Market news

-

19:00

DJIA 17933.14 2.47 0.01%, NASDAQ 5062.68 4.27 0.08%, S&P 500 2092.02 3.36 0.16%

-

17:00

European stocks closed: FTSE 6693.26 -97.25 -1.43%, DAX 10259.13 -66.75 -0.65%, CAC 4377.46 -34.22 -0.78%

-

16:39

WSE: Session Results

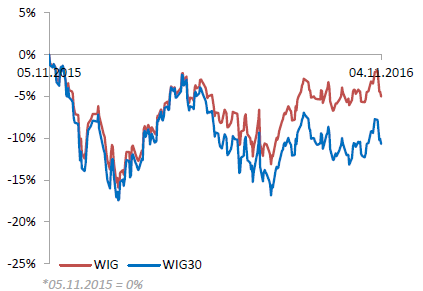

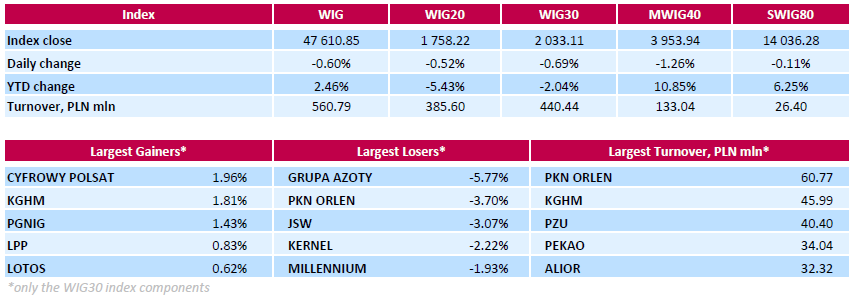

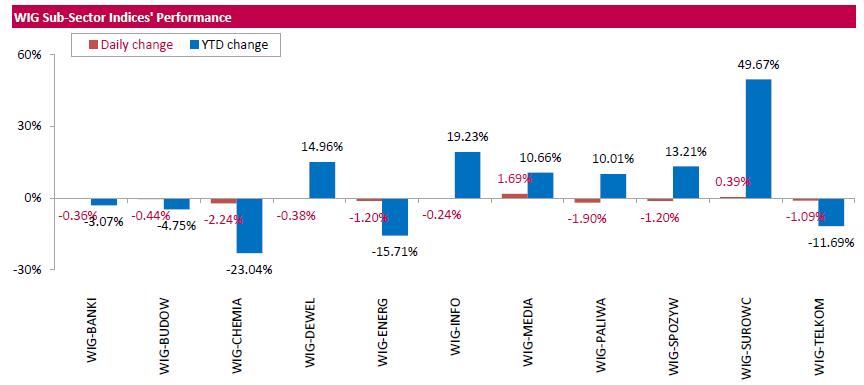

Polish equity market closed lower on Friday. The broad market measure, the WIG index, declined by 0.6%. Except for media (+1.69%) and materials (+0.39%), every sector in the WIG Index fell, with chemicals (-2.24%) lagging behind. The large-cap stocks' benchmark, the WIG30 Index, lost 0.69%. In the index basket, chemical producer GRUPA AZOTY (WSE: ATT) was the weakest name, tumbling by 5.77%. It was followed by oil refiner PKN ORLEN (WSE: PKN), coking coal producer JSW (WSE: JSW) and agricultural producer KERNEL (WSE: KER), slumping by 3.7%, 3.07% and 2.22% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) led the advancers, climbing by 1.96%. Other major gainers were copper producer KGHM (WSE: KGH), oil and gas producer PGNIG (WSE: PGN) and clothing retailer LPP (WSE: LPP), adding 1.81%, 1.43% and 0.83% respectively.

-

16:27

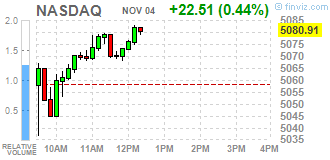

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Friday, despite worries over the outcome of the U.S. presidential election continued to weigh on sentiment. Investors have been unnerved by signs the U.S. presidential race between Democrat Hillary Clinton and Republican Donald Trump is tightening, after Clinton had until recently been thought to have a clear lead.

Most of Dow stocks in positive area (19 of 30). Top gainer - General Electric Company (GE, +1.70%). Top loser - The Procter & Gamble Company (PG, -1.07%).

Most of all S&P sectors also in positive area. Top gainer - Conglomerates (+1.3%). Top loser - Basic Materials (-0.3%).

At the moment:

Dow 17889.00 +37.00 +0.21%

S&P 500 2093.25 +9.75 +0.47%

Nasdaq 100 4690.50 +16.00 +0.34%

Oil 44.11 -0.55 -1.23%

Gold 1304.70 +1.40 +0.11%

U.S. 10yr 1.78 -0.03

-

13:33

U.S. Stocks open: Dow -0.12%, Nasdaq -0.30%, S&P -0.05%

-

13:25

Before the bell: S&P futures +0.11%, NASDAQ futures +0.05%

U.S. stock-index futures fluctuated after data showed steady progress in the labor market, while investors remained focused on the looming presidential election.

Global Stocks:

Nikkei 16,905.36 -229.32 -1.34%

Hang Seng 22,642.62 -40.89 -0.18%

Shanghai 3,125.08 -3.86 -0.12%

FTSE 6,691.54 -98.97 -1.46%

CAC 4,373.57 -38.11 -0.86%

DAX 10,246.84 -79.04 -0.77%

Crude $44.31 (-0.78%)

Gold $1,302.00 (-0.10%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

768.4

1.37(0.1786%)

16320

AMERICAN INTERNATIONAL GROUP

AIG

139.51

-0.51(-0.3642%)

180

Apple Inc.

AAPL

109.73

-0.10(-0.091%)

71169

AT&T Inc

T

36.83

0.20(0.546%)

1110

Barrick Gold Corporation, NYSE

ABX

18.24

-0.09(-0.491%)

63802

Boeing Co

BA

139.51

-0.51(-0.3642%)

180

Caterpillar Inc

CAT

81.31

0.04(0.0492%)

195

Chevron Corp

CVX

105

-0.39(-0.3701%)

12025

Cisco Systems Inc

CSCO

30.25

-0.07(-0.2309%)

203

E. I. du Pont de Nemours and Co

DD

68.49

-0.01(-0.0146%)

300

Facebook, Inc.

FB

120.14

0.14(0.1167%)

106387

Ford Motor Co.

F

11.33

-0.02(-0.1762%)

9709

General Electric Co

GE

28.3

0.02(0.0707%)

2704

Goldman Sachs

GS

176.74

0.53(0.3008%)

250

Google Inc.

GOOG

115

-0.03(-0.0261%)

300

Hewlett-Packard Co.

HPQ

139.51

-0.51(-0.3642%)

180

Intel Corp

INTC

33.85

-0.08(-0.2358%)

3953

Johnson & Johnson

JNJ

115

-0.03(-0.0261%)

300

Microsoft Corp

MSFT

59.19

-0.02(-0.0338%)

4914

Pfizer Inc

PFE

115

-0.03(-0.0261%)

300

Starbucks Corporation, NASDAQ

SBUX

52.47

0.70(1.3521%)

32063

Tesla Motors, Inc., NASDAQ

TSLA

188.09

0.67(0.3575%)

14083

The Coca-Cola Co

KO

41.83

-0.20(-0.4758%)

2220

Twitter, Inc., NYSE

TWTR

17.53

-0.05(-0.2844%)

20042

UnitedHealth Group Inc

UNH

137.93

0.10(0.0725%)

554

Walt Disney Co

DIS

93.15

-0.22(-0.2356%)

3066

Yahoo! Inc., NASDAQ

YHOO

40.15

-0.08(-0.1989%)

482

-

12:25

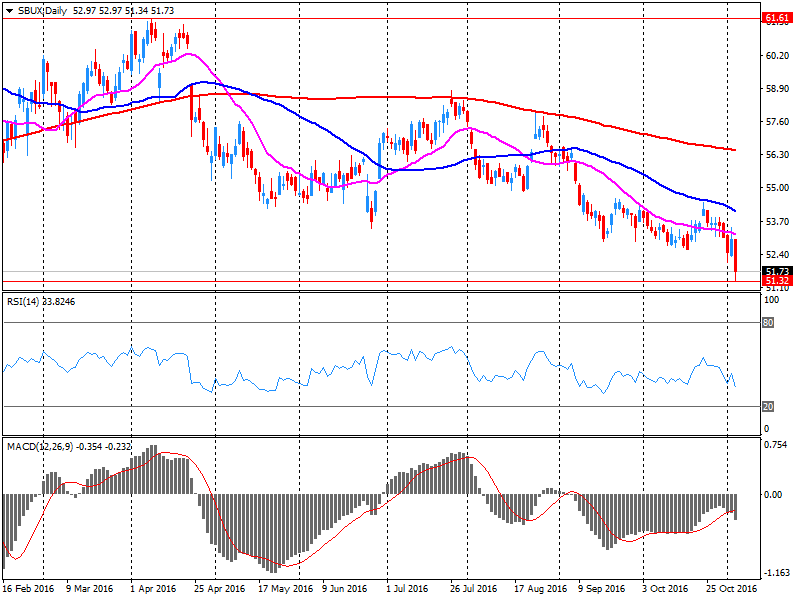

Company News: Starbucks (SBUX) Q4 results beat analysts’ expectations

Starbucks reported Q4 FY 2016 earnings of $0.56 per share (versus $0.43 in Q4 FY 2015), beating analysts' consensus estimate of $0.55.

The company's quarterly revenues amounted to $5.711 bln (+16.2% y/y), slightly beating analysts' consensus estimate of $5.688 bln.

The company also issued downside guidance for FY2017, projecting EPS of $2.12-2.14 (versus analysts' consensus estimate of $2.16) and consolidated revenue growth in the double digits (consensus +8%).

SBUX rose to $52.70 (+1.80%) in pre-market trading.

-

08:28

Major stock markets trading in the red zone: FTSE -0.7%, DAX -0.4%, CAC40 -0.3%, FTMIB -0.1%, IBEX -0.4%

-

05:52

Global Stocks

Europe's main stock benchmark closed a touch higher on Thursday, with banks providing support after a dose of upbeat results and a U.K. court ruling viewed as favorable for the country's financial sector. Banking shares moved higher in the wake of encouraging quarterly reports from Société Générale SA and ING Groep NV, plus a ruling that the British government can't trigger the Brexit process without signoff from parliament.

The S&P 500 on Thursday fell for an eighth straight session, notching its longest retreat since the financial crisis in 2008. The epic losing streak has prompted a steady stream of predictions from doomsayers about an impending market collapse. But it's important to remember that in the grand scheme of things, this selloff is a mere blip.

Asian shares were broadly lower Friday, with Japan shrugging off better-than-expected economic data as concerns around the narrowing race for the White House curbed investor appetite. Early Friday, the Nikkei Japan services purchasing managers index rose to 50.5 in October from 48.2 in September. A reading above 50 indicates expansion, while a reading below 50 indicates contraction.

-