Market news

-

22:27

Stocks. Daily history for Oct 19’2017:

(index / closing price / change items /% change)

Nikkei +85.47 21448.52 +0.40%

TOPIX +5.40 1730.04 +0.31%

Hang Seng -552.67 28159.09 -1.92%

CSI 300 -12.91 3931.25 -0.33%

Euro Stoxx 50 -17.57 3602.08 -0.49%

FTSE 100 -19.83 7523.04 -0.26%

DAX -52.93 12990.10 -0.41%

CAC 40 -15.52 5368.29 -0.29%

DJIA +5.44 23163.04 +0.02%

S&P 500 +0.84 2562.10 +0.03%

NASDAQ -19.15 6605.07 -0.29%

S&P/TSX +35.84 15818.00 +0.23%

-

20:09

The major US stock indexes finished trading in different directions

Major US stock indexes completed the trading session without a single dynamic against the backdrop of the fall in Apple shares and a number of weak corporate results.

A certain influence on the course of trading was provided by the US data. The Ministry of Labor reported that the number of Americans applying for unemployment benefits fell to its lowest level for more than 44 years in the past week, indicating a rebound in employment growth after the decline associated with a decline in employment in September. Primary claims for unemployment benefits fell by 22,000 to 222,000, seasonally adjusted for the week to October 4, the lowest level since March 1973. Data for the previous week were revised, and showed 1000 more initial hits than previously reported.

At the same time, the report submitted by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the production sector increased in October, reaching a level of 27.9 points compared to 23.8 points in September. Economists had expected a decline to 22 points.

In addition, the index of leading indicators from the Conference Board for the US fell by 0.2 percent in September to 128.6, after an increase of 0.4 percent in August and 0.3 percent in July. "The index fell for the first time in the past 12 months, partly as a result of the temporary impact of hurricanes," said Ataman Ozildirim, director of business cycles at the Conference Board. - The source of weakness was focused on the labor market, while most of the components of the index continued to make a positive contribution. Despite the decline in September, the long-term trend of LEI remains in line with the continued steady growth of the US economy in the second half of the year. "

Most components of the DOW index finished trading in positive territory (20 out of 30). The leader of growth was the shares of The Travelers Companies, Inc. (TRV, + 2.28%). Outsider were the shares of Apple Inc. (AAPL, -2.60%).

Most sectors of the S & P index recorded a decline. The largest decrease was in consumer goods (-1.3%). The utilities sector grew most (+ 0.7%).

At closing:

DJIA + 0.04% 23,166.69 +9.09

Nasdaq -0.29% 6,605.07 -19.15

S & P + 0.03% 2.562.11 + 0.85

-

19:00

DJIA -0.05% 23,144.92 -12.68 Nasdaq -0.43% 6,595.90 -28.32 S&P -0.05% 2,559.9 -1.35

-

16:00

European stocks closed: FTSE 100 -19.83 7523.04 -0.26% DAX -52.93 12990.10 -0.41% CAC 40 -15.52 5368.29 -0.29%

-

13:31

U.S. Stocks open: Dow -0.24%, Nasdaq -0.62%, S&P -0.37%

-

13:21

Before the bell: S&P futures -0.44%, NASDAQ futures -0.61%

U.S. stock-index futures signaled that equities would retreat from their freshly minted record highs at today's opening bell.

Global Stocks:

Nikkei 21,448.52 +85.47 +0.40%

Hang Seng 28,159.09 -552.67 -1.92%

Shanghai 3,370.10 -11.70 -0.35%

S&P/ASX 5,896.13 +5.65 +0.10%

FTSE 7,500.33 -42.54 -0.56%

CAC 5,347.25 -36.56 -0.68%

DAX 12,938.63 -104.40 -0.80%

Crude $51.25 (-1.52%)

Gold $1,287.30 (+0.34%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

46.25

-1.50(-3.14%)

5806

ALTRIA GROUP INC.

MO

64.1

-0.71(-1.10%)

40703

Amazon.com Inc., NASDAQ

AMZN

989

-8.00(-0.80%)

19466

American Express Co

AXP

89.54

-2.54(-2.76%)

29442

Apple Inc.

AAPL

157.15

-2.61(-1.63%)

484349

AT&T Inc

T

35.87

0.16(0.45%)

137912

Barrick Gold Corporation, NYSE

ABX

16.28

0.11(0.68%)

86486

Boeing Co

BA

257.1

-2.94(-1.13%)

11634

Caterpillar Inc

CAT

130.02

-1.27(-0.97%)

5126

Chevron Corp

CVX

117.6

-0.55(-0.47%)

3554

Cisco Systems Inc

CSCO

33.47

-0.08(-0.24%)

4398

Citigroup Inc., NYSE

C

72.44

-0.68(-0.93%)

33989

Deere & Company, NYSE

DE

129.33

0.61(0.47%)

100

Exxon Mobil Corp

XOM

82.48

-0.28(-0.34%)

3159

Facebook, Inc.

FB

174.65

-1.38(-0.78%)

97961

Ford Motor Co.

F

12.12

-0.07(-0.57%)

8995

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.7

-0.13(-0.88%)

25959

General Electric Co

GE

23.03

-0.09(-0.39%)

76848

General Motors Company, NYSE

GM

44.8

-0.32(-0.71%)

13269

Goldman Sachs

GS

239.41

-2.62(-1.08%)

6609

Google Inc.

GOOG

984

-8.81(-0.89%)

3050

Hewlett-Packard Co.

HPQ

21.65

-0.07(-0.32%)

2030

Home Depot Inc

HD

162.7

-0.75(-0.46%)

3732

Intel Corp

INTC

39.85

-0.40(-0.99%)

45004

International Business Machines Co...

IBM

159

-0.53(-0.33%)

58797

JPMorgan Chase and Co

JPM

97.23

-0.76(-0.78%)

29356

McDonald's Corp

MCD

165.3

-0.47(-0.28%)

1836

Merck & Co Inc

MRK

63.16

-0.35(-0.55%)

3595

Microsoft Corp

MSFT

77.28

-0.33(-0.43%)

39106

Nike

NKE

51.4

-0.90(-1.72%)

47074

Pfizer Inc

PFE

35.73

-0.10(-0.28%)

5286

Procter & Gamble Co

PG

91.7

-0.38(-0.41%)

6456

Starbucks Corporation, NASDAQ

SBUX

54.95

-0.26(-0.47%)

3372

Tesla Motors, Inc., NASDAQ

TSLA

355.61

-4.04(-1.12%)

59504

The Coca-Cola Co

KO

46.24

-0.16(-0.34%)

2042

Travelers Companies Inc

TRV

129.99

-0.03(-0.02%)

4045

Twitter, Inc., NYSE

TWTR

17.88

-0.14(-0.78%)

18278

United Technologies Corp

UTX

119.14

-0.04(-0.03%)

1843

UnitedHealth Group Inc

UNH

204.09

-1.14(-0.56%)

330

Verizon Communications Inc

VZ

49.65

1.00(2.06%)

243891

Visa

V

107.31

-0.49(-0.45%)

10407

Wal-Mart Stores Inc

WMT

86

-0.22(-0.26%)

7125

Walt Disney Co

DIS

98

-0.25(-0.25%)

3845

Yandex N.V., NASDAQ

YNDX

32.1

-0.22(-0.68%)

100

-

12:49

Rating reiterations before the market open

Facebook (FB) reiterated with a Buy at Stifel; target $200

-

12:48

Downgrades before the market open

NIKE (NKE) downgraded to Neutral from Buy at Goldman

-

12:25

Company News: Verizon (VZ) quarterly earnings beat analysts’ forecast

Verizon (VZ) reported Q3 FY 2017 earnings of $0.98 per share (versus $1.01 in Q3 FY 2016), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $31.700 bln (+2.5% y/y), generally in-line with analysts' consensus estimate of $31.446 bln.

VZ rose to $49.70 (+2.16%) in pre-market trading.

-

12:19

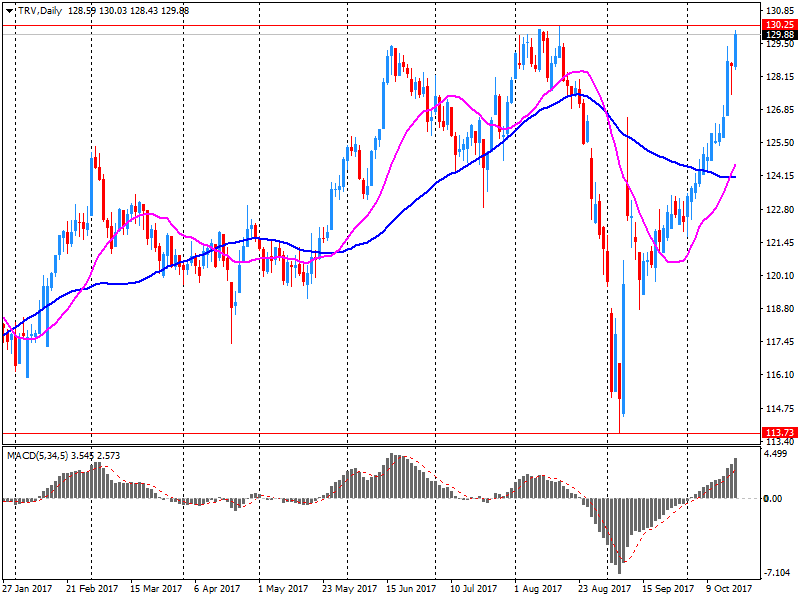

Company News: Travelers (TRV) quarterly results beat analysts’ estimates

Travelers (TRV) reported Q3 FY 2017 earnings of $0.91 per share (versus $2.40 in Q3 FY 2016), beating analysts' consensus estimate of $0.37.

The company's quarterly revenues amounted to $6.660 bln (+4.2% y/y), beating analysts' consensus estimate of $6.426 bln.

TRV rose to $132.20 (+1.68%) in pre-market trading.

-

12:13

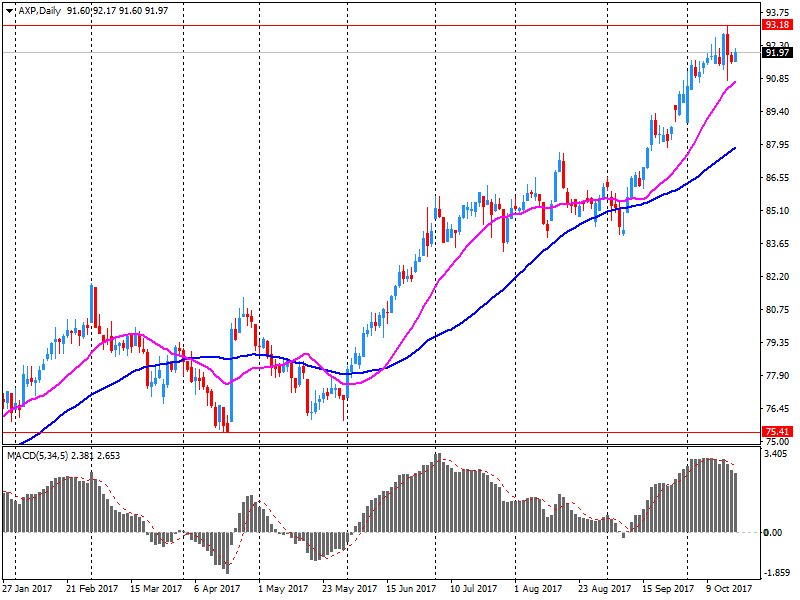

Company News: American Express (AXP) quarterly results beat analysts’ expectations

American Express (AXP) reported Q3 FY 2017 earnings of $1.50 per share (versus $1.24 in Q3 FY 2016), beating analysts' consensus estimate of $1.48.

The company's quarterly revenues amounted to $8.436 bln (+8.5% y/y), beating analysts' consensus estimate of $8.307 bln.

The company also issued upside guidance for FY2017, projecting EPS of $5.80-5.90 (prior $5.60-5.80), versus analysts' consensus estimate of $5.74.

AXP fell to $90.10 (-2.15%) in pre-market trading.

-

12:02

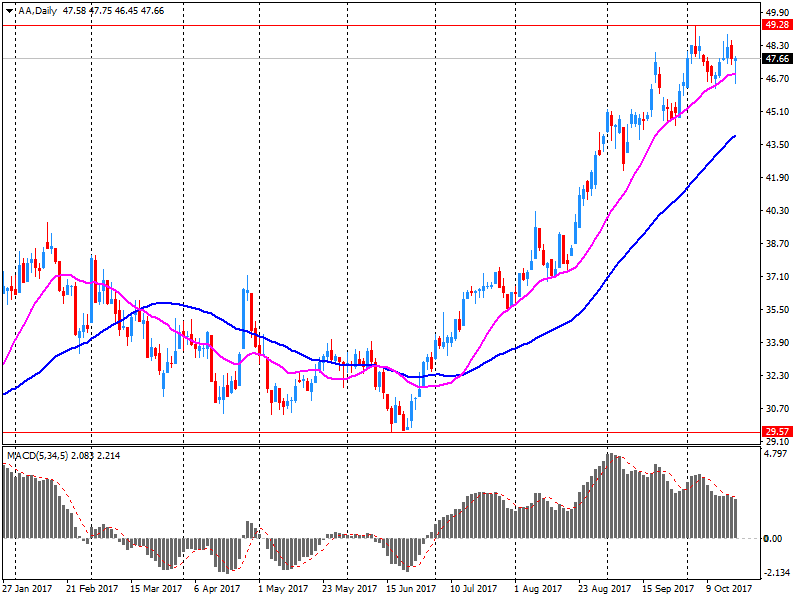

Company News: Alcoa (AA) quarterly earnings miss analysts’ estimate

Alcoa (AA) reported Q3 FY 2017 earnings of $0.72 per share (versus $0.32 in Q3 FY 2016), missing analysts' consensus estimate of $0.77.

The company's quarterly revenues amounted to $2.964 bln (+27.3% y/y), generally in-line with analysts' consensus estimate of $2.946 bln.

AA fell to $46.40 (-2.83%) in pre-market trading.

-

08:03

Spain's IBEX falls sharply, now down 0.4 pct after catalan leader fails to clarify independence bid

-

07:47

Major stock exchanges in Europe trading in the red zone: FTSE 7526.41 -16.46 -0.22%, DAX 13038.03 -5.00 -0.04%, CAC 5374.66 -9.15 -0.17%

-

06:29

Eurostoxx 50 futures up 0.1 pct, DAX futures up 0.1 pct, CAC 40 futures down 0.1 pct, FTSE futures down 0.1 pct

-

05:41

Global Stocks

European stocks finished with gains Wednesday, as falls in the euro and the pound helped exporters and offset disappointing financial updates from companies such as Zalando. Where indexes are trading: The Stoxx Europe 600 index SXXP, +0.29% posted a 0.3% rise to end at 391.56. On Tuesday, the pan-European benchmark fell 0.3%.

The Dow Jones Industrial Average punched firmly higher on Wednesday to a historic close above 23,000. It took 54 trading days for the gauge to close above the next round-number milestone, representing the third fastest 1,000-point advance in history. However, the record-setting climb for the more than 120-year old stock-market average might hint at some softness.

Asian stocks inched up to near decade highs on Thursday, continuing to ride on a global equities rally, while the dollar resumed its rise on the back of a spike in U.S. yields.

-