on growth and inflation will probably be limited regardless of the outcomes of forthcoming elections and political decisions

-

-

09:05

Italian industrial production increased by 0.4% in March

In March 2017 the seasonally adjusted industrial production index increased by 0.4% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was -0.3.

The calendar adjusted industrial production index increased by 2.8% compared with March 2016 (calendar working days in March 2017 being 23 versus 22 days in March 2016); in the period January- March 2017 the percentage change was +1.6 compared with the same period of 2016.

-

08:03

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0800 (EUR 200m) 1.0900 (412m) 1.0920-30 (EUR 1.4bln) 1.1000 (387m)

USDJPY: 112.20-30 (USD 301m) 113.50 (220m)

EURGBP: 0.8300 (EUR 300m)

AUDUSD: 0.7375 (AUD 251m) 0.7480 (807m) 0.7500 (350m)

NZDUSD: 0.6920-30 (NZD 290m)

EURJPY: 123.00 (EUR 521m) 123.50 (195m)

Информационно-аналитический отдел TeleTrade

-

07:45

Major stock markets in Europe trading mixed: FTSE 7351.73 +9.52 + 0.13%, DAX 12739.43 -9.69 -0.08%, CAC 5396.89 -1.12 -0.02%

-

07:22

Fitch - tension with North Korea is an important reason why South Korea's rating is one notch below outcome of our sovereign rating model

-

Would not expect korean exports to China to drop sharply, even if thaad remains in place

-

Korea's general government debt of 38.7% of gdp is slightly below 'aa' median of 39.7%

-

Fiscal policy might become more expansionary under new government, given Moon's pledge to use stimulus to create jobs

-

Moon likely to adopt more conciliatory stance towards N. Korea but S. Korea's influence over security situation appears to have weakened in recent months

-

Political crisis that ended with impeachment and arrest on corruption charges of previous president did not affect sovereign rating

-

-

06:49

French industrial production bounced back sharply says INSEE

In March 2017, output bounced back sharply in the manufacturing industry (+2.5% after −0.7% in February), as well as in the whole industry (+2.0% after −1.7%).

Over the first quarter of 2017, output went down slightly in the manufacturing industry (−0.3% q-o-q) and decreased in the overall industry (−0.5% q-o-q).

Output decreased in mining and quarrying, energy, water supply (−2.0%) and tumbled in the manufacture of coke and refined petroleum products (−13.6%). To a lesser extent, it also went down in the manufacture of machinery and equipment goods (−0.7%), in "other manufacturing" (−0.2%) and in the manufacture of food products and beverages (−0.4%). Conversely, it increased in the manufacture of transport equipment (+0.5%).

-

06:46

France: Trade Balance, bln, March -5.4 (forecast -6)

-

06:45

France: Industrial Production, m/m, March 2.0% (forecast 1%)

-

06:32

North Korea to proceed with 6th nuclear test, ambassador says - Sky

-

06:30

BoJ Gov Kuroda: unnecessary, inappropriate to think fiscal policy should bear full burden of reviving growth as monetary policy is reaching its limits

-

Fiscal, monetary policies must work together, each play its own role to revive economy

-

Unnecessary, inappropriate to think monetary policy should directly bankroll govt debt

-

Shifting to protectionism from free trade won't help reduce poverty

-

Wage growth remains slow despite improvements in corporate profits and tightening labour market, but we are seeing some positive signs

-

-

06:25

Romania's Q1 trade deficit widens to 2.32 bln euros, march trade balance at -1.056 bln euros

-

06:24

China's inflation accelerated to a 3-month high in April

China's inflation accelerated to a 3-month high in April, while factory gate inflation eased on weakening commodity prices, data published by the National Bureau of Statistics cited by rttnews.

Inflation rose to 1.2 percent in April from 0.9 percent in March. Economists had forecast inflation to rise moderately to 1.1 percent.

Inflation was well below the government's target of around 3 percent for the whole year of 2017.

Non-food inflation rose to 2.4 percent from 2.3 percent. At the same time, food prices declined 3.5 percent, but slower than the 4.4 percent fall seen in March.

On a monthly basis, consumer prices edged up 0.1 percent, in contrast to a 0.3 percent fall in March. This was the first rise in three months.

-

06:19

Options levels on wednesday, May 10, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1046 (8112)

$1.0984 (3956)

$1.0941 (3572)

Price at time of writing this review: $1.0891

Support levels (open interest**, contracts):

$1.0843 (1768)

$1.0805 (4071)

$1.0748 (4930)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 83352 contracts, with the maximum number of contracts with strike price $1,1000 (8112);

- Overall open interest on the PUT options with the expiration date June, 9 is 88530 contracts, with the maximum number of contracts with strike price $1,0700 (5802);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from May, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.3203 (2169)

$1.3105 (2311)

$1.3008 (3590)

Price at time of writing this review: $1.2959

Support levels (open interest**, contracts):

$1.2891 (1246)

$1.2795 (1957)

$1.2697 (1823)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 31769 contracts, with the maximum number of contracts with strike price $1,3000 (3590);

- Overall open interest on the PUT options with the expiration date June, 9 is 34192 contracts, with the maximum number of contracts with strike price $1,1500 (3061);

- The ratio of PUT/CALL was 1.08 versus 1.08 from the previous trading day according to data from May, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:33

Global Stocks

European stocks marched higher Tuesday, with the DAX 30 ending at a record after German trade data exceeding expectations. Investors also appeared in the mood to take on more risk in the wake of France's presidential election.

Stocks closed near session lows Tuesday as the Dow industrials and S&P 500 finished lower and the tech-heavy Nasdaq carved out a new record while investors sifted through mostly upbeat earnings reports against a backdrop of falling oil prices and remarks from Federal Reserve speakers.

China's consumer inflation accelerated in April, as higher non-food prices helped outweigh continued falls in food prices, official data showed Wednesday. China's consumer price index increased 1.2% in April from a year earlier, compared with a 0.9% gain in March, the National Bureau of Statistics said.

-

05:02

Japan: Leading Economic Index , March 105.5 (forecast 105.5)

-

05:02

Japan: Coincident Index, March 114.6

-

01:31

China: PPI y/y, April 6.4% (forecast 6.9%)

-

01:31

China: CPI y/y, April 1.2% (forecast 1.1%)

-