Market news

-

23:58

Stocks. Daily history for Nov 02’2017:

(index / closing price / change items /% change)

Nikkei +119.04 22539.12 +0.53%

TOPIX +7.37 1794.08 +0.41%

Hang Seng -75.42 28518.64 -0.26%

CSI 300 +0.51 3997.13 +0.01%

Euro Stoxx 50 -8.60 3688.80 -0.23%

FTSE 100 +67.36 7555.32 +0.90%

DAX -24.58 13440.93 -0.18%

CAC 40 -3.79 5510.50 -0.07%

DJIA +81.25 23516.26 +0.35%

S&P 500 +0.49 2579.85 +0.02%

NASDAQ -1.56714.94 -0.02%

S&P/TSX -14.34 16014.99 -0.09%

-

20:08

The main US stock indexes mostly rose as a result of today's trading

Major US stock indexes finished the session mostly in positive territory, while the DJIA index updated a record high. Investors evaluated the long-awaited proposals to reduce taxes, promulgated by the Republicans, which caused deep skepticism about the adoption of the bill. In addition, traders were waiting for news about who will become the next head of the Fed.

President of the United States Donald Trump nominated Jerome Powell as chairman of the Fed, which, in the case of Senate Powell's approval in February, will be replaced by Janet Yellen. The White House expects that the candidature of Powell will be approved by the senators. It is worth emphasizing that the US president did not renew the powers of the current chairman of the Fed for the first time in 40 years. After the decision of Trump, the head of the Fed, Yellen congratulated Powell on his nomination, and expressed confidence that Powell is committed to the mission of the Fed.

The focus was also on the US data. The Ministry of Labor reported that the number of Americans applying for new unemployment benefits fell last week, despite the fact that Puerto Rico, devastated by hurricanes, has just begun processing the lagging applications. Initial applications for unemployment benefits, an indicator of layoffs across all US states, fell by 5,000 to 229,000, seasonally adjusted for the week ending October 28. Economists had expected 235,000 initial hits last week.

A separate report from the Ministry of Labor showed that productivity in the non-agricultural sector, measured as goods and services produced per hour, increased by 3.0%, seasonally adjusted in the third quarter, compared to a growth rate of 1.5% in the second quarter of 2017. Economists had expected growth of 2.4% in the last quarter. The output increased by 3.8% compared to the second quarter, while the hours worked - by 0.8%.

Meanwhile, the index of business activity in New York improved moderately last month, but was below forecasts. According to the data, the index, assessing the economic conditions in the manufacturing and services sectors for companies registered in New York, rose in October to 51.6 points from 49.7 points in September. Economists predicted that the index will rise to 56.8 points. At the same time, the index reflecting economic conditions in 6 months, has improved to 62.6 points against 58.4 points in September.

Components of the DOW index finished trading mixed (13 in negative, 17 in positive territory). The leader of growth was the shares of The Boeing Company (BA, + 1.72%). Outsider was the shares of The Home Depot, Inc. (HD, -1.72%).

Most sectors of the S & P index recorded a decline. The largest decrease was shown by the sector of conglomerates (-1.9%). The financial sector grew most (+ 0.6%).

At closing:

DJIA + 0.35% 23.516.06 +81.05

Nasdaq -0.02% 6,714.94 -1.59

S & P + 0.02% 2.579.85 + 0.49

-

19:01

DJIA +0.12% 23,462.38 +27.37 Nasdaq +0.12% 6,707.71 +7.95 S&P -0.19% 2,574.36 -5.00

-

17:00

European stocks closed: FTSE 100 +67.36 7555.32 +0.90% DAX -24.58 13440.93 -0.18% CAC 40 -3.79 5510.50 -0.07%

-

13:33

U.S. Stocks open: Dow +0.03%, Nasdaq -0.13%, S&P -0.04%

-

13:29

Before the bell: S&P futures +0.04%, NASDAQ futures +0.08%

U.S. stock-index futures were flat on Thursday as investors waited for the unveiling of a long-awaited tax bill and President Donald Trump's decision on the next Federal Reserve chair.

Global Stocks:

Nikkei 22,539.12 +119.04 +0.53%

Hang Seng 28,518.64 -75.42 -0.26%

Shanghai 3,383.14 -12.77 -0.38%

S&P/ASX 5,931.71 -6.06 -0.10%

FTSE 7,549.55 +61.59 +0.82%

CAC 5,506.15 -8.14 -0.15%

DAX 13,451.46 -14.05 -0.10%

Crude $54.21 (-0.17%)

Gold $1,277.10 (-0.02%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

64.6

-0.10(-0.15%)

11217

Amazon.com Inc., NASDAQ

AMZN

1,100.06

-3.62(-0.33%)

10924

Apple Inc.

AAPL

167.44

0.55(0.33%)

319218

AT&T Inc

T

33.51

-0.04(-0.12%)

9070

Barrick Gold Corporation, NYSE

ABX

14.21

-0.01(-0.07%)

22097

Chevron Corp

CVX

116

0.10(0.09%)

308

Cisco Systems Inc

CSCO

34.52

-0.10(-0.29%)

2781

Citigroup Inc., NYSE

C

74.1

0.07(0.09%)

23013

Deere & Company, NYSE

DE

133.77

-0.50(-0.37%)

575

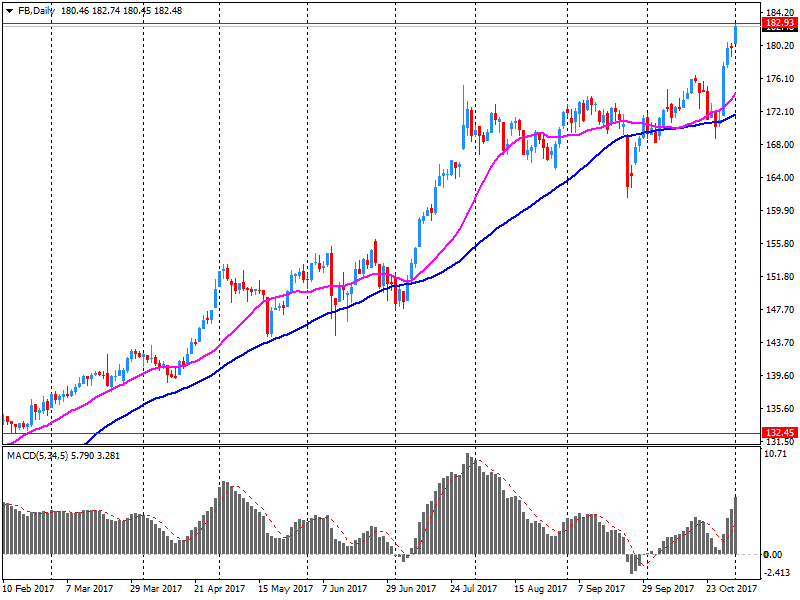

Facebook, Inc.

FB

181.3

-1.36(-0.74%)

1544970

Ford Motor Co.

F

12.34

-0.01(-0.08%)

8140

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.39

0.01(0.07%)

2601

General Electric Co

GE

20.05

0.03(0.15%)

74130

General Motors Company, NYSE

GM

43.2

0.07(0.16%)

22905

Google Inc.

GOOG

1,022.98

-2.52(-0.25%)

1461

Home Depot Inc

HD

165

-0.38(-0.23%)

1141

Intel Corp

INTC

46.6

-0.11(-0.24%)

1096867

JPMorgan Chase and Co

JPM

101

0.08(0.08%)

2863

Merck & Co Inc

MRK

55.45

0.11(0.20%)

916

Microsoft Corp

MSFT

83.05

-0.13(-0.16%)

3401

Nike

NKE

54.79

-0.28(-0.51%)

1150

Pfizer Inc

PFE

35.3

0.04(0.11%)

2485

Starbucks Corporation, NASDAQ

SBUX

54.88

-0.25(-0.45%)

2875

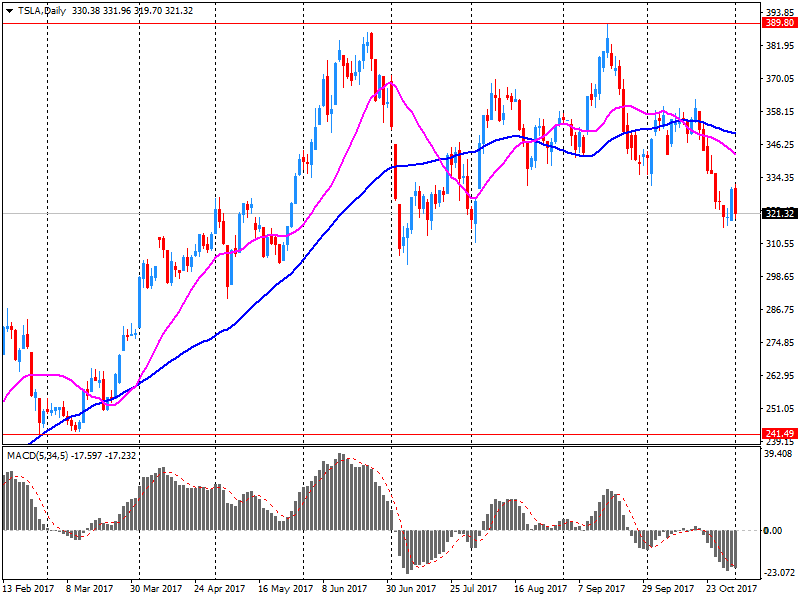

Tesla Motors, Inc., NASDAQ

TSLA

302

-19.08(-5.94%)

415176

The Coca-Cola Co

KO

45.75

-0.05(-0.11%)

278

Twitter, Inc., NYSE

TWTR

20.56

-0.05(-0.24%)

18033

Verizon Communications Inc

VZ

48

0.17(0.36%)

548

Visa

V

111.2

0.13(0.12%)

127

Wal-Mart Stores Inc

WMT

88.07

0.13(0.15%)

1544

Yandex N.V., NASDAQ

YNDX

33.58

-0.45(-1.32%)

4070

-

12:39

Target price changes before the market open

Facebook (FB) target raised to $215 from $185 at Needham

Facebook (FB) target raised to $195 from $200 at Stifel

Facebook (FB) target raised to $230 from $195 at RBC Capital Mkts

Tesla (TSLA) target lowered to $340 at RBC Capital Mkts

-

12:38

Downgrades before the market open

Yandex N.V. (YNDX) downgraded to Hold from Buy at VTB Capital

-

12:22

Company News: DowDuPont (DWDP) quarterly earnings beat analysts’ estimates

DowDuPont (DWDP) reported Q3 FY 2017 earnings of $0.55 per share (versus $0.91 in Q3 FY 2016), beating analysts' consensus estimate of $0.45.

The company's quarterly revenues amounted to $18.285 bln (+7.6% y/y), generally in-line with analysts' consensus estimate of $18.243 bln.

DWDP rose to $74.32 (+1.36%) in pre-market trading.

-

12:11

Company News: Tesla (TSLA) quarterly losses beat analysts’ estimate

Tesla (TSLA) reported Q3 FY 2017 losses of $2.92 per share (versus $0.71 in Q3 FY 2016), missing analysts' consensus estimate of -$2.29.

The company's quarterly revenues amounted to $2.985 bln (+29.9% y/y), beating analysts' consensus estimate of $2.939 bln.

The company also announced about delaying Model 3 production targets. It currently expects to achieve a production rate of 5,000 Model 3 vehicles per week by late Q1 2018 (from end of 2017 previously).

TSLA fell to $306.06 (-4.68%) in pre-market trading.

-

11:49

Company News: Facebook (FB) quarterly results beat analysts’ expectations

Facebook (FB) reported Q3 FY 2017 earnings of $1.59 per share (versus $1.09 in Q3 FY 2016), beating analysts' consensus estimate of $1.28.

The company's quarterly revenues amounted to $10.328 bln (+47.3% y/y), beating analysts' consensus estimate of $9.844 bln.

The company also reported the daily active users (DAUs) were 1.37 billion on average for September 2017 (+16% y/y), and monthly active users (MAUs) were 2.07 billion as of September 30, 2017(+16% y/y).

FB fell to $180.50 (-1.18%) in pre-market trading.

-

09:01

Major stock exchanges in Europe trading mostly in the red zone: FTSE 7487.43 -0.53 -0.01%, DAX 13451.69 -13.82 -0.10%, CAC 5513.84 -0.45 -0.01%

-

07:37

Eurostoxx 50 futures down 0.3 pct, DAX futures down 0.3 pct, CAC 40 futures down 0.1 pct, FTSE futures down 0.3 pct, IBEX futures down 0.1 pct

-

06:32

Global Stocks

Stocks inched higher in Asia on Thursday, tracking muted gains on Wall Street overnight even as the Federal Reserve signaled an optimistic view of the U.S. economy. Many investors retreated to the sidelines ahead of President Donald Trump's nomination for the Federal Reserve's next leader. Trump is likely to tap Fed governor Jerome Powell as the next chairman of the central bank, according to a person familiar with the matter.

European stocks posted their highest close in more than two years Wednesday, boosted by resource stocks after solid Chinese manufacturing data and car makers following strong U.S. sales figures. The Stoxx Europe 600 index SXXP, +0.39% climbed 0.4% to 396.77, for its highest close since August 2015, according to FactSet data.

U.S. stocks mostly closed higher Wednesday, with the Dow and the S&P 500 ending near record levels after the Federal Reserve stood pat on interest rates but referred to the U.S. economy in positive terms. The central bank, in its statement following a two-day meeting, said economic activity has been picking up at a "solid rate," versus the "moderate" rate that it had referenced in September.

-