Market news

-

22:30

Stocks. Daily history for Apr 03’2017:

(index / closing price / change items /% change)

Nikkei +73.97 18983.23 +0.39%

TOPIX +4.43 1517.03 +0.29%

Hang Seng +149.89 24261.48 +0.62%

CSI 300 +19.29 3456.05 +0.56%

Euro Stoxx 50 -27.99 3472.94 -0.80%

FTSE 100 -40.23 7282.69 -0.55%

DAX -55.67 12257.20 -0.45%

CAC 40 -36.60 5085.91 -0.71%

DJIA -13.01 20650.21 -0.06%

S&P 500 -3.88 2358.84 -0.16%

NASDAQ -17.05 5894.68 -0.29%

S&P/TSX +36.65 15584.40 +0.24%

-

20:07

The main US stock indexes completed the session in a negative territory

Major US stock indices showed a decline after New York and other states accused the Trump administration of illegally blocking energy efficiency standards, casting doubt on the ability of the new government to promote the planned reforms.

In addition, as it became known that the conditions for doing business in the US industrial sector continued to improve in March, but the last figure was the lowest for 6 months. The loss of momentum reflected a weaker growth in production and new orders, as well as a slow increase in jobs. Producers sought to adjust their inventory strategies in response to restrained sales growth, while inventories of finished products declined for the first time in six months. In March, the final PMI index fell to 53.3 from 54.2 in February. The last reading was the lowest since September 2016.

However, the report published by the Institute for Supply Management (ISM) showed that in March, activity in the US manufacturing sector worsened, but less than the average forecasts of experts. The PMI index for the manufacturing sector was 57.2 points against 57.7 points in February. Analysts had expected that this figure would drop to 57.0 points. In addition, more detailed information showed: the price index in March rose to 70.5 from 68.0 in February, the employment index improved to 58.9 from 54.2, the index of new orders fell to 64.5 from 65.1, the index Production fell to 57.6 from 62.9, and the stock index fell to 49.0 from 51.5 in February.

The components of the DOW index mostly decreased (20 out of 30). The shares of E.I. du Pont de Nemours and Company fell more than others (DD, -0.71%). The leader of growth was UnitedHealth Group Incorporated (UNH, + 1.09%).

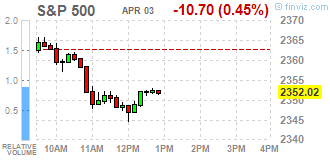

All sectors of the S & P index finished trading in the red. The conglomerate sector fell most of all (-0.6%).

At closing:

DJIA -0.06% 20.651.00 -12.22

Nasdaq -0.29% 5,894.68 -17.06

S & P -0.16% 2,358.87 -3.85

-

19:00

DJIA -0.12% 20,639.09 -24.13 Nasdaq -0.23% 5,898.17 -13.57 S&P -0.23% 2,357.32 -5.40

-

16:56

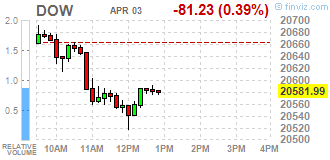

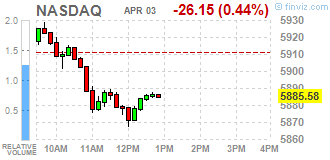

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes trade lower on Monday after New York and other states challenged the Trump administration for illegally blocking energy efficiency standards, casting further doubt on the new government's ability to push through planned reforms. The move by a coalition of U.S. states and municipalities comes barely two weeks after President Donald Trump's administration had to pull legislation to overhaul the U.S. healthcare system.

Most of Dow stocks in negative area (25 of 30). Top loser - E. I. du Pont de Nemours and Company (DD, -1.36%). Top gainer - UnitedHealth Group Incorporated (UNH, +0.66%).

All S&P sectors in negative area. Top loser - Basic Materials (-0.8%).

At the moment:

Dow 20524.00 -80.00 -0.39%

S&P 500 2348.75 -10.50 -0.45%

Nasdaq 100 5422.00 -16.50 -0.30%

Oil 50.35 -0.25 -0.49%

Gold 1254.50 +3.30 +0.26%

U.S. 10yr 2.35 -0.05

-

16:00

European stocks closed: FTSE 100 -40.23 7282.69 -0.55% DAX -55.67 12257.20 -0.45% CAC 40 -36.60 5085.91 -0.71%

-

13:32

U.S. Stocks open: Dow +0.12%, Nasdaq +0.15%, S&P +0.06%

-

13:22

Before the bell: S&P futures +0.02%, NASDAQ futures -0.05%

U.S. stock-index futures were flat as investors awaited the earnings season to see if corporate profits justify lofty valuations, and, more immediately, a meeting between the U.S. President Donald Trump and the President of the People's Republic of China Xi Jinping.

Global Stocks:

Nikkei 18,983.23 +73.97 +0.39%

Hang Seng 24,261.48 +149.89 +0.62%

Shanghai -

FTSE 7,322.52 -0.40 -0.01%

CAC 5,102.63 -19.88 -0.39%

DAX 12,325.28 +12.41 +0.10%

Crude $50.67 (+0.14%)

Gold $1,249.30 (-0.15%)

-

12:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

191.5

0.17(0.09%)

602

ALCOA INC.

AA

34.62

0.22(0.64%)

6047

ALTRIA GROUP INC.

MO

71.59

0.17(0.24%)

1007

Amazon.com Inc., NASDAQ

AMZN

888.99

2.45(0.28%)

27140

Apple Inc.

AAPL

143.78

0.12(0.08%)

58417

AT&T Inc

T

41.68

0.13(0.31%)

9646

Barrick Gold Corporation, NYSE

ABX

18.98

-0.01(-0.05%)

16784

Chevron Corp

CVX

107.89

0.52(0.48%)

787

Citigroup Inc., NYSE

C

59.8

-0.02(-0.03%)

4103

Exxon Mobil Corp

XOM

82.25

0.24(0.29%)

14403

Facebook, Inc.

FB

141.8

-0.25(-0.18%)

40887

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.53

0.17(1.27%)

91506

General Electric Co

GE

29.79

-0.01(-0.03%)

13653

General Motors Company, NYSE

GM

35.45

0.09(0.25%)

21105

Goldman Sachs

GS

229.99

0.27(0.12%)

910

Google Inc.

GOOG

831.16

1.60(0.19%)

2445

Home Depot Inc

HD

146.8

-0.03(-0.02%)

391

Intel Corp

INTC

36.05

-0.02(-0.06%)

3270

Johnson & Johnson

JNJ

124.7

0.15(0.12%)

2011

JPMorgan Chase and Co

JPM

88

0.16(0.18%)

7875

Merck & Co Inc

MRK

63.7

0.16(0.25%)

1234

Microsoft Corp

MSFT

65.99

0.13(0.20%)

6280

Nike

NKE

55.7

-0.03(-0.05%)

909

Pfizer Inc

PFE

34.12

-0.09(-0.26%)

2051

Tesla Motors, Inc., NASDAQ

TSLA

287.52

9.22(3.31%)

273818

Twitter, Inc., NYSE

TWTR

15.02

0.07(0.47%)

13984

Verizon Communications Inc

VZ

48.87

0.12(0.25%)

2440

-

08:42

Major European stock markets trading mostly in the green zone: FTSE 7328.19 +5.27 + 0.07%, DAX 12355.91 +43.04 + 0.35%, CAC 5122.09 -0.42 -0.01%

-

06:43

Mixed start of trading on the main European stock markets is expected: DAX +0.3%, CAC40 +0.1%, FTSE -0.2%

-

05:30

Global Stocks

European stocks ended a volatile trading session mostly higher, with the Stoxx Europe 600 index logging a third quarter of gains.

U.S. stocks closed lower on Friday, but still posted sizable weekly and quarterly gains. Monthly performance was mixed. Real estate shares, utilities and consumer discretionary stocks attracted buyers. Technology stocks were the best performers over the past quarter, up 12%. The benchmark index gained 0.8% over the week and was flat for the month. Over the quarter, the index was up 5.5%, advancing for a sixth straight quarter.

The second quarter kicked off with a lukewarm start for Asian equities on Monday, with markets wavering between neutral and slight gains, ahead of Donald Trump's summit with China's president later this week.

-