Market news

-

22:25

Stocks. Daily history for Oct 12’2017:

(index / closing price / change items /% change)

Nikkei +73.45 20954.72 +0.35%

TOPIX +3.32 1700.13 +0.20%

Hang Seng +69.46 28459.03 +0.24%

CSI 300 +10.26 3912.95 +0.26%

Euro Stoxx 50 -1.85 3605.54 -0.05%

FTSE 100 +22.43 7556.24 +0.30%

DAX +12.21 12982.89 +0.09%

CAC 40 -1.60 5360.81 -0.03%

DJIA -31.88 22841.01 -0.14%

S&P 500 -4.31 2550.93 -0.17%

NASDAQ -12.04 6591.51 -0.18%

S&P/TSX -58.19 15742.21 -0.37%

-

20:14

The main US stock indexes fell slightly as a result of today's trading

On Thursday, the major US stock indexes finished trading below the zero mark, as the growth of the industrial goods sectors and conglomerate sectors was offset by the financial results of JPMorgan and Citigroup, which did not inspire investors.

Meanwhile, some support for the market was provided by data on the United States. The number of Americans applying for new unemployment benefits fell during the second consecutive week in early October, although recent hurricanes continued to affect data in the South of the United States. Initial applications for unemployment benefits, the indicator of layoffs in the US, decreased by 15,000 to 243,000, seasonally adjusted for the week ending October 7, the Ministry of Labor said. Economists were expecting 251,000 new applications last week.

At the same time, the producer price index in September increased by 0.4%, which was in line with the forecast of economists. Another measure preferred by economists, the basic PPI, increased by 0.2%. The basic PPI excludes food, energy and trade margins. The increase in the PPI pushed the 12-month rate of wholesale inflation to 2.6% (maximum since February 2012). Most of the increase in wholesale prices in September was due to the increase in gasoline prices after Hurricane Harvey violated the work of several large oil refineries. Another growth factor is a higher margin for retailers

Oil prices have partially recovered after the publication of data on oil products from the US Department of Energy, but continue to show a decline of more than 1% against the backdrop of today's report from the International Energy Agency (IEA). The US Energy Ministry reported that last week oil reserves fell sharply, exceeding forecasts of analysts, while gasoline stocks increased significantly. According to the data, in the week of September 30 - October 6, oil reserves fell by 2.747 million barrels, to 462.216 million barrels. Analysts had expected a fall of 1.991 million barrels.

Most components of the DOW index finished trading in the red (20 of 30). Outsider were shares of The Walt Disney Company (DIS, -1.69%). Caterpillar Inc. was the growth leader. (CAT, + 1.05%).

The S & P sector showed mixed dynamics. The largest decrease was in the services sector (-0.5%). The industrial goods sector grew most (+ 0.3%).

At closing:

DJIA -0.14% 22.841.01 -31.88

Nasdaq -0.18% 6,591.51 -12.04

S & P -0.17% 2.550.93 -4.31

-

19:00

DJIA -0.15% 22,838.30 -34.59 Nasdaq -0.12% 6,595.73 -7.82 Nasdaq -0.14% 2,551.69 -3.55

-

16:00

European stocks closed: FTSE 100 +22.43 7556.24 +0.30% DAX +12.21 12982.89 +0.09% CAC 40 -1.60 5360.81 -0.03%

-

13:34

U.S. Stocks open: Dow -0.11%, Nasdaq -0.09%, S&P -0.13%

-

13:28

Before the bell: S&P futures -0.18%, NASDAQ futures -0.15%

U.S. stock-index futures were lower on Thursday as Q3 earnings season gets under way.

Global Stocks:

Nikkei 20,954.72 +73.45 +0.35%

Hang Seng 28,459.03 +69.46 +0.24%

Shanghai 3,387.65 -0.6375 -0.02%

S&P/ASX 5,794.47 +22.32 +0.39%

FTSE 7,559.56 +25.75 +0.34%

CAC 5,350.33 -12.08 -0.23%

DAX 12,965.39 -5.29 -0.04%

Crude $50.57 (-1.42%)

Gold $1,295.20 (+0.49%)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

994.98

-0.02(-0.00%)

12036

American Express Co

AXP

91.49

-0.47(-0.51%)

2211

Apple Inc.

AAPL

156.17

-0.38(-0.24%)

41218

AT&T Inc

T

37.56

-0.63(-1.65%)

307912

Barrick Gold Corporation, NYSE

ABX

16.73

-0.03(-0.18%)

13147

Caterpillar Inc

CAT

128.5

-0.10(-0.08%)

1048

Cisco Systems Inc

CSCO

33.1

-0.49(-1.46%)

31292

Citigroup Inc., NYSE

C

75.5

0.56(0.75%)

562227

Exxon Mobil Corp

XOM

82.45

-0.15(-0.18%)

208

Facebook, Inc.

FB

172.5

-0.24(-0.14%)

24121

Ford Motor Co.

F

12.3

-0.08(-0.65%)

220482

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.67

0.24(1.66%)

12259

General Electric Co

GE

23.03

-0.04(-0.17%)

25121

General Motors Company, NYSE

GM

44.75

-0.72(-1.58%)

121739

Goldman Sachs

GS

242.5

0.10(0.04%)

4977

Google Inc.

GOOG

986.3

-2.95(-0.30%)

684

International Business Machines Co...

IBM

147.45

-0.17(-0.12%)

976

Johnson & Johnson

JNJ

136.5

-0.15(-0.11%)

787

JPMorgan Chase and Co

JPM

97.44

0.60(0.62%)

263335

Microsoft Corp

MSFT

76.21

-0.21(-0.27%)

318

Nike

NKE

50.98

-0.05(-0.10%)

6390

Pfizer Inc

PFE

36.4

-0.05(-0.14%)

4997

Starbucks Corporation, NASDAQ

SBUX

55.45

-0.19(-0.34%)

1352

Tesla Motors, Inc., NASDAQ

TSLA

352.89

-1.71(-0.48%)

23621

The Coca-Cola Co

KO

46.01

-0.09(-0.20%)

1117

Twitter, Inc., NYSE

TWTR

17.7

-0.03(-0.17%)

17513

Verizon Communications Inc

VZ

48.4

-0.46(-0.94%)

13162

Visa

V

108.71

0.27(0.25%)

1636

Wal-Mart Stores Inc

WMT

85.72

-0.01(-0.01%)

34775

Walt Disney Co

DIS

97.8

-0.75(-0.76%)

34749

Yandex N.V., NASDAQ

YNDX

31.9

0.07(0.22%)

700

-

12:58

Target price changes before the market open

Alphabet (GOOG) target raised to $970 at Pivotal Research Group

Honeywell (HON) target raised to $160 from $152 at Argus

-

12:56

Downgrades before the market open

Walt Disney (DIS) downgraded to Neutral from Buy at Guggenheim

Wal-Mart (WMT) removed from Conviction Buy List at Goldman

-

12:14

Company News: Citigroup (C) Q3 financials beat analysts’ forecasts

Citigroup (C) reported Q3 FY 2017 earnings of $1.42 per share (versus $1.24 in Q3 FY 2016), beating analysts' consensus estimate of $1.30.

The company's quarterly revenues amounted to $18.173 bln (+2.3% y/y), beating analysts' consensus estimate of $17.870 bln.

C rose to $75.20 (+0.35%) in pre-market trading.

-

12:03

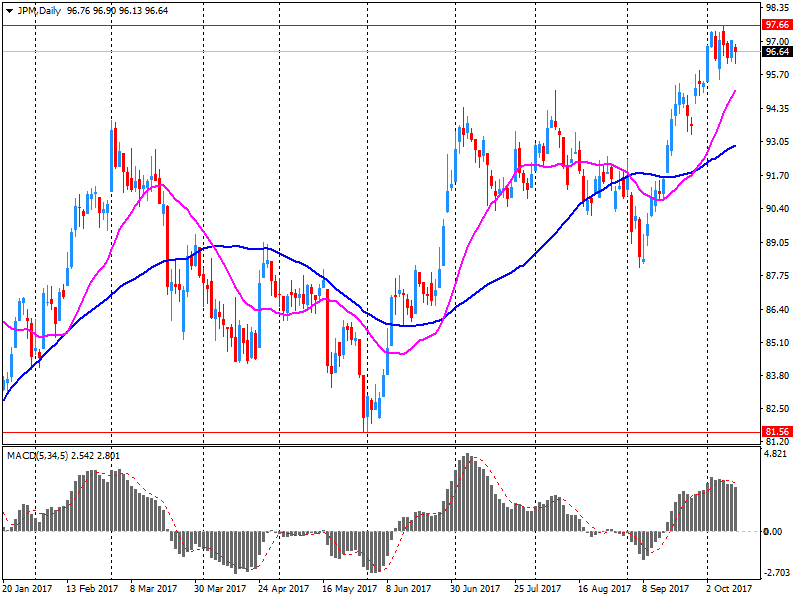

Company News: JPMorgan Chase (JPM) Q3 results beat analysts’ expectations

JPMorgan Chase (JPM) reported Q3 FY 2017 earnings of $1.76 per share (versus $1.58 in Q3 FY 2016), beating analysts' consensus estimate of $1.66.

The company's quarterly revenues amounted to $25.326 bln (+2.6% y/y), beating analysts' consensus estimate of $24.907 bln.

JPM fell to $96.52 (-0.33%) in pre-market trading.

-

07:31

Major stock exchanges in Europe trading mixed: FTSE 7532.49 -1.32 -0.02%, DAX 12986.01 +15.33 + 0.12%, CAC 5361.42 -0.99 -0.02%

-

06:13

Eurostoxx 50 futures up 0.1 pct, DAX futures flat, CAC 40 futures flat, FTSE futures flat

-

05:38

Global Stocks

Spanish stocks bounced higher on Wednesday, as worries over the standoff between Catalonia and Madrid subsided, after Catalan leader Carles Puigdemont suspended independence plans. What stocks are doing: The IBEX 35 index IBEX, +1.34% rallied 1.3% to end at 10,278.40, its highest close since Sep. 29, according to FactSet. The Madrid benchmark was rebounding from a 0.9% loss on Tuesday, when concerns over an escalation in Spain's political crisis blunted the appetite for investing.

Equity markets in Asia extended their gains on Thursday, taking cues from fresh overnight records set by key U.S. indexes as the earnings season kicks off. Strong earnings growth has supported major stock indexes this year, and some analysts said they expect third-quarter results to continue to outperform expectations. Meanwhile, the Federal Reserve signaled its confidence that the U.S. economy was strong enough to support further rate increases.

All three main U.S. stock benchmarks closed at records on Wednesday after minutes from the Federal Reserve's September meeting suggested caution among policy makers on the next interest rate hike which the market had widely expected in December.

-