Market news

-

23:37

Stocks. Daily history for Nov 16’2017:

(index / closing price / change items /% change)

Nikkei +322.80 22351.12 +1.47%

TOPIX +17.70 1761.71 +1.01%

Hang Seng +167.07 29018.76 +0.58%

CSI 300 +31.34 4105.01 +0.77%

Euro Stoxx 50 +19.08 3564.80 +0.54%

FTSE 100 +14.33 7386.94 +0.19%

DAX +70.85 13047.22 +0.55%

CAC 40 +35.14 5336.39 +0.66%

DJIA +187.08 23458.36 +0.80%

S&P 500 +21.02 2585.64 +0.82%

NASDAQ +87.09 6793.29 +1.30%

S&P/TSX +56.89 15935.37 +0.36%

-

20:00

DJIA +0.85% 23,469.55 +198.27 Nasdaq +0.90% 6,798.55 +60.68 S&P +0.88% 2,587.31 +22.69

-

17:00

European stocks closed: FTSE 100 +14.33 7386.94 +0.19% DAX +70.85 13047.22 +0.55% CAC 40 +35.14 5336.39 +0.66%

-

15:58

DAX Daily Time Frame Chart

As we can see on daily chart, DAX has been correcting its price since it reached new highs at 13511.

On the previous day, we watched the rejection of the price in the support level (12892.6).

If that rejections confirms, then we might expect an appreciation of DAX until the last high or even a formation of a new higher high.

-

14:34

U.S. Stocks open: Dow +0.62%, Nasdaq +0.67%, S&P +0.47%

-

14:29

Before the bell: S&P futures +0.30%, NASDAQ futures +0.42%

U.S. stock-index futures were higher on Thursday, rebounding after two straight days of losses on the back of strong earnings from Cisco (CSCO) and Wal-Mart (WMT), while investors awaited a House vote on tax reform and analyzed another large batch of economic data

Global Stocks:

Nikkei 22,351.12 +322.80 +1.47%

Hang Seng 29,018.76 +167.07 +0.58%

Shanghai 3,399.86 -2.66 -0.08%

S&P/ASX 5,943.51 +9.28 +0.16%

FTSE 7,378.44 +5.83 +0.08%

CAC 5,334.90 +33.65 +0.63%

DAX 13,042.97 +66.60 +0.51%

Crude $55.21 (-0.22%)

Gold $1,279.50 (+0.14%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

42.6

0.39(0.92%)

17415

ALTRIA GROUP INC.

MO

65.78

0.52(0.80%)

205

Amazon.com Inc., NASDAQ

AMZN

1,131.50

4.81(0.43%)

24596

Apple Inc.

AAPL

170.7

1.62(0.96%)

289058

AT&T Inc

T

33.93

0.12(0.35%)

18846

Barrick Gold Corporation, NYSE

ABX

13.97

0.02(0.14%)

7750

Boeing Co

BA

264.2

1.34(0.51%)

1362

Caterpillar Inc

CAT

135

0.90(0.67%)

2186

Chevron Corp

CVX

115.01

-0.36(-0.31%)

21620

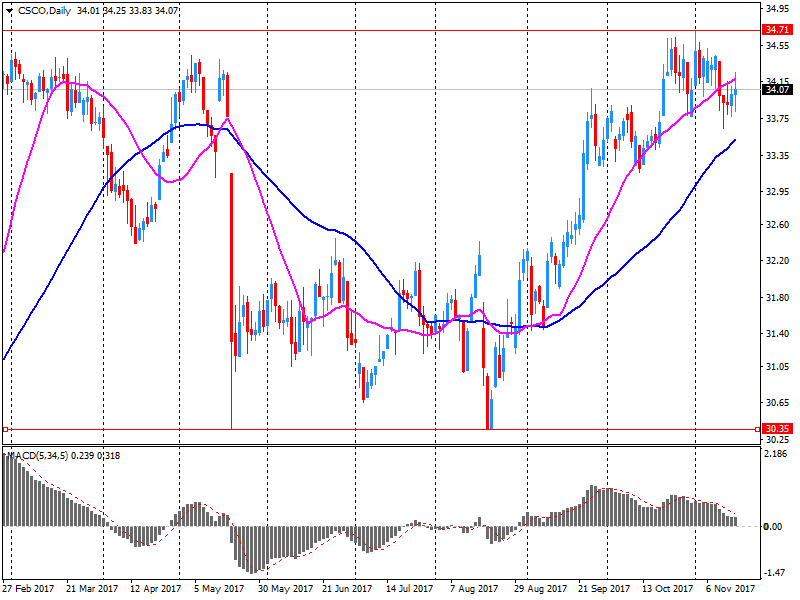

Cisco Systems Inc

CSCO

36.32

2.21(6.48%)

853289

Citigroup Inc., NYSE

C

72.24

0.51(0.71%)

29677

Deere & Company, NYSE

DE

132.68

0.41(0.31%)

200

Exxon Mobil Corp

XOM

80.88

-0.33(-0.41%)

6781

Facebook, Inc.

FB

179.25

1.30(0.73%)

61544

Ford Motor Co.

F

12.01

0.01(0.08%)

20530

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.8

0.17(1.25%)

22586

General Electric Co

GE

18.38

0.12(0.66%)

436517

Goldman Sachs

GS

238.75

1.14(0.48%)

446

Google Inc.

GOOG

1,024.35

3.44(0.34%)

3122

Home Depot Inc

HD

166.7

1.23(0.74%)

3394

HONEYWELL INTERNATIONAL INC.

HON

146.5

0.88(0.60%)

870

Intel Corp

INTC

45.66

0.20(0.44%)

31292

International Business Machines Co...

IBM

148.23

1.13(0.77%)

2531

Johnson & Johnson

JNJ

140.05

0.95(0.68%)

350

JPMorgan Chase and Co

JPM

98.95

0.76(0.77%)

9395

McDonald's Corp

MCD

168

0.68(0.41%)

515

Merck & Co Inc

MRK

54.97

0.17(0.31%)

771

Microsoft Corp

MSFT

83.34

0.36(0.43%)

54068

Pfizer Inc

PFE

35.33

-0.03(-0.08%)

264

Procter & Gamble Co

PG

89.55

1.32(1.50%)

20269

Starbucks Corporation, NASDAQ

SBUX

56.64

-0.06(-0.11%)

3388

Tesla Motors, Inc., NASDAQ

TSLA

314.6

3.30(1.06%)

52739

Twitter, Inc., NYSE

TWTR

20.07

0.16(0.80%)

10801

Verizon Communications Inc

VZ

44.3

0.19(0.43%)

7905

Visa

V

110.6

0.55(0.50%)

5388

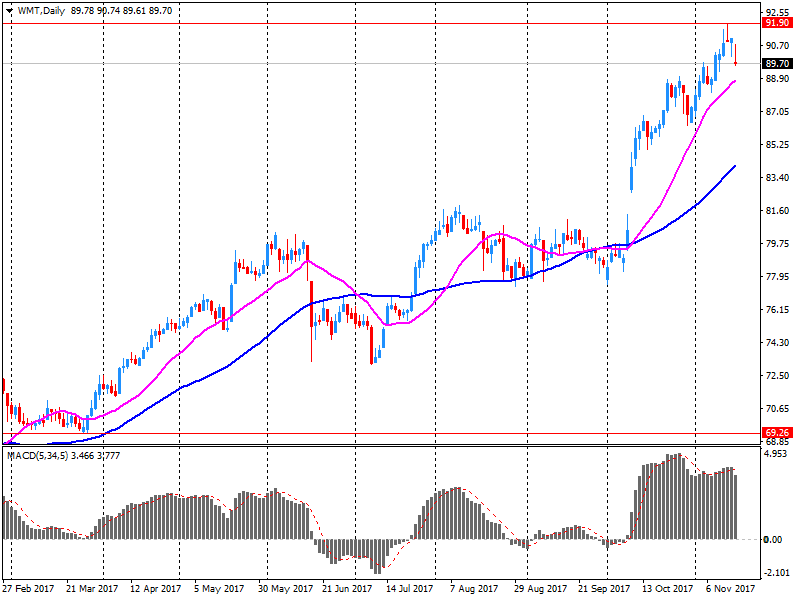

Wal-Mart Stores Inc

WMT

94.2

4.37(4.86%)

810593

Yandex N.V., NASDAQ

YNDX

31.32

0.08(0.26%)

6496

-

13:51

Target price changes before the market open

Cisco System (CSCO) target raised to $33 from $29 at Nomura; Neutral

Cisco System (CSCO) target raised to $39 from $33 at KeyBanc Capital Mkts; Overweight

Cisco System (CSCO) target raised to $40 from $37 at Jefferies; Buy

Cisco System (CSCO) target raised to $45 from $40 at Deutsche Bank; Buy

Cisco System (CSCO) target raised to 37 from $34 at Barclays; Overweight

Cisco System (CSCO) target raised to $40 from $36 at Oppenheimer; Outperform

Cisco System (CSCO) target raised to $40 from $36 at Citigroup; Buy

Cisco System (CSCO) target raised to $39 from $37 at UBS; Buy

Exxon Mobil (XOM) target lowered to $85 at RBC Capital Mkts

-

13:23

Company News: Cisco Systems (CSCO) quarterly earnings beat analysts’ estimate

Cisco Systems (CSCO) reported Q1 FY 2018 earnings of $0.61 per share (versus $0.61 in Q1 FY 2017), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $12.136 bln (-1.7% y/y), generally in-line with analysts' consensus estimate of $12.111 bln.

The company also issued upside guidance for Q2 FY2018, projecting EPS of $0.58-0.60 (versus analysts' consensus estimate of $0.58) and revenues of ~$11.70-11.93 bln (+1-3%; versus analysts' consensus estimate of $11.69 bln).

CSCO rose to $36.24 (+6.24%) in pre-market trading.

-

13:10

Company News: Wal-Mart (WMT) quarterly results beat analysts’ expectations

Wal-Mart (WMT) reported Q3 FY 2018 earnings of $1.00 per share (versus $0.98 in Q3 FY 2017), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $122.236 bln (+4.2% y/y), beating analysts' consensus estimate of $120.233 bln.

The company also issued upside guidance for FY2018, projecting EPS of $4.38-4.46 (up from $4.30-4.40) versus analysts' consensus estimate of $4.38.

WMT rose to $94.27 (+4.94%) in pre-market trading.

-

08:42

Major European stock exchanges trading mostly in the green zone: FTSE 7372.60 -0.01 0%, DAX 13038.79 +62.42 + 0.48%, CAC 5320.07 +18.82 + 0.36%

-

06:32

Global Stocks

European stocks closed lower on Wednesday, as strength in the euro and a drop in commodity shares drew the regional benchmark near a two-month low. Equities in Europe fell alongside a slide for U.S. stocks, pulled lower in part by jitters over the prospects of success for the U.S. tax overhaul in Washington.

U.S. stocks closed lower Wednesday, with both the Dow and the S&P 500 suffering their biggest one-day percentage drops since September as falling oil prices and worries over the progress of a U.S. tax overhaul left investors increasingly averse to putting more money into assets seen as risky.

Global stock markets stabilized somewhat in Asia on Thursday, following broad weakness since the end of last week, with shares in Japan gaining after six straight sessions in the red. The Nikkei Stock Average NIK, +1.23% was up 0.8%, recovering from Wednesday's 1.6% decline, though the index was still off 3.5% since closing at a 25-year high on Tuesday last week.

-