Market news

-

22:34

Stocks. Daily history for Oct 25’2017:

(index / closing price / change items /% change)

Nikkei -97.55 21707.62 -0.45%

TOPIX -5.49 1751.43 -0.31%

Hang Seng +147.92 28302.89 +0.53%

CSI 300 +17.55 3976.95 +0.44%

Euro Stoxx 50 -19.23 3591.46 -0.53%

FTSE 100 -79.33 7447.21 -1.05%

DAX -59.78 12953.41 -0.46%

CAC 40 -19.91 5374.89 -0.37%

DJIA -112.30 23329.46 -0.48%

S&P 500 -11.98 2557.15 -0.47%

NASDAQ -34.54 6563.89 -0.52%

S&P/TSX -50.37 15854.77 -0.32%

-

20:10

The main US stock indexes finished trading in negative territory

Major US stock indices moderately declined on Wednesday after the last quarterly reports of companies, including AT & T and Boeing, did not impress investors.

According to the published report, AT & T (T)'s profit for the third quarter of 2017 fiscal year (FY) reached $ 0.74 per share (versus $ 0.74 in the third quarter of 2016 FY), which was below the average forecast of analysts at $ 0.75. Quarterly revenue of the company was 39.668 billion (-3.0% y / y), while the average forecast of analysts was $ 40.335 billion.

Meanwhile, the profit of Boeing (BA) for the third quarter of 2017 FY reached $ 2.72 per share (versus $ 3.51 in the third quarter of 2016 FY), which was above the average forecast of analysts at $ 2.66. Quarterly revenue of the company was $ 24.309 billion (+ 1.7% y / y), while the average forecast of analysts was $ 24.090 billion.

In addition, as it became known, orders for durable goods grew by 2.2% in September, ahead of growth forecasts of 1.1%. With the exception of transport, orders increased by 0.7%. Investments in the business grew by 1.3% for the third month in a row, based on a closely related measure known as basic orders for capital goods. Last year, these orders grew by 7.8%.

The sales of newly built houses grew at the highest rates during the decade in September, as reliable demand supported the builders. Sales of new buildings rose to 667,000 per annum, the Ministry of Commerce reported. This is 18.9% more than in August, and 17% more than a year ago. Economists predicted 555,000 annual rates. According to the government, sales were restored after the August hurricanes. They were strong in every region, including in the south, which was destroyed by hurricanes.

Most components of the DOW index finished trading in the red (23 of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 2.78%). Outsider were shares of The Boeing Company (BA, -3.32%).

All sectors of the S & P index recorded a decline. The largest decline was shown by the sector of conglomerates (-1.8%).

At closing:

DJIA -0.48% 23,329.46 -112.30

Nasdaq -0.52% 6,563.89 -34.54

S & P -0.47% 2.557.15 -11.98

-

19:00

DJIA -0.51% 23,322.51 -119.25 Nasdaq -0.63% 6,557.17 -41.26 S&P -0.53% 2,555.51 -13.62

-

16:00

European stocks closed: FTSE 100 -79.33 7447.21 -1.05% DAX -59.78 12953.41 -0.46% CAC 40 -19.91 5374.89 -0.37%

-

13:33

U.S. Stocks open: Dow +0.02%, Nasdaq -0.06%, S&P -0.08%

-

13:29

Before the bell: S&P futures -0.17%, NASDAQ futures -0.23%

U.S. stock-index futures fell as investors assessed latest batch of corporate earnings.

Global Stocks:

Nikkei 21,707.62 -97.55 -0.45%

Hang Seng 28,302.89 +147.92 +0.53%

Shanghai 3,398.30 +10.06 +0.30%

S&P/ASX 5,905.60 +7.98 +0.14%

FTSE 7,488.40 -38.14 -0.51%

CAC 5,403.90 +9.10 +0.17%

DAX 3,007.75 -5.44 -0.04%

Crude $52.22 (-0.48%)

Gold $1,273.20 (-0.40%)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

234.45

-0.20(-0.09%)

1768

ALCOA INC.

AA

50

-0.08(-0.16%)

436

Amazon.com Inc., NASDAQ

AMZN

976.67

0.77(0.08%)

9332

Apple Inc.

AAPL

157.27

0.17(0.11%)

41215

AT&T Inc

T

34.26

-0.60(-1.72%)

1959606

Barrick Gold Corporation, NYSE

ABX

15.81

-0.04(-0.25%)

188488

Boeing Co

BA

264.93

-1.07(-0.40%)

118633

Caterpillar Inc

CAT

137.99

-0.25(-0.18%)

5713

Cisco Systems Inc

CSCO

34.74

0.16(0.46%)

26554

Citigroup Inc., NYSE

C

74.71

0.47(0.63%)

35917

Facebook, Inc.

FB

171.65

-0.15(-0.09%)

36069

Ford Motor Co.

F

12.17

-0.02(-0.16%)

26918

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.58

0.35(2.30%)

334624

General Electric Co

GE

21.81

-0.08(-0.37%)

169958

General Motors Company, NYSE

GM

45.8

-0.68(-1.46%)

143149

Goldman Sachs

GS

246.5

1.66(0.68%)

6290

Google Inc.

GOOG

970.55

0.01(0.00%)

549

Hewlett-Packard Co.

HPQ

21.75

-0.20(-0.91%)

208

Home Depot Inc

HD

166.1

0.07(0.04%)

1331

Intel Corp

INTC

41.03

0.08(0.20%)

22971

International Paper Company

IP

59.07

0.40(0.68%)

4004

Johnson & Johnson

JNJ

141.5

-0.14(-0.10%)

943

JPMorgan Chase and Co

JPM

101.7

0.78(0.77%)

31730

McDonald's Corp

MCD

163.8

-0.08(-0.05%)

2985

Microsoft Corp

MSFT

78.7

-0.16(-0.20%)

15069

Nike

NKE

53.67

0.25(0.47%)

1053

Pfizer Inc

PFE

36.15

-0.12(-0.33%)

1167

Procter & Gamble Co

PG

86.86

-0.12(-0.14%)

2141

Starbucks Corporation, NASDAQ

SBUX

54.09

-0.19(-0.35%)

2895

Tesla Motors, Inc., NASDAQ

TSLA

336.85

-0.49(-0.15%)

1510065

The Coca-Cola Co

KO

46.2

0.02(0.04%)

11773

Twitter, Inc., NYSE

TWTR

17.35

0.10(0.58%)

15093

Verizon Communications Inc

VZ

48.53

-0.41(-0.84%)

4825

Visa

V

109.4

0.99(0.91%)

194730

Wal-Mart Stores Inc

WMT

88

0.02(0.02%)

3719

Yandex N.V., NASDAQ

YNDX

32.56

-0.26(-0.79%)

1648

-

12:58

Analyst coverage initiations before the market open

Apple (AAPL) initiated with a Buy at HSBC Securities; target $193

-

12:57

Target price changes before the market open

United Tech (UTX) target raised to $124 at Stifel

Caterpillar (CAT) target raised to $145 from $125 at Stifel

Caterpillar (CAT) target raised to $143 from $120 at RBC Capital Mkts

3M Co. (MMM) target raised to $244 from $220 at Stifel

3M Co. target (MMM) raised to $209 at RBC Capital Mkts

General Motors (GM) target raised to $316 from $327 at RBC Capital Mkts

-

12:56

Downgrades before the market open

General Motors (GM) downgraded to Equal-Weight from Overweight at Morgan Stanley

-

12:55

Upgrades before the market open

3M Co. (MMM) upgraded to Neutral from Sell at Goldman; target raised to $229 from $194

-

12:40

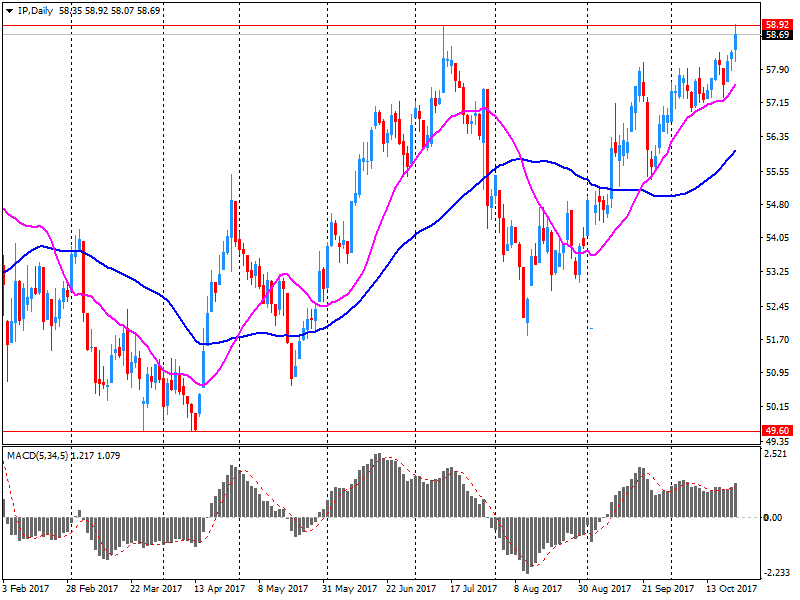

Company News: Int'l Paper (IP) quarterly earnings beat analysts’ estimate

Int'l Paper (IP) reported Q3 FY 2017 earnings of $1.08 per share (versus $0.91 in Q3 FY 2016), beating analysts' consensus estimate of $1.05.

The company's quarterly revenues amounted to $5.913 bln (+12.3% y/y), generally in-line with analysts' consensus estimate of $5.854 bln.

IP traded at $58.67 (0.00%) in pre-market trading.

-

12:36

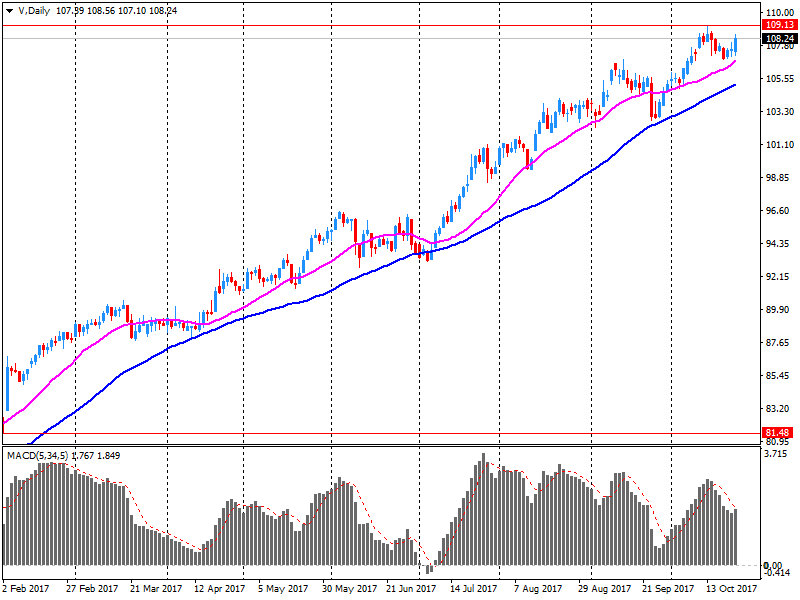

Company News: Visa (V) quarterly results beat analysts’ forecasts

Visa (V) reported Q4 FY 2017 earnings of $0.90 per share (versus $0.78 in Q4 FY 2016), beating analysts' consensus estimate of $0.85.

The company's quarterly revenues amounted to $4.855 bln (+13.9% y/y), beating analysts' consensus estimate of $4.630 bln.

V rose to $109.25 (+0.77%) in pre-market trading.

-

12:22

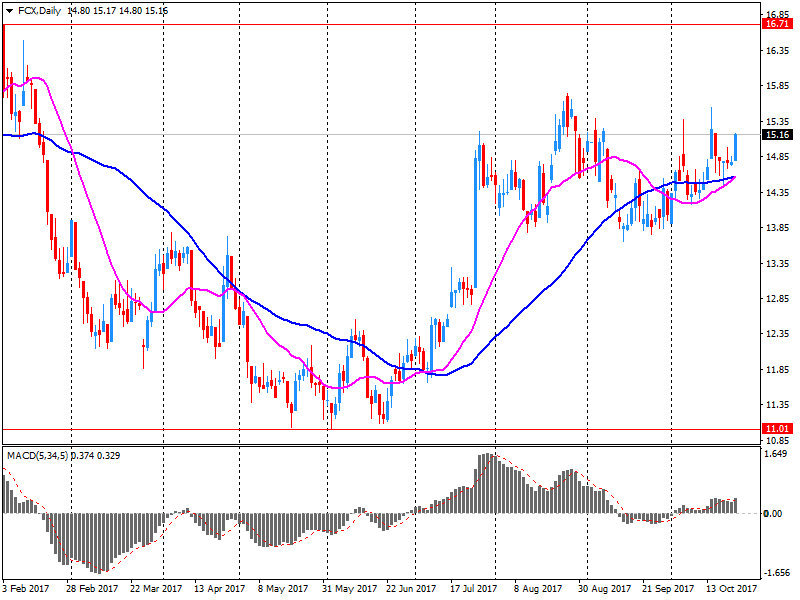

Company News: Freeport-McMoRan (FCX) quarterly results beat analysts’ estimate

Freeport-McMoRan (FCX) reported Q3 FY 2017 earnings of $0.34 per share (versus $0.13 in Q3 FY 2016), beating analysts' consensus estimate of $0.31.

The company's quarterly revenues amounted to $4.310 bln (+11.2% y/y), beating analysts' consensus estimate of $4.056 bln.

FCX rose to $15.58 (+2.30%) in pre-market trading.

-

12:15

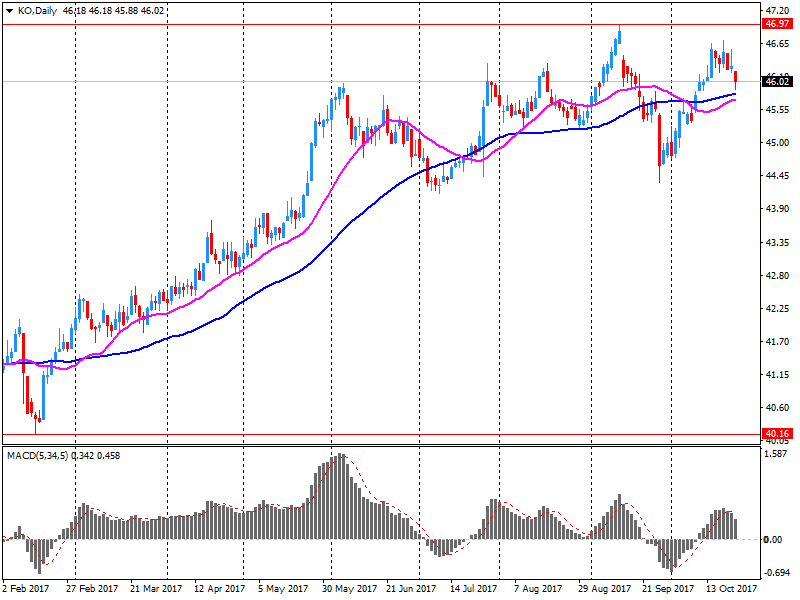

Company News: Coca-Cola (KO) quarterly results beat analysts’ expectations

Coca-Cola (KO) reported Q3 FY 2017 earnings of $0.50 per share (versus $0.49 in Q3 FY 2016), beating analysts' consensus estimate of $0.49.

The company's quarterly revenues amounted to $9.078 bln (-14.6% y/y), beating analysts' consensus estimate of $8.727 bln.

KO fell to $45.98 (-0.43%) in pre-market trading.

-

12:08

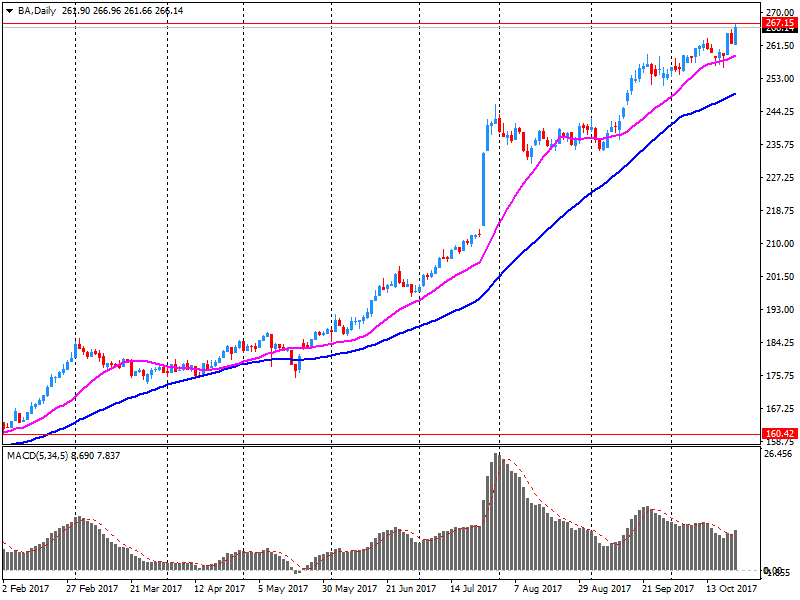

Company News: Boeing (BA) quarterly earnings beat analysts’ forecasts

Boeing (BA) reported Q3 FY 2017 earnings of $2.72 per share (versus $3.51 in Q3 FY 2016), beating analysts' consensus estimate of $2.66.

The company's quarterly revenues amounted to $24.309 bln (+1.7% y/y), generally in-line with analysts' consensus estimate of $24.090 bln.

The company also issued raised guidance for FY2017 EPS of $9.90-10.10 (up from prior $9.80-10.00) versus analysts' consensus estimate of $10.03.

BA fell to $264.00 (-0.75%) in pre-market trading.

-

12:07

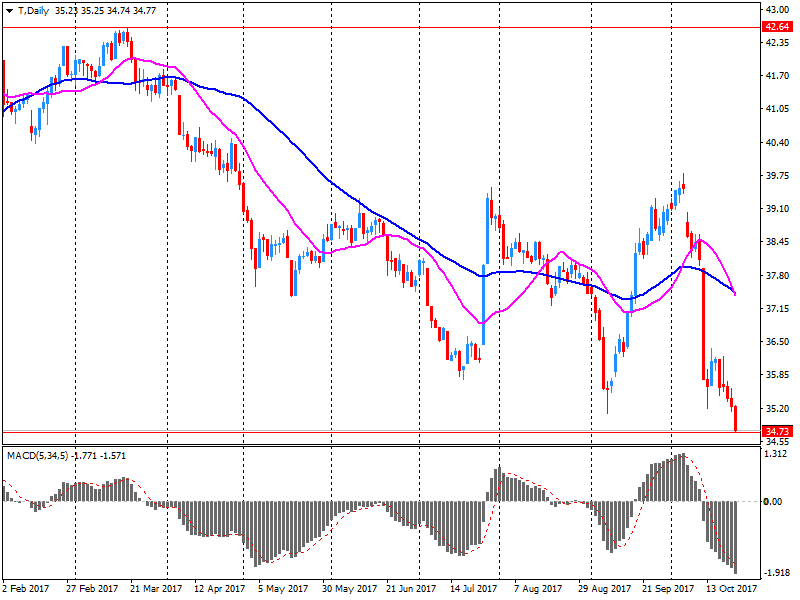

Company News: AT&T (T) quarterly results miss analysts’ estimates

AT&T (T) reported Q3 FY 2017 earnings of $0.74 per share (versus $0.74 in Q3 FY 2016), missing analysts' consensus estimate of $0.75.

The company's quarterly revenues amounted to $39.668 bln (-3.0% y/y), missing analysts' consensus estimate of $40.335 bln.

T fell to $34.12 (-2.12%) in pre-market trading.

-

06:45

Eurostoxx 50 futures down 0.2 pct, DAX futures down 0.2 pct, CAC 40 futures flat, FTSE futures down 0.3 pct, IBEX futures down 0.3 pct

-

05:27

Global Stocks

A pan-European stock benchmark closed lower Tuesday after two days of gains, weighed down by earnings-driven drops for Swedish miner Boliden AB and hospitality chain Whitbread PLC. National equity gauges for Europe's biggest economies edged higher, as data showed a slowing in the eurozone economy ahead of a closely watched European Central Bank meeting later in the week.

U.S. stocks closed higher on Tuesday, with the Dow ending in record territory, supported by earnings results that continued to come in ahead of expectations. Both Caterpillar and 3M boosted the blue-chip average's advance, while broader gains were limited by declines in health-care shares.

Major indexes in Asia were narrowly mixed on Wednesday, following Wall Street's stronger lead, as investors also awaited the unveiling of China's new leadership line-up. The Nikkei 225 rose 0.17 percent as the dollar held onto overnight gains. The benchmark index is rising high after notching its 16th straight winning session on Tuesday - its longest ever win streak.

-