Market news

-

22:31

Stocks. Daily history for Oct 26’2017:

(index / closing price / change items /% change)

Nikkei +32.16 21739.78 +0.15%

TOPIX +2.47 1753.90 +0.14%

Hang Seng -100.51 28202.38 -0.36%

CSI 300 +16.63 3993.58 +0.42%

Euro Stoxx 50 +45.74 3637.20 +1.27%

FTSE 100 +39.29 7486.50 +0.53%

DAX +179.87 13133.28 +1.39%

CAC 40 +80.51 5455.40 +1.50%

DJIA +71.40 23400.86 +0.31%

S&P 500 +3.25 2560.40 +0.13%

NASDAQ -7.12 6556.77 -0.11%

S&P/TSX +36.86 15891.63 +0.23%

-

20:18

The main US stock indexes finished trading mostly in positive territory

The main US stock indexes mainly increased, as the rise in the price of shares in the consumer goods and technology sector made it possible to compensate for the collapse of the shares in the health sector.

The focus was also on the United States. As it became known, the number of Americans applying for unemployment benefits last week increased less than expected, indicating that the labor market continues to toughen after recent hurricane-related disruptions. Initial applications for unemployment benefits increased by 10,000 to 233,000, seasonally adjusted for the week to October 21, the Ministry of Labor said. The latter value was the lowest since March 1973. The four-week moving average of primary hits fell 9,000 to 239,500 last week.

At the same time, the number of contracts for the purchase of housing on the secondary market did not change in September, while activity in annual terms decreased for the fifth time in the last six months, as demand for real estate still exceeded supply. The National Association of Realtors said its forecast domestic sales index, based on contracts signed last month, remained at 106.0. The August index was revised to -2.8 percent from -2.6 percent. Economists predicted that unfinished transactions for the sale of housing last month increased by 0.2 percent.

Most components of the DOW index finished trading in positive territory (24 out of 30). Leader of the growth were shares of NIKE, Inc. (NKE, + 3.31%). Outsider were shares of 3M Company (MMM, -2.02%).

Most sectors of the S & P index recorded an increase. The consumer goods sector grew most (+ 0.7%). The health sector showed the greatest decline (-1.0%).

At closing:

DJIA + 0.31% 23,400.86 +71.40

Nasdaq -0.11% 6,556.77 -7.12

S & P + 0.13% 2.560.40 +3.25

-

19:00

DJIA +0.36% 23,412.45 +82.99 Nasdaq +0.02% 6,565.44 +1.55 S&P +0.18% 2,561.83 +4.68

-

16:01

European stocks closed: FTSE 100 +39.29 7486.50 +0.53% DAX +179.87 13133.28 +1.39% CAC 40 +80.51 5455.40 +1.50%

-

13:33

U.S. Stocks open: Dow +0.43%, Nasdaq -0.05%, S&P +0.23%

-

13:25

Before the bell: S&P futures +0.10%, NASDAQ futures -0.07%

U.S. stock-index futures were little changed on Thursday amid a batch of corporate earnings and ongoing speculation about the Federal Reserve's next chair.

Global Stocks:

Nikkei 21,739.78 +32.16 +0.15%

Hang Seng 28,202.38 -100.51 -0.36%

Shanghai 3,408.24 +11.35 +0.33%

S&P/ASX 5,916.30 +10.70 +0.18%

FTSE 7,482.62 +35.41 +0.48%

CAC 5,419.20 +44.31 +0.82%

DAX 13,030.96 +77.55 +0.60%

Crude $52.22 (+0.08%)

Gold $1,276.20 (-0.22%)

-

12:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

238

0.32(0.13%)

887

ALCOA INC.

AA

50

0.48(0.97%)

126

ALTRIA GROUP INC.

MO

63.35

-0.44(-0.69%)

13853

Amazon.com Inc., NASDAQ

AMZN

979.11

6.20(0.64%)

17812

Apple Inc.

AAPL

157.2

0.79(0.51%)

134639

AT&T Inc

T

33.7

0.21(0.63%)

122337

Barrick Gold Corporation, NYSE

ABX

15.51

-0.24(-1.52%)

98487

Boeing Co

BA

259.95

1.53(0.59%)

6361

Caterpillar Inc

CAT

138

1.16(0.85%)

652

Cisco Systems Inc

CSCO

34.37

0.07(0.20%)

26225

Citigroup Inc., NYSE

C

73.8

0.18(0.24%)

5613

Facebook, Inc.

FB

171.48

0.88(0.52%)

39123

Ford Motor Co.

F

12.29

0.25(2.08%)

595604

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.74

0.04(0.27%)

16397

General Electric Co

GE

21.54

0.04(0.19%)

103674

General Motors Company, NYSE

GM

45.22

0.10(0.22%)

14257

Goldman Sachs

GS

242.52

0.81(0.34%)

1280

Google Inc.

GOOG

980.2

6.87(0.71%)

8092

Intel Corp

INTC

40.95

0.17(0.42%)

19444

International Business Machines Co...

IBM

154.1

0.60(0.39%)

6262

Johnson & Johnson

JNJ

142.3

-0.06(-0.04%)

1972

JPMorgan Chase and Co

JPM

101.25

0.23(0.23%)

5422

McDonald's Corp

MCD

164.49

0.91(0.56%)

548

Microsoft Corp

MSFT

78.93

0.30(0.38%)

75819

Nike

NKE

54.8

-0.14(-0.25%)

11908

Pfizer Inc

PFE

36.23

0.07(0.19%)

134858

Procter & Gamble Co

PG

86.6

-0.26(-0.30%)

1947

Starbucks Corporation, NASDAQ

SBUX

54.52

0.36(0.66%)

13268

Tesla Motors, Inc., NASDAQ

TSLA

328.2

2.36(0.72%)

24948

The Coca-Cola Co

KO

46.15

0.10(0.22%)

2505

Twitter, Inc., NYSE

TWTR

19.07

1.93(11.26%)

5771861

Verizon Communications Inc

VZ

49.01

0.37(0.76%)

1268

Visa

V

110.38

0.89(0.81%)

5406

Wal-Mart Stores Inc

WMT

88.4

-0.08(-0.09%)

2467

-

12:38

Downgrades before the market open

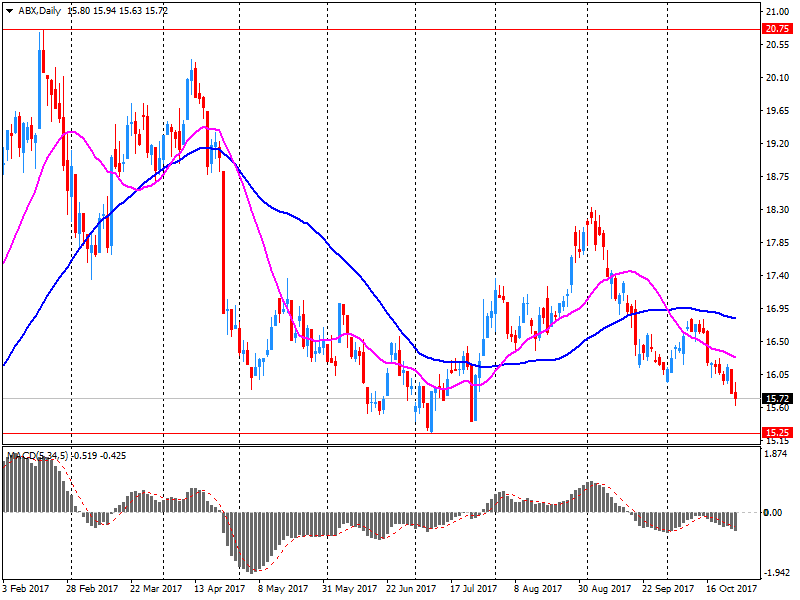

Barrick Gold (ABX) downgraded to Neutral from Outperform at Credit Suisse

-

12:31

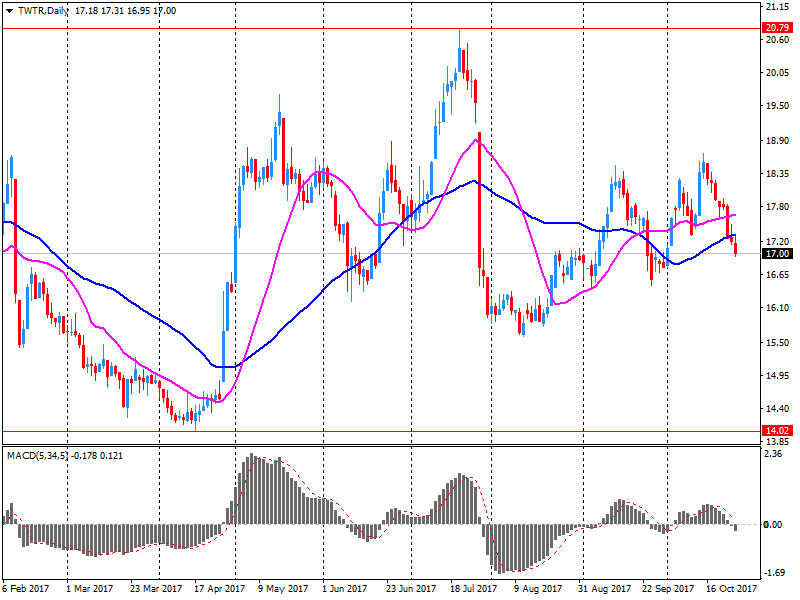

Company News: Twitter (TWTR) quarterly earnings beat analysts’ expectations

Twitter (TWTR) reported Q3 FY 2017 earnings of $0.10 per share (versus $0.13 in Q3 FY 2016), beating analysts' consensus estimate of $0.06.

The company's quarterly revenues amounted to $0.590 bln (-4.2% y/y), generally in-line with analysts' consensus estimate of $0.586 bln.

TWTR rose to $19.20 (+12.02%) in pre-market trading.

-

12:25

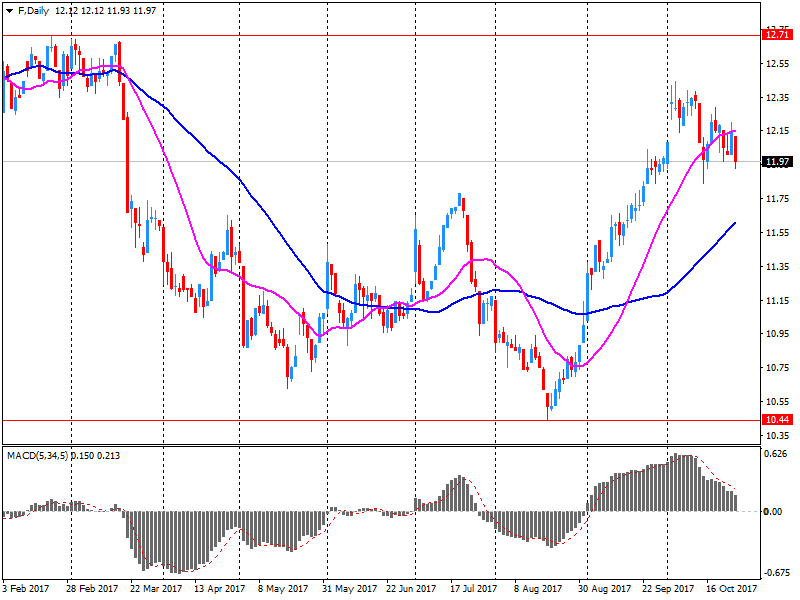

Company News: Ford Motor (F) quarterly results beat analysts’ expectations

Ford Motor (F) reported Q3 FY 2017 earnings of $0.43 per share (versus $0.26 in Q3 FY 2016), beating analysts' consensus estimate of $0.33.

The company's quarterly revenues amounted to $33.646 bln (+0.9% y/y), beating analysts' consensus estimate of $32.805 bln.

The company also raised guidance for FY2017 EPS to $1.75-1.85 from $1.65-1.85 versus analysts' consensus estimate of $1.74.

F rose to $12.25 (+1.74%) in pre-market trading.

-

12:14

Company News: Barrick Gold (ABX) posts quarterly earnings in line with analysts' estimates

Barrick Gold (ABX) reported Q3 FY 2017 earnings of $0.16 per share (versus $0.24 in Q3 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $1.933 bln (-15.8% y/y), missing analysts' consensus estimate of $2.020 bln.

ABX fell to $15.56 (-1.21%) in pre-market trading.

-

12:06

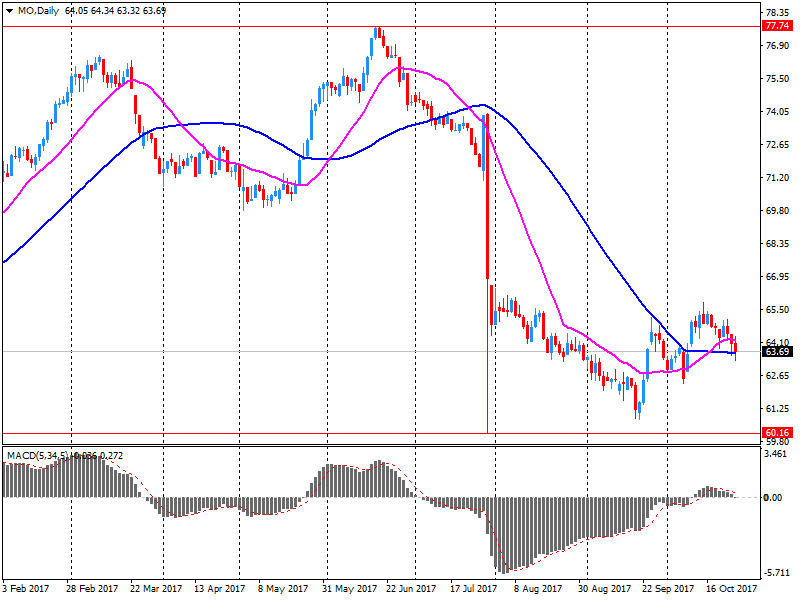

Company News: Altria (MO) quarterly earnings beat analysts’ estimate

Altria (MO) reported Q3 FY 2017 earnings of $0.90 per share (versus $0.82 in Q3 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $5.100 bln (-1.8% y/y), missing analysts' consensus estimate of $5.217 bln.

The company also issued in-line guidance for FY2017, projecting EPS of $3.26-3.32 versus analysts' consensus estimate of $3.27.

MO rose to $63.94 (+0.24%) in pre-market trading.

-

07:31

Major european stock exchanges trading in the green zone: FTSE + 0.1%, DAX + 0.01%, CAC + 0.1%

-

06:17

FTSE futures up 0.22 pct, DAX futures up 0.27 pct, CAC 40 futures up 0.18 pct, Eurostoxx 50 futures up 0.20 pct

-

05:29

Global Stocks

U.K. stocks closed lower Wednesday after a stronger-than-expected reading on British economic growth drove the pound up against the U.S. dollar and the euro. The FTSE 100 index UKX, -1.05% fell 1.1% to end at 7,447.21. On Tuesday, the London benchmark rose less than 0.1%, notching a third straight gain. It was also the third session in a row that stocks closed with a move smaller than 0.1%.

The S&P 500 and the Dow on Wednesday posted their biggest one-day declines in more than seven weeks on a string of disappointing earnings, even as the stock market pared early losses.

A global stock pullback moved into Asia on Thursday, with most markets down modestly following similar-sized declines overnight in Europe and the U.S., pausing what has been a big month of gains for many indexes.

-