Market news

-

20:11

The main US stock indexes rose slightly on the basis of trading results

On Friday, the main US stock indexes rose slightly, helped by the rise in price of shares in Apple and other technology companies, but the fall of insurance companies and hospital operators has limited growth.

In addition, the focus was on the US. As it became known today, the consumer price index in September rose by 0.5%, noting the biggest increase in eight months. Economists predicted an increase of 0.6% due to higher gasoline prices. With the exception of food and energy, the basic consumer price index rose by 0.1%.

Retail sales in the US increased by 1.6% in September, reflecting the largest increase in two and a half years. The greatest increase was caused by new cars and trucks. With the exception of cars, sales grew by 1%. And sales, excluding cars and gasoline, climbed to smaller, but still stable, 0.5%. Economists predicted an increase in total sales of 1.7% and 0.3%, excluding cars.

Preliminary results of the studies, presented by Thomson-Reuters and the Michigan Institute, showed: the mood sensor among US consumers grew in October despite the average forecasts of experts. According to the data, in October the consumer sentiment index rose to 101.1 points compared to the final reading for September at the level of 95.1 points. According to average estimates, the index had to fall to the level of 95 points.

US enterprises increased their reserves in August in maximum nine months, which indicates a strong confidence in future demand. The Ministry of Trade reported that in August the volume of inventories increased by 0.7%, after rising in July by 0.3%. This was the biggest leap since November 2016. Sales also rose by 0.7% in August, compared with a 0.3% increase in July. This was the biggest increase in sales since December 2016.

Most components of the DOW index recorded a rise (16 out of 30). The leader of growth was shares of American Express Company (AXP, + 1.34%). Outsider were the shares of Verizon Communications Inc. (VZ, -1.05%).

Most sectors of the S & P index finished trading in positive territory. The base resources sector grew most (+ 0.5%). The utilities sector showed the greatest decrease (-0.5%).

At closing:

Dow + 0.13% 22.871.72 +30.71

Nasdaq + 0.22% 6,605.80 +14.29

S & P + 0.09% 2.553.17 +2.24

-

19:00

DJIA +0.18% 22,882.29 +41.28 Nasdaq +0.29% 6,610.32 +18.81 S&P +0.18% 2,555.49 +4.56

-

17:01

U.S.: Baker Hughes Oil Rig Count, October 743

-

16:00

European stocks closed: FTSE 100 -20.80 7535.44 -0.28% DAX +8.98 12991.87 +0.07% CAC 40 -9.07 5351.74 -0.17%

-

14:41

Fed's Evans says priority now is for inflation to get back up to Fed's 2 percent objective

-

14:20

US consumer sentiment surged in early October, reaching its highest level since the start of 2004 says UoM

The October gain was broadly shared, occurring among all age and income subgroups and across all partisan viewpoints. The data indicate a robust outlook for consumer spending that extends the current expansion to at least mid 2018, which would mark the 2nd longest expansion since the mid 1800's.

While the early October surge indicates greater optimism about the future course of the economy, it also reflects an unmistakable sense among consumers that economic prospects are now about as good as could be expected. This "as good as it gets" outlook is supported by a moderation in the expected pace of growth in both personal finances and the overall economy, accompanied by a growing sense that, even with this moderation, it would still mean the continuation of good economic times.

-

14:02

US business inventories rose 0.7% in August, as expected

Inventories manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,889.0 billion, up 0.7 percent (±0.1 percent) from July 2017 and were up 3.6 percent (±0.3 percent) from August 2016.

The total business inventories/sales ratio based on seasonally adjusted data at the end of August was 1.38. The August 2016 ratio was 1.40.

-

14:00

U.S.: Reuters/Michigan Consumer Sentiment Index, October 101.1 (forecast 95.0)

-

14:00

U.S.: Business inventories , August 0.7% (forecast 0.7%)

-

13:46

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1700 (EUR 575m) 1.1800 (515m)

USDJPY: 110.00 (370m) 111.00 (260m) 111.40 (265m) 112.50(580m) 112.60 (1.55bln) 112.65-70 (660m) 113.00 (1.2bln) 113.60 (345m)

GBPUSD: 1.3100 (Gbp340m)

AUDUSD: Ntg of note

USDCHF 0.9635 (USD 330m)

NZDUSD: 0.6940 (NZD 725m) 0.6975 (470m)

AUDNZD: 1.1000 (AUD 600m)

USDCAD: 1.2450 (USD 430m) 1.2465 (490m)

-

13:33

U.S. Stocks open: Dow +0.15%, Nasdaq +0.29%, S&P +0.15%

-

13:27

Before the bell: S&P futures +0.18%, NASDAQ futures +0.30%

U.S. stock-index futures were higher on Friday as investors assessed quarterly results of Bank of America (BAC) and the U.S. data on consumer inflation and retail sales for September.

Global Stocks:

Nikkei 21,155.18 +200.46 +0.96%

Hang Seng 28,476.43 +17.40 +0.06%

Shanghai 3,391.54 +5.44 +0.16%

S&P/ASX 5,814.15 +19.69 +0.34%

FTSE 7,543.63 -12.61 -0.17%

CAC 5,354.97 -5.84 -0.11%

DAX 112,991.00 +8.11 +0.06%

Crude $51.61 (+2.00%)

Gold $1,298.90 (+0.19%)

-

12:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

48.45

0.92(1.94%)

5083

ALTRIA GROUP INC.

MO

65.49

0.14(0.21%)

103429

Amazon.com Inc., NASDAQ

AMZN

1,007.10

6.17(0.62%)

49274

AMERICAN INTERNATIONAL GROUP

AIG

62.49

-0.06(-0.10%)

47705

Apple Inc.

AAPL

156.56

0.56(0.36%)

357517

AT&T Inc

T

35.88

0.02(0.06%)

470187

Barrick Gold Corporation, NYSE

ABX

16.88

0.20(1.20%)

9970

Caterpillar Inc

CAT

130.5

0.51(0.39%)

32091

Chevron Corp

CVX

119.56

0.42(0.35%)

99879

Citigroup Inc., NYSE

C

72.1

-0.27(-0.37%)

393274

Exxon Mobil Corp

XOM

82.6

0.17(0.21%)

223416

Facebook, Inc.

FB

173.2

0.65(0.38%)

158064

Ford Motor Co.

F

12.08

-0.04(-0.33%)

268075

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.75

0.24(1.65%)

125431

General Electric Co

GE

23.13

0.08(0.35%)

496049

General Motors Company, NYSE

GM

45.25

0.36(0.80%)

114251

Goldman Sachs

GS

238.45

-1.35(-0.56%)

22254

Google Inc.

GOOG

993

5.17(0.52%)

18315

Hewlett-Packard Co.

HPQ

20.89

0.49(2.40%)

93571

Home Depot Inc

HD

164.92

0.33(0.20%)

62111

HONEYWELL INTERNATIONAL INC.

HON

143

-0.19(-0.13%)

40147

Intel Corp

INTC

39.33

0.14(0.36%)

254636

International Business Machines Co...

IBM

147.5

0.47(0.32%)

46124

JPMorgan Chase and Co

JPM

95.4

-0.59(-0.61%)

213812

McDonald's Corp

MCD

164.17

0.26(0.16%)

44108

Microsoft Corp

MSFT

77.4

0.28(0.36%)

420976

Nike

NKE

50.97

0.14(0.28%)

70534

Pfizer Inc

PFE

36.3

-0.05(-0.14%)

315858

Procter & Gamble Co

PG

92.4

0.25(0.27%)

134160

Starbucks Corporation, NASDAQ

SBUX

56

0.03(0.05%)

77285

Tesla Motors, Inc., NASDAQ

TSLA

357

1.32(0.37%)

18837

The Coca-Cola Co

KO

46.12

0.01(0.02%)

202173

Twitter, Inc., NYSE

TWTR

18.54

0.09(0.49%)

50744

United Technologies Corp

UTX

119

0.18(0.15%)

39484

UnitedHealth Group Inc

UNH

190.96

-1.96(-1.02%)

56027

Verizon Communications Inc

VZ

48.25

-0.10(-0.21%)

218712

Walt Disney Co

DIS

97

0.07(0.07%)

91133

-

12:53

Analyst coverage initiations before the market open

Visa (V) initiated with a Overweight at Stephens; target $125

-

12:52

Target price changes before the market open

McDonald's (MCD) target raised to $180 from $175 at RBC Capital Mkts

Citigroup (C) target raised to $79 from $75 at RBC Capital Mkts

HP (HPQ) target raised to $23 from $21 at Mizuho

-

12:51

Downgrades before the market open

Ford Motor (F) downgraded to Equal Weight from Overweight at Barclays

-

12:51

Upgrades before the market open

General Motors (GM) upgraded to Overweight from Equal Weight at Barclays

-

12:40

US retail sales were $483.9 billion in September, an increase of 1.6 percent from the previous month

Advance estimates of U.S. retail and food services sales for September 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $483.9 billion, an increase of 1.6 percent from the previous month, and 4.4 percent above September 2016.

Total sales for the July 2017 through September 2017 period were up 3.9 percent from the same period a year ago. The July 2017 to August 2017 percent change was revised from down 0.2 percent to down 0.1 percent.

Retail trade sales were up 1.7 percent from August 2017, and up 4.7 percent from last year. Gasoline Stations were up 11.4 percent from September 2016, while Building Materials and Garden Equipment and Supplies Dealers were up 10.7 percent from last year.

-

12:38

US inflation rose less than expected in September

The Consumer Price Index rose 0.5 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.2 percent.

The gasoline index increased 13.1 percent in September and accounted for about three-fourths of the seasonally adjusted all items increase. Other major energy component indexes were mixed, and the food index rose slightly.

The index for all items less food and energy increased 0.1 percent in September. The shelter index continued to increase, and the indexes for motor

vehicle insurance, recreation, education, and wireless telephone services also rose. These increases more than offset declines in the indexes for new

vehicles, household furnishings and operations, medical care, and used cars and trucks. -

12:30

U.S.: Retail Sales YoY, September 4.4%

-

12:30

U.S.: CPI, Y/Y, September 2.2% (forecast 2.3%)

-

12:30

U.S.: CPI, m/m , September 0.5% (forecast 0.6%)

-

12:30

U.S.: CPI excluding food and energy, Y/Y, September 1.7% (forecast 1.8%)

-

12:30

U.S.: Retail sales excluding auto, September 1% (forecast 0.3%)

-

12:30

U.S.: CPI excluding food and energy, m/m, September 0.1% (forecast 0.2%)

-

12:30

U.S.: Retail sales, September 1.6% (forecast 1.7%)

-

11:58

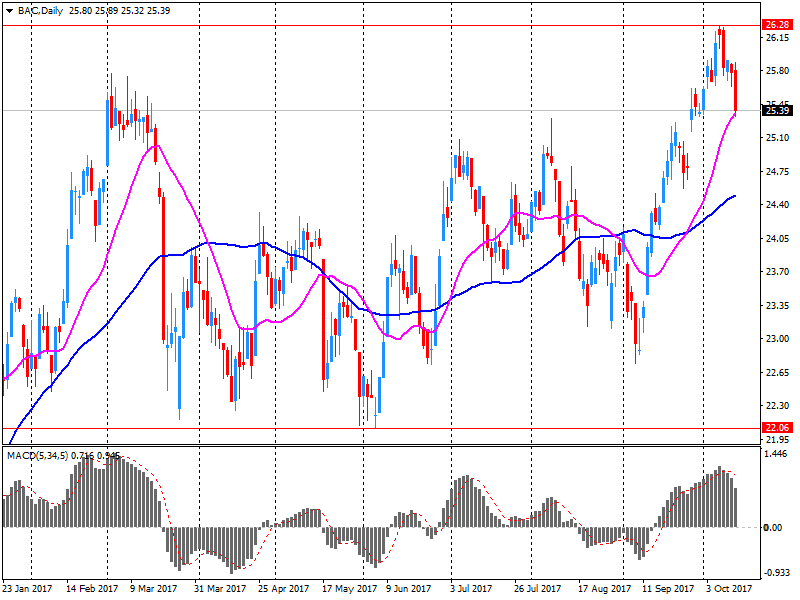

Company News: Bank of America (BAC) Q3 EPS beat analysts’ estimate

Bank of America (BAC) reported Q3 FY 2017 earnings of $0.48 per share (versus $0.41 in Q3 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $22.079 bln (+2.1% y/y), generally in-line with analysts' consensus estimate of $22.069 bln.

BAC rose to $25.70 (+0.98%) in pre-market trading.

-

11:56

British PM May's spokeswoman says there could be more to say on Brexit financial settlement at EU summit next week

-

10:29

German government spokesman Siebert says too early to discuss any Brexit transition ideas

-

09:59

Siwss producer price index rose more than expected in September

The Producer and Import Price Index rose in September 2017 by 0.5% compared with the previous month, reaching 100.5 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, basic metals, semi-finished products of metal, and scrap.

Compared with September 2016, the price level of the whole range of domestic and imported products rose by 0.8%. These are some of the findings from the Federal Statistical Office (FSO).

-

09:54

Economic upswing in Germany is broadening, growth driven by consumption, construction, exports and investments in equipment - Economy Ministry monthly report

-

09:52

EU's Juncker says "they have to pay" if Britain wants to move to second phase of Brexit talks

-

09:48

ECB’s Hansson: We Could Be More Specific On Our Intention On Rates @LiveSquawk

-

08:00

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1800(515 m), 1.1700(575 m)

USD/JPY: 113.00(119 m), 112.65/70(660 m), 112.60(155 m), 112.50(580 m)

-

07:15

Switzerland: Producer & Import Prices, m/m, September 0.5%

-

07:15

Switzerland: Producer & Import Prices, y/y, September 0.8% (forecast 0.6%)

-

06:52

China's exports grew at a slower-than-expected pace in September

China's exports grew at a slower-than-expected pace in September, data from the General Administration of Customs, cited by rttnews.

In dollar terms, exports climbed 8.1 percent year-over-year in September, below economists' forecast for an increase of 10.0 percent.

At the same time, imports surged 18.7 percent in September from a year ago, faster than the expected growth of 15.0 percent.

The trade surplus totaled $28.47 billion in September versus the expected surplus of $38.0 billion.

-

06:51

10-year U.S. treasury yield at 2.323 percent, unchanged from thursday's U.S. close

-

06:50

Eurostoxx 50 futures up 0.17 pct, DAX futures up 0.10 pct, CAC 40 futures up 0.13 pct, FTSE futures down 0.18 pct

-

06:49

S&P says do not believe Catalan independence will occur; believe sovereign Catalonia would not be recognized by meaningful no of other national govts

-

06:48

Options levels on friday, October 13, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2011 (3250)

$1.1954 (3324)

$1.1915 (1388)

Price at time of writing this review: $1.1840

Support levels (open interest**, contracts):

$1.1771 (2001)

$1.1743 (3018)

$1.1710 (3115)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 97649 contracts (according to data from October, 12) with the maximum number of contracts with strike price $1,2000 (6064);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3418 (3437)

$1.3376 (3200)

$1.3347 (2232)

Price at time of writing this review: $1.3281

Support levels (open interest**, contracts):

$1.3225 (2160)

$1.3181 (1964)

$1.3123 (1269)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 35987 contracts, with the maximum number of contracts with strike price $1,3300 (3437);

- Overall open interest on the PUT options with the expiration date November, 3 is 31953 contracts, with the maximum number of contracts with strike price $1,3000 (2213);

- The ratio of PUT/CALL was 0.89 versus 0.89 from the previous trading day according to data from October, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:47

Consumer prices in Germany were 1.8% higher y/y

Consumer prices in Germany were 1.8% higher in September 2017 compared with September 2016. In August 2017, the inflation rate as measured by the consumer price index was 1.8%, too. Compared with August 2017, the consumer price index increased by 0.1% in September 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 28 September 2017.

In September 2017, the prices of energy products were up 2.7% year on year. The increase in energy prices was higher than the overall rise in prices and had a strong upward effect on the inflation rate. In September 2017, prices were up year on year especially for mineral oil products (+6.2%, of which heating oil: +12.9%; motor fuels: +4.5%) and electricity (+2.0%). Only gas prices declined on a year earlier (-2.5%). Excluding energy prices, the inflation rate would have been +1.7% in September 2017.

-

06:00

Germany: CPI, m/m, September 0.1% (forecast 0.1%)

-

06:00

Germany: CPI, y/y , September 1.8% (forecast 1.8%)

-

05:34

Global Stocks

Spanish stocks closed fractionally lower Thursday, catching their breath after the prior day's rally that was sparked by worries abating over Catalonia's independence push, while Europe's main equity benchmark also struggled for direction.

The U.S. stock market heralded the beginning of third-quarter earnings season by finishing slightly lower on Thursday, even as Wall Street banks turned in generally upbeat results.

Stocks showed little movement Friday as markets opened in the Asia Pacific region, but more new highs could be in store with Japan topping 21,000 for the first time since 1996. The Nikkei NIK, +0.94% rose 0.3% early, touching 21,032, even as the yen strengthened slightly. Japan's benchmark index hit a two-decade closing high during the week.

-

03:31

China: Trade Balance, bln, September 28.47 (forecast 39.5)

-