Market news

-

23:26

Stocks. Daily history for Nov 14’2017:

(index / closing price / change items /% change)

Nikkei -0.98 22380.01 +0.00%

TOPIX -4.62 1778.87 -0.26%

Hang Seng -30.06 29152.12 -0.10%

CSI 300 -28.72 4099.35 -0.70%

Euro Stoxx 50 -18.14 3556.38 -0.51%

FTSE 100 -0.76 7414.42 -0.01%

DAX -40.94 13033.48 -0.31%

CAC 40 -26.05 5315.58 -0.49%

DJIA -30.23 23409.47 -0.13%

S&P 500 -5.97 2578.87 -0.23%

NASDAQ -19.72 6737.87 -0.29%

S&P/TSX -113.13 15913.13 -0.71%

-

21:09

The main US stock indices fell on the results of today's session

Major US stock indexes finished trading in negative territory against the backdrop of a strong fall in shares of General Electric for the second day in a row, as well as a collapse in oil prices.

In addition, as it became known today, in October the producer price index in the US has steadily increased, which indicates an increase in inflationary pressures. The producer price index, the inflation rate experienced by enterprises, increased by 0.4% in October compared with a month earlier, the Labor Ministry reported on Tuesday. If we exclude more volatile food and energy components, the so-called base prices also increased by 0.4% in October. According to the economist of the Ministry of Labor, the growth of the general producer price index as a whole was due to the surge in trade services, which grew by 1.1% compared to a month earlier. Economists had expected a 0.1% increase in total producer prices and 0.2% in base prices.

Oil prices fell by about 2%, due to the evidence of growth in US production, and a gloomy outlook for demand growth in the report of the International Energy Agency (IEA). The IEA in its monthly report presented a surprisingly gloomy outlook for oil demand, which suggests slowing consumption, and contradicts the more bullish forecasts from OPEC voiced the day before. IEA lowered the forecast of growth in oil demand by 100,000 barrels per day this year and in 2018, to about 1.5 million barrels per day in 2017 and up to 1.3 million barrels per day in 2018. The IEA said that warmer temperatures could reduce consumption, while a sharp increase in output outside the OPEC group of producers could mean that the global market will return to excess in the first half of 2018.

Most components of the DOW index finished the session in the red (16 of 30). Outsider were shares of General Electric Company (GE, -5.52%). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.54%).

Almost all sectors of the S & P index recorded a fall. The greatest decrease was shown by the sector of raw materials (-1.8%). Growth was recorded only by the utilities sector (+ 0.8%).

At closing:

DJIA -0.13% 23,409.54 -30.16

Nasdaq -0.29% 6,737.87 -19.72

S & P-0.23% 2.578.86 -5.98

-

20:00

DJIA -0.16% 23,402.90 -36.80 Nasdaq -0.37% 6,732.49 -25.11 S&P -0.26% 2,578.13 -6.71

-

17:00

European stocks closed: FTSE 100 -0.76 7414.42 -0.01% DAX -40.94 13033.48 -0.31% CAC 40 -26.05 5315.58 -0.49%

-

14:35

U.S. Stocks open: Dow -0.31%, Nasdaq -0.34%, S&P -0.36%

-

14:29

Before the bell: S&P futures -0.28%, NASDAQ futures -0.22%

U.S. stock-index futures were lower on Tuesday as investors continued to worry about Republican tax plans.

Global Stocks:

Nikkei 22,380.01 -0.98 0.00%

Hang Seng 29,152.12 -30.06 -0.10%

Shanghai 3,429.97 -17.87 -0.52%

S&P/ASX 5,968.75 -53.03 -0.88%

FTSE 7,425.27 +10.09 +0.14%

CAC 5,318.98 -22.65 -0.42%

DAX 13,042.65 -31.77 -0.24%

Crude $56.47 (-0.51%)

Gold $1,272.90 (-0.47%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

65.76

-0.08(-0.12%)

1502

Amazon.com Inc., NASDAQ

AMZN

1,133.64

4.47(0.40%)

13808

Apple Inc.

AAPL

173.8

-0.17(-0.10%)

53680

AT&T Inc

T

34.19

0.02(0.06%)

8748

Barrick Gold Corporation, NYSE

ABX

13.85

-0.10(-0.72%)

74226

Boeing Co

BA

262.64

0.22(0.08%)

3953

Caterpillar Inc

CAT

137.3

0.77(0.56%)

3068

Citigroup Inc., NYSE

C

71.7

-0.29(-0.40%)

8317

Facebook, Inc.

FB

178.6

-0.17(-0.10%)

15734

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.21

-0.22(-1.52%)

35298

General Electric Co

GE

18.95

-0.07(-0.37%)

797837

General Motors Company, NYSE

GM

43.56

-0.01(-0.02%)

460

Google Inc.

GOOG

1,025.25

-0.50(-0.05%)

702

Home Depot Inc

HD

165.7

0.35(0.21%)

245532

Intel Corp

INTC

45.6

-0.15(-0.33%)

2804

International Business Machines Co...

IBM

148.74

0.34(0.23%)

3086

JPMorgan Chase and Co

JPM

97.52

-0.34(-0.35%)

2435

McDonald's Corp

MCD

167.42

0.05(0.03%)

770

Merck & Co Inc

MRK

55.59

0.49(0.89%)

175

Microsoft Corp

MSFT

84

0.07(0.08%)

4657

Nike

NKE

55.93

0.02(0.04%)

1526

Pfizer Inc

PFE

35.29

-0.01(-0.03%)

3229

Tesla Motors, Inc., NASDAQ

TSLA

314.84

-0.56(-0.18%)

24070

The Coca-Cola Co

KO

46.91

0.19(0.41%)

40237

Twitter, Inc., NYSE

TWTR

20.2

0.03(0.15%)

13153

Wal-Mart Stores Inc

WMT

91.04

0.05(0.06%)

8003

Walt Disney Co

DIS

104.75

0.01(0.01%)

1444

-

13:39

Rating reiterations before the market open

Apple (AAPL) maintained at Outperform at RBC Capital Mkts; target $190

-

13:38

Downgrades before the market open

General Electric (GE) downgraded to Sector Perform at RBC Capital Mkts; target lowered to $20

-

13:37

Upgrades before the market open

Coca-Cola (KO) upgraded to Outperform from Market Perform at Wells Fargo

-

13:05

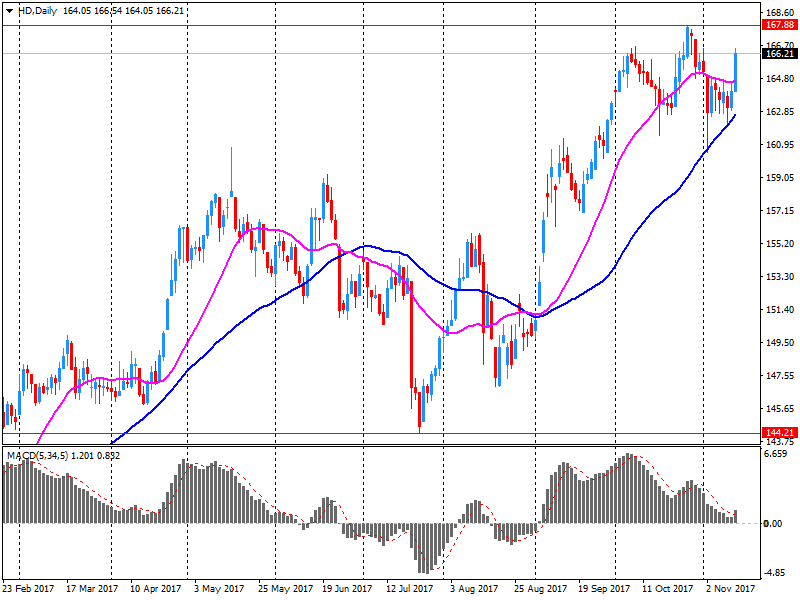

Company News: Home Depot (HD) quarterly results beat analysts’ expectations

Home Depot (HD) reported Q3 FY 2017 earnings of $1.84 per share (versus $1.60 in Q3 FY 2016), beating analysts' consensus estimate of $1.82.

The company's quarterly revenues amounted to $25.026 bln (+8.1% y/y), beating analysts' consensus estimate of $24.533 bln.

HD fell to $164.63 (-0.44%) in pre-market trading.

-

07:19

Eurostoxx 50 futures down 0.1 pct, DAX futures down 0.1 pct, CAC 40 futures up 0.1 pct, FTSE futures flat, IBEX futures down 0.2 pct

-

06:31

Global Stocks

European stocks on Monday closed lower for a fifth straight session, after French utility Electricite de France SA issued a profit warning, and on concerns about Brexit weighing on growth prospects for the eurozone. Markets also appeared rattled by uncertainty surrounding progress for a cut in U.S. taxes.

U.S. stocks closed marginally higher Monday after the Dow and the S&P 500 posted their first weekly drops in two months last week. Upside was capped, however, as uncertainty continued to swirl around the state of Republican tax-cut legislation while blue-chip General Electric Co. tumbled to a more-than-five-year low.

Global equity markets were lower in Asia on Tuesday, as a pullback in commodity shares dragged Australia's benchmark index lower, while tighter liquidity weighed on Chinese stocks. Commodity stocks have been key to the recent rebound for Australia's underperforming equities market, helping the S&P/ASX 200 XJO, -0.92% hit 10-year highs earlier this month, but profit-taking pressure has been building.

-