Market news

-

22:33

Commodities. Daily history for Oct 23’2017:

(raw materials / closing price /% change)

Oil 51.86 +0.04%

Gold 1,283.60 +0.24%

-

22:32

Stocks. Daily history for Oct 23’2017:

(index / closing price / change items /% change)

Nikkei +239.01 21696.65 +1.11%

TOPIX +14.61 1745.25 +0.84%

Hang Seng -181.36 28305.88 -0.64%

CSI 300 +3.95 3930.80 +0.10%

Euro Stoxx 50 +3.78 3608.87 +0.10%

FTSE 100 +1.22 7524.45 +0.02%

DAX +11.86 13003.14 +0.09%

CAC 40 +14.43 5386.81 +0.27%

DJIA -54.67 23273.96 -0.23%

S&P 500 -10.23 2564.98 -0.40%

NASDAQ -42.22 6586.83 -0.64%

S&P/TSX -1.46 15855.76 -0.01%

-

22:25

Currencies. Daily history for Oct 23’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1748 -0,27%

GBP/USD $1,3196 +0,05%

USD/CHF Chf0,98483 +0,09%

USD/JPY Y113,47 -0,03%

EUR/JPY Y133,31 -0,29%

GBP/JPY Y149,741 +0,03%

AUD/USD $0,7808 -0,06%

NZD/USD $0,6975 +0,16%

USD/CAD C$1,26457 +0,16%

-

22:05

Schedule for today, Tuesday, Oct 24’2017 (GMT0)

03:30 Japan Manufacturing PMI (Preliminary) October 52.9 53.1

10:00 France Services PMI (Preliminary) October 57.0 56.9

10:00 France Manufacturing PMI (Preliminary) October 56.1 55.9

10:30 Germany Manufacturing PMI (Preliminary) October 60.6 60.0

10:30 Germany Services PMI (Preliminary) October 55.6 55.6

11:00 Eurozone Services PMI (Preliminary) October 55.8 55.7

11:00 Eurozone Manufacturing PMI (Preliminary) October 58.1 58.2

16:00 Belgium Business Climate October -3.5 -3.0

16:45 U.S. Manufacturing PMI (Preliminary) October 53.1 53.6

16:45 U.S. Services PMI (Preliminary) October 55.3 55.6

17:00 U.S. Richmond Fed Manufacturing Index October 19 17

-

20:13

The main US stock indexes finished trading in negative territory

Major US stock indexes ended the session in negative territory amid the collapse of shares of General Electric and the decline in quotations of the conglomerate sector.

In addition, as it became known, the revival of production activity led to a sharp improvement in the index of economic activity from the Federal Reserve Bank of Chicago last month, but weaker indicators that remained negative for many months restrain the average value of the index, and it will take several months to improve significant growth. The index of economic activity from the Federal Reserve Bank of Chicago in September recovered to a level of +0.17, with a downward revision of -0.37 in August, which was another turnaround of a particularly volatile measure in the last few months.

Oil futures traded neutrally amid fears of potential supply disruptions due to tensions in the oil-rich Kurdish region of Iraq, as well as a drop in drilling activity in the United States. Baker Hughes reported on Friday that from October 14 to October 20, the number of active drilling rigs for oil production in the United States was reduced by 7 pieces, and amounted to 736 units. The last value is the lowest level since June.

The components of the DOW index finished the auction mixed (15 in positive territory, 15 in negative territory). Wal-Mart Stores, Inc. became the leader of growth. (WMT, + 1.43%). Outsider were shares of General Electric Company (GE, -6.46%).

Almost all sectors of the S & P index recorded a fall. The largest decrease was shown by the sector of conglomerates (-1.1%). Only the utilities sector grew (+ 0.1%).

At closing:

DJIA -0.23% 23.273.96 -54.67

Nasdaq -0.64% 6,586.83 -42.22

S & P -0.40% 2.564.98 -10.23

-

19:00

DJIA -0.02% 23,324.04 -4.59 Nasdaq -0.32% 6,607.57 -21.48 S&P -0.18% 2,570.52 -4.69

-

16:00

European stocks closed: FTSE 100 +1.22 7524.45 +0.02% DAX +11.86 13003.14 +0.09% CAC 40 +14.43 5386.81 +0.27%

-

15:54

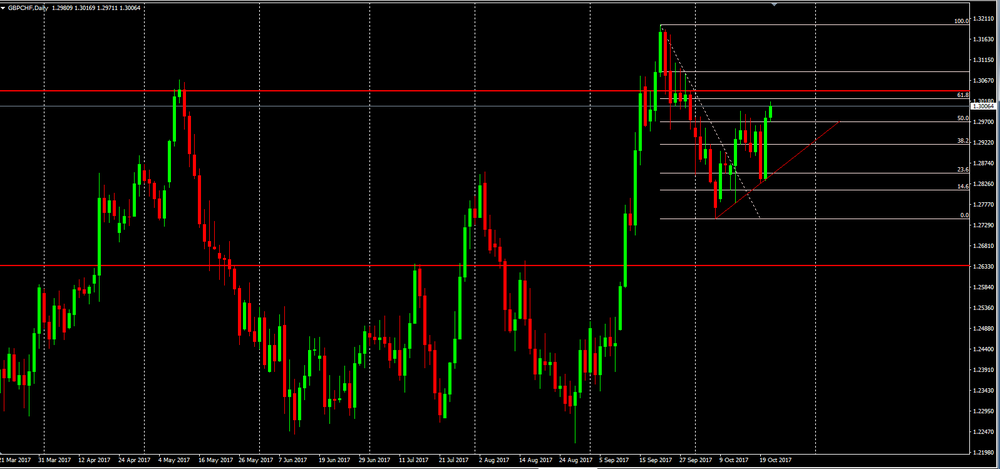

GBP/CHF DAILY TIME FRAME CHART

As we can seen on the daily chart, GBP/CHF reached new highs and since that it has been correcting his last bullish movement.

In this case, the use of fibonacci levels is useful to see if the price is showing signs of recovering its previous bullish tendency, or if in the case of rejecting the 61.8% fibonacci, a reversal of bearish.

Therefore, in this asset we have two possible bias.

Our suggestion is to wait for the closing of today's candle (Monday) and then draw conclusions for either long or short entries.

-

14:28

There are no plans for Trump to send former U.S. President Carter on mission to North Korea - White House official

-

14:00

Eurozone: Consumer Confidence, October -1 (forecast -1.1)

-

13:46

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1720 (EUR 345m) 1.1730 (895m) 1.1785 (605m) 1.1800 (505m)

1.1870 (465m) 1.1900-05 (390m) 1.1930-35 (415m) 1.1945 (645m) 1.1965 (475mn)

USDJPY: 112.85 (640m) 113.00 (445m) 113.20-25 (585m) 113.50 (400m)114.60 (415m)

GBPUSD: Ntg of note

USDCHF: 0.9695-0.9700 (USD 1.1bln)

AUDUSD: 0.7775 (AUD 395m) 0.7850 (380m)

USDCAD: 1.2520-25 (USD 490m) 1.2900 (500m)

-

13:34

U.S. Stocks open: Dow +0.03%, Nasdaq +0.13%, S&P +0.10%

-

13:29

Before the bell: S&P futures +0.09%, NASDAQ futures +0.20%

U.S. stock-index futures rose on the back of prospect of fiscal reform in the U.S. and good Q3 corporate earnings.

Global Stocks:

Nikkei 21,696.65 +239.01 +1.11%

Hang Seng 28,305.88 -181.36 -0.64%

Shanghai 3,382.27 +3.62 +0.11%

S&P/ASX 5,893.96 -13.03 -0.22%

FTSE 7,528.06 +4.83 +0.06%

CAC 5,394.11 +21.73 +0.40%

DAX 13,011.81 +20.53 +0.16%

Crude $51.99 (+0.29%)

Gold $1,274.60 (-0.46%)

-

13:14

Dublin - Eurogroup's Dijsselbloem says things are back on track in Greece, we stand ready to do more if they do their part

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

48

0.07(0.15%)

355

Amazon.com Inc., NASDAQ

AMZN

985.8

2.89(0.29%)

8868

Apple Inc.

AAPL

156.81

0.56(0.36%)

43064

AT&T Inc

T

35.44

-0.10(-0.28%)

67187

Barrick Gold Corporation, NYSE

ABX

15.93

-0.10(-0.62%)

13936

Boeing Co

BA

265.48

0.73(0.28%)

2547

Caterpillar Inc

CAT

131.75

0.39(0.30%)

3397

Cisco Systems Inc

CSCO

34.44

0.19(0.55%)

10724

Citigroup Inc., NYSE

C

73.66

0.13(0.18%)

14702

Exxon Mobil Corp

XOM

82.82

-0.29(-0.35%)

12738

Facebook, Inc.

FB

175.4

0.42(0.24%)

29322

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.92

0.09(0.61%)

8808

General Electric Co

GE

23.54

-0.29(-1.22%)

821589

General Motors Company, NYSE

GM

45.73

0.12(0.26%)

1491

Goldman Sachs

GS

245

0.27(0.11%)

1630

Google Inc.

GOOG

990

1.80(0.18%)

950

Intel Corp

INTC

40.46

0.03(0.07%)

13271

International Business Machines Co...

IBM

162.05

-0.02(-0.01%)

3882

Johnson & Johnson

JNJ

142

-0.40(-0.28%)

399

JPMorgan Chase and Co

JPM

99.6

0.09(0.09%)

1284

McDonald's Corp

MCD

166.65

0.35(0.21%)

4766

Merck & Co Inc

MRK

64.08

0.20(0.31%)

187

Microsoft Corp

MSFT

78.96

0.15(0.19%)

17081

Nike

NKE

53.19

0.13(0.25%)

3125

Procter & Gamble Co

PG

88.4

0.15(0.17%)

3587

Starbucks Corporation, NASDAQ

SBUX

54.5

-0.07(-0.13%)

6035

Tesla Motors, Inc., NASDAQ

TSLA

349.98

4.88(1.41%)

79827

The Coca-Cola Co

KO

46.24

-0.14(-0.30%)

823

Twitter, Inc., NYSE

TWTR

17.93

0.06(0.34%)

21366

Verizon Communications Inc

VZ

49.5

-0.03(-0.06%)

543

Visa

V

107.8

0.25(0.23%)

1773

Wal-Mart Stores Inc

WMT

87.51

0.07(0.08%)

1987

Walt Disney Co

DIS

99.75

0.35(0.35%)

918

Yandex N.V., NASDAQ

YNDX

31.18

0.02(0.06%)

456

-

12:46

Target price changes before the market open

Honeywell (HON) target raised to $156 at RBC Capital Mkts

UnitedHealth (UNH) target raised to $259 from $235 at Mizuho

-

12:46

Downgrades before the market open

General Electric (GE) downgraded to Neutral from Buy at UBS

General Electric (GE) downgraded to Underweight from Equal-Weight at Morgan Stanley

-

12:45

Upgrades before the market open

General Electric (GE) upgraded to Buy from Neutral at BofA/Merrill

-

12:39

Canadian wholesale sales rose 0.5% to $62.8 billion in August

Wholesale sales rose 0.5% to $62.8 billion in August, led by the personal and household goods and motor vehicle and parts subsectors.

Sales were up in four of the seven subsectors, together representing 47% of total wholesale sales.

In volume terms, wholesale sales rose 0.4%.

Sales in the personal and household goods subsector rose for the ninth consecutive month-posting the largest gain in dollar terms in August, rising 3.3% to a record $9.0 billion. Sales were up in four of the six industries, with the textile, clothing and footwear industry contributing the most to the gain.

Sales in the motor vehicle and parts subsector increased for the third time in four months, up 2.0% to $11.8 billion. The growth in the subsector was attributable to higher sales in the motor vehicle industry, which recorded its second consecutive monthly gain. There were higher imports of passenger cars and light trucks in August, and motor vehicle manufacturing sales increased.

-

12:35

Earnings Season in U.S.: Major Reports of the Week

October 24

Before the Open:

3M (MMM). Consensus EPS $2.21, Consensus Revenues $7927.28 mln.

Caterpillar (CAT). Consensus EPS $1.27, Consensus Revenues $10691.44 mln.

General Motors (GM). Consensus EPS $1.11, Consensus Revenues $29926.68 mln.

McDonald's (MCD). Consensus EPS $1.77, Consensus Revenues $5747.94 mln.

United Tech (UTX). Consensus EPS $1.69, Consensus Revenues $14993.81 mln.

Yandex N.V. (YNDX). Consensus EPS RUB9.21, Consensus Revenues RUB23460.38 mln.

After the Close:

AT&T (T). Consensus EPS $0.75, Consensus Revenues $40335.46 mln.

October 25

Before the Open:

Boeing (BA). Consensus EPS $2.65, Consensus Revenues $24068.71 mln.

Coca-Cola (KO). Consensus EPS $0.49, Consensus Revenues $8730.64 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.29, Consensus Revenues $4045.22 mln.

Int'l Paper(IP). Consensus EPS $1.05, Consensus Revenues $5909.27 mln.

Visa (V). Consensus EPS $0.85, Consensus Revenues $4629.30 mln.

After the Close:

Barrick Gold (ABX). Consensus EPS $0.16, Consensus Revenues $2035.87 mln.

October 26

Before the Open:

Altria (MO). Consensus EPS $0.88, Consensus Revenues $5217.26 mln.

Ford Motor (F). Consensus EPS $0.33, Consensus Revenues $32804.60 mln.

Twitter (TWTR). Consensus EPS $0.06, Consensus Revenues $586.22 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $8.33, Consensus Revenues $27110.74 mln.

Amazon (AMZN). Consensus EPS -$0.03, Consensus Revenues $42184.18 mln.

Intel (INTC). Consensus EPS $0.80, Consensus Revenues $15724.88 mln.

Microsoft (MSFT). Consensus EPS $0.72, Consensus Revenues $23526.08 mln.

October 27

Before the Open:

Chevron (CVX). Consensus EPS $0.97, Consensus Revenues $34629.07 mln.

Exxon Mobil (XOM). Consensus EPS $0.86, Consensus Revenues $65688.19 mln.

Merck (MRK). Consensus EPS $1.03, Consensus Revenues $10520.56 mln.

-

12:30

Canada: Wholesale Sales, m/m, August 0.5%

-

12:30

U.S.: Chicago Federal National Activity Index, September 0.17 (forecast -0.10)

-

10:00

United Kingdom: CBI industrial order books balance, October -2 (forecast 9)

-

09:41

Britain's foreign minister Johnson says should start thinking about the future and thinking more creatively in Brexit talks

-

09:00

Britain's foreign minister Johnson has absolutely no doubt that Iran nuclear deal can be preserved

-

Says should continue to demonstrate to people of Iran that they will be better off under Iran nuclear deal

-

-

08:40

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1900 (390 m), 1.1870 (460 m), 1.1800 (505 m), 1.1785 (605 m), 1.1730 (895 m), 1.1720 (340 m)

USD/JPY: 114.60 (415 m), 113.50 (353 m), 113.20/25 (585 m), 113.00 (445 m), 112.85 (640 m)

AUD/USD: 0.7850 (380 m), 0.7775 (395 m)

-

08:25

Poland's 2016 GDP growth at 2.9 pct vs 2.7 estimated in april - Stats office

-

2016 general government deficit at 2.5 pct of GDP vs. 2.4 pct estimated in april

-

Public debt at 54.1 pct of GDP in 2016 vs. 54.4 pct of GDP estimated in april

-

-

08:02

Catalonia's foreign affairs spokesman says EU democracy will not be credible if allows Spain to impose direct rule on Catalonia

-

No-one but the catalan people has the right to change catalan institutions

-

-

08:01

Major European stock exchanges trading mostly in the green zone: FTSE 7518.69 -4.54 -0.06%, DAX 13013.89 +22.61 + 0.17%, CAC 5374.95 + 2.57 + 0.05%

-

06:56

As widely expected, Japan Prime Minister Abe's ruling coalition is set for a sweeping victory in Sunday's general election, and may retain the two-thirds parliamentary majority needed to revise Japan's constitution - Zerohedge

-

06:37

Eurostoxx 50 futures up 0.1 pct, DAX futures up 0.1 pct, CAC 40 futures up 0.1 pct, FTSE futures up 0.1 pct, IBEX futures up 0.1 pct

-

06:36

Fed's Mester says international regulatory coordination on systemically important banks is desirable

-

06:30

10-year U.S. treasury yield at 2.380 percent vs U.S. close of 2.381 percent on friday

-

06:29

Moody's- stable outlook for australian banks underpinned by favorable domestic economic trends and strengthening capital positions, stable profitability

-

Australian banks' funding and liquidity levels will stay stable

-

Home loan repricing will prop-up net interest margins and profitability

-

Expects that australian banks will strengthen capital to meet higher minimum capital requirements

-

-

05:29

Global Stocks

The U.S. stock market feels as though it is made out of Teflon, with virtually nothing able to disrupt its climb to record levels. The broad S&P 500 index SPX, +0.51% which on Friday closed at a record for the 49th time this year at 2,575.21, has sailed through 350 trading days without a 3% pullback, rising weeks and months on end to a 15% gain since the start of the year. According to Bespoke Investment Group, "2017 is tied for the fifth most closing highs on record, dating back to 1929.

Asian stock markets, with the exception of South Korea and Hong Kong, are higher on Monday amid optimism that U.S. President Donald Trump's tax reforms are moving closer to execution, while the Japanese market surged after Japanese Prime Minister Shinzo Abe's landslide victory in Sunday's elections.

-

04:51

Options levels on monday, October 23, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1909 (3331)

$1.1861 (1371)

$1.1818 (277)

Price at time of writing this review: $1.1768

Support levels (open interest**, contracts):

$1.1733 (2968)

$1.1704 (2928)

$1.1670 (4898)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 3 is 101573 contracts (according to data from October, 20) with the maximum number of contracts with strike price $1,2000 (6870);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3357 (3500)

$1.3301 (3956)

$1.3263 (2367)

Price at time of writing this review: $1.3199

Support levels (open interest**, contracts):

$1.3112 (1600)

$1.3083 (2274)

$1.3050 (2213)

Comments:

- Overall open interest on the CALL options with the expiration date November, 3 is 40098 contracts, with the maximum number of contracts with strike price $1,3200 (3956);

- Overall open interest on the PUT options with the expiration date November, 3 is 35442 contracts, with the maximum number of contracts with strike price $1,3000 (3175);

- The ratio of PUT/CALL was 0.88 versus 0.86 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-