Market news

-

21:13

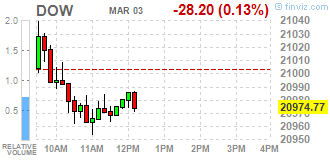

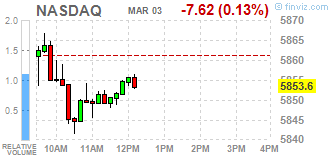

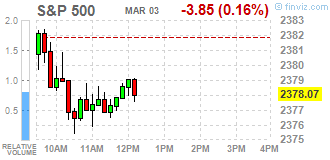

Major US stock indexes finished trading near zero

Major US stock indexes closed near zero, as investors awaited the speech of the Fed's Janet Yellen to assess the possibility of raising interest rates this month. She reported that Fed officials will consider the possibility of raising rates at the March meeting. "Raising rates would be appropriate if the situation with regards to inflation and employment will develop in line with expectations. Overall, the monetary policy stance remains "moderately loose". Gradual rate hikes seem appropriate in the coming months ", - she said.

As it became known, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), rose to 57.6 points in February, compared with 56.5 in January. The last reading was the highest since August 2015. Analysts predicted that the rate will remain unchanged. The indicator is the result of a survey of about 400 companies from 60 sectors across the United States. ISM index value greater than 50, is generally regarded as an indicator of manufacturing activity growth.

DOW index components closed mostly in the red (16 of 30). Most remaining shares fell NIKE, Inc. (NKE, -1.90%). leaders of growth were shares of Caterpillar Inc. (CAT, + 0.81%).

Most of the S & P sector showed an increase. Most utilities sector fell (-0.1%). Growth leaders were conglomerates sector (+ 0.7%).

At the close:

Dow + 0.01% 21,005.71 +2.74

Nasdaq + 0.16% 5,870.75 +9.53

S & P + 0.05% 2,383.12 +1.20

-

20:00

DJIA +0.04% 21,010.36 +7.39 Nasdaq +0.01% 5,861.92 +0.70 S&P -0.02% 2,381.39 -0.53

-

17:21

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes slightly fell on Friday, as investors preferred to wait and watch Federal Reserve Chair Janet Yellen's speech for a steer on the chances of an interest rate hike this month. Yellen could support a rising sentiment among policymakers for an increase in rates amid data pointing to an improving U.S. economy.

Most of Dow stocks in negative area (20 of 30). Top loser NIKE, Inc. (NKE, -1.52%). Top gainer - The Goldman Sachs Group, Inc. (GS, +0.65%).

S&P sectors mixed. Top loser - Utilities (-0.4%). Top gainer - Basic Materials (+0.3%).

At the moment:

Dow 20973.00 -33.00 -0.16%

S&P 500 2378.00 -4.00 -0.17%

Nasdaq 100 5359.25 -5.50 -0.10%

Oil 53.18 +0.57 +1.08%

Gold 1224.80 -8.10 -0.66%

U.S. 10yr 2.51 +0.02

-

17:00

European stocks closed: FTSE 100 -8.09 7374.26 -0.11% DAX -32.21 12027.36 -0.27% CAC 40 +31.33 4995.13 +0.63%

-

14:32

U.S. Stocks open: Dow +0.05%, Nasdaq -0.12%, S&P -0.08%

-

14:27

Before the bell: S&P futures -0.13%, NASDAQ futures -0.14%

U.S. stock-index futures fell as investors were cautious ahead of Federal Reserve Chair Janet Yellen's speech, which could give more clarity on the possibility of an interest rate hike at the Fed's March meeting.

Global Stocks:

Nikkei 19,469.17 -95.63 -0.49%

Hang Seng 23,552.72 -175.35 -0.74%

Shanghai 3,219.19 -10.84 -0.34%

FTSE 7,367.75 -14.60 -0.20%

CAC 4,989.22 +25.42 +0.51%

DAX 112,024.18 -35.39 -0.29%

Crude $52.85 (+0.46%)

Gold $1,230.60 (-0.19%)

-

14:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

McDonald's (MCD) target raised to $136 from $130 at Telsey Advisory Group

-

07:48

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.2%, FTSE -0.2%

-

06:31

Global Stocks

Stocks across Europe closed with minor losses Thursday, after rallying the previous day as investors saw the possibility of gains for European companies from a rise in U.S. fiscal spending. The global rally in stocks Wednesday followed comments from U.S. Federal Reserve officials that suggested the world's largest economy is ready for another interest rate hike. Also, U.S. President Donald Trump said he'll push Congress for $1 trillion in infrastructure investment.

The Dow shed more than 100 points Thursday to finish barely above 21,000 as weak financial shares dragged on the market while Wall Street focused on social app Snap Inc., which soared on its trading debut. Markets have been in rally mode since the November election, largely on anticipation that President Donald Trump would push for policies on taxes and regulation that will accelerate economic growth and boost corporate profits.

Asian shares took a breather after U.S. peers capped the worst day since January as bets increased that the Federal Reserve will raise rates in two weeks. The dollar snapped its five-session winning streak as investors await further clues on the timing of the U.S. interest rate hikes from Fed Chair Janet Yellen's speech in Chicago later today.

-