Market news

-

22:27

Stocks. Daily history for Mar 27’2017:

(index / closing price / change items /% change)

Nikkei -276.94 18985.59 -1.44%

TOPIX -19.53 1524.39 -1.26%

Hang Seng -164.57 24193.70 -0.68%

CSI 300 -11.56 3478.04 -0.33%

Euro Stoxx 50 -7.01 3437.14 -0.20%

FTSE 100 -43.32 7293.50 -0.59%

DAX -68.20 11996.07 -0.57%

CAC 40 -3.47 5017.43 -0.07%

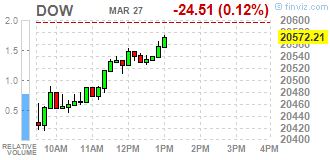

DJIA -45.74 20550.98 -0.22%

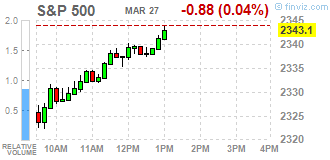

S&P 500 -2.39 2341.59 -0.10%

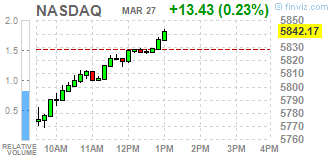

NASDAQ +11.64 5840.38 +0.20%

S&P/TSX +63.55 15506.22 +0.41%

-

20:07

Major US stock indexes completed the session without a single dynamic

The main US stock indexes ended the auction mixed in the background of Friday's failure to vote in the US Congress on President Donald Trump's bill on health care reform, which made investors doubt that he will be able to carry out tax reform.

In addition, as shown by data provided by the Federal Reserve Bank of Dallas, business activity of Texas producers deteriorated significantly in March, recording the first drop in the last 7 months. In addition, the March value was lower than the experts' forecasts. According to the report, the manufacturing index of the Federal Reserve Bank of Dallas in March fell to 16.9 points from 24.5 points in February. Experts expected that the index will drop only to 22.0 points.

The cost of oil moderately declined on Monday amid uncertainty over whether OPEC will extend the agreement to cut production for the second half of the year. Pressure on oil also provided data from the company Baker Hughes. On Friday, Baker Hughes reported that from 18 to 24 March the number of active drilling rigs for oil production in the US increased to 652 units from 631 units. The latter value is the highest since mid-September 2015.

The components of the DOW index have mostly grown (18 out of 30). The shares of Chevron Corporation fell more than others (CVX, -1.52%). The leader of growth was the shares of E. I. du Pont de Nemours and Company (DD, + 1.28%).

Most sectors of the S & P index recorded an increase. The financial sector fell most of all (-0.2%). The leader of growth was the healthcare sector (+ 0.7%).

At closing:

DJIA -0.22% 20.550.66 -46.06

Nasdaq + 0.20% 5,840.37 +11.63

S & P -0.10% 2,341.61 -2.37

-

19:00

DJIA -0.30% 20,535.28 -61.44 Nasdaq +0.11% 5,835.43 +6.69 S&P -0.21% 2,339.17 -4.81

-

17:10

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday as investors picked up beaten-down stocks after Wall Street tumbled following the withdrawal of President Donald Trump's healthcare reform bill. Wall Street has rallied since November on bets that Trump's campaign promises of tax cuts and deregulation would sail through a Congress controlled by Republicans.

Most of Dow stocks in negative area (17 of 30). Top loser - Chevron Corporation (CVX-1.31%). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.23%).

Most of S&P sectors also in negative area. Top loser - Industrial goods (-0.5%). Top gainer - Healthcare (+0.6%).

At the moment:

Dow 20501.00 -74.00 -0.36%

S&P 500 2337.25 -7.50 -0.32%

Nasdaq 100 5377.25 -1.50 -0.03%

Oil 47.71 -0.26 -0.54%

Gold 1254.20 +5.70 +0.46%

U.S. 10yr 2.37 -0.03

-

16:00

European stocks closed: FTSE 100 -43.32 7293.50 -0.59% DAX -68.20 11996.07 -0.57% CAC 40 -3.47 5017.43 -0.07%

-

13:32

U.S. Stocks open: Dow -0.80%, Nasdaq -0.87%, S&P -0.80%

-

13:27

Before the bell: S&P futures -0.88%, NASDAQ futures -0.11%

U.S. stock-index futures fell, as the failure of President Donald Trump's healthcare reform bill cast doubts over his ability to deliver on his agenda of tax cuts and simpler regulations.

Global Stocks:

Nikkei 18,985.59 -276.94 -1.44%

Hang Seng 24,193.70 -164.57 -0.68%

Shanghai 3,266.82 -2.62 -0.08%

FTSE 7,275.22 -61.60 -0.84%

CAC 4,998.29 -22.61 -0.45%

DAX 11,951.59 -112.68 -0.93%

Crude $47.50 (-0.98%)

Gold $1,257.60 (+0.73%)

-

13:02

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

190

-1.51(-0.79%)

2270

ALCOA INC.

AA

31.5

-1.06(-3.26%)

10025

ALTRIA GROUP INC.

MO

72.66

-0.51(-0.70%)

14491

Amazon.com Inc., NASDAQ

AMZN

839

-6.61(-0.78%)

15404

American Express Co

AXP

77.13

-1.07(-1.37%)

600

AMERICAN INTERNATIONAL GROUP

AIG

59.89

-0.99(-1.63%)

4668

Apple Inc.

AAPL

139.44

-1.20(-0.85%)

188947

AT&T Inc

T

41.52

-0.16(-0.38%)

6311

Barrick Gold Corporation, NYSE

ABX

19.6

0.39(2.03%)

183797

Boeing Co

BA

174

-1.82(-1.04%)

4369

Caterpillar Inc

CAT

90.5

-1.65(-1.79%)

30478

Chevron Corp

CVX

107.08

-0.91(-0.84%)

265

Cisco Systems Inc

CSCO

33.79

-0.29(-0.85%)

7501

Citigroup Inc., NYSE

C

56.7

-1.37(-2.36%)

73199

Deere & Company, NYSE

DE

107.98

-1.00(-0.92%)

380

Exxon Mobil Corp

XOM

80.71

-0.52(-0.64%)

5857

Facebook, Inc.

FB

139.08

-1.26(-0.90%)

91537

FedEx Corporation, NYSE

FDX

186.5

-1.62(-0.86%)

3751

Ford Motor Co.

F

11.56

-0.06(-0.52%)

39765

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.26

-0.55(-4.29%)

91625

General Electric Co

GE

29.45

-0.27(-0.91%)

35110

General Motors Company, NYSE

GM

34.18

-0.38(-1.10%)

9453

Goldman Sachs

GS

223.2

-5.21(-2.28%)

44266

Google Inc.

GOOG

807.05

-7.38(-0.91%)

3478

Hewlett-Packard Co.

HPQ

17.01

-0.22(-1.28%)

901

Home Depot Inc

HD

146.36

-1.35(-0.91%)

300

Intel Corp

INTC

35

-0.16(-0.46%)

32065

International Business Machines Co...

IBM

172.5

-1.33(-0.77%)

4060

Johnson & Johnson

JNJ

124.76

-0.72(-0.57%)

1360

JPMorgan Chase and Co

JPM

85.35

-1.94(-2.22%)

65936

McDonald's Corp

MCD

128.95

-0.39(-0.30%)

989

Merck & Co Inc

MRK

62.56

-0.62(-0.98%)

997

Microsoft Corp

MSFT

64.64

-0.34(-0.52%)

19243

Nike

NKE

55.66

-0.70(-1.24%)

11176

Pfizer Inc

PFE

33.75

-0.25(-0.74%)

9813

Procter & Gamble Co

PG

90.2

-0.37(-0.41%)

4917

Starbucks Corporation, NASDAQ

SBUX

56.5

-0.31(-0.55%)

2524

Tesla Motors, Inc., NASDAQ

TSLA

260.72

-2.44(-0.93%)

57075

The Coca-Cola Co

KO

41.97

-0.15(-0.36%)

2949

Twitter, Inc., NYSE

TWTR

15.02

-0.12(-0.79%)

60471

United Technologies Corp

UTX

110.69

-1.11(-0.99%)

5972

UnitedHealth Group Inc

UNH

163.85

-1.15(-0.70%)

1201

Verizon Communications Inc

VZ

49.53

-0.15(-0.30%)

1120

Visa

V

88.5

-0.69(-0.77%)

2406

Wal-Mart Stores Inc

WMT

69.33

-0.28(-0.40%)

8000

Walt Disney Co

DIS

111.53

-0.61(-0.54%)

3503

Yahoo! Inc., NASDAQ

YHOO

46.04

-0.36(-0.78%)

1605

Yandex N.V., NASDAQ

YNDX

22.03

-0.38(-1.70%)

520

-

12:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Starbucks (SBUX) initiated with a Outperform at Telsey Advisory Group; target $66

-

07:45

Major European stock exchanges started trading in the red zone: FTSE 7276.02 -60.80 -0.83%, DAX 11956.48 -107.79 -0.89%, CAC 4977.82 -43.08 -0.86%

-

06:40

Negative start of trading expected on the main European stock markets: DAX -0.6%, CAC40 -0.6%, FTSE -0.6%

-

05:36

Global Stocks

Stocks in Europe have been falling four out of the five trading days this week, as traders have looked to the U.S. where President Donald Trump has been struggling to push through his promised repeal of Obama's Affordable Care Act. The vote was scheduled for Thursday, but pushed back a day because of opposition from some Republicans. Right before the European market closed on Friday House Speaker Paul Ryan went to the White House to meet with Trump, which was being interpreted by some as a bad sign for the passage of the bill.

Earnings in China's industrial sector surged 31.5% in the January to February period from a year earlier, supported by an acceleration in output and higher commodities prices, official data showed Monday. Apart from rapid growth in coal, steel and oil prices, lower costs for the companies' main businesses also contributed to stronger profits, National Bureau of Statistics economist He Ping said in a statement accompanying the data release.

-